Technique (previously MicroStrategy) simply purchased 20,356 extra Bitcoin, per an announcement from Michael Saylor. That is the corporate’s largest buy in over two months, however its inventory worth has been dropping.

Technique has been funding these acquisitions by means of multibillion-dollar inventory gross sales, that are apparently shaking confidence within the firm. If Bitcoin’s personal worth doldrums proceed, it might have a severely destructive impression on the agency.

Saylor Retains Shopping for Bitcoin

Technique, which not too long ago rebranded from MicroStrategy, has as soon as once more prolonged its lead as one of many world’s largest Bitcoin holders. Earlier immediately, the agency accomplished a $2 billion inventory providing, and Michael Saylor simply introduced that the proceeds are getting used on Bitcoin acquisitions.

“Technique has acquired 20,356 BTC for $1.99 billion at $97,514 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of February 23, we maintain 499,096 BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin,” Saylor claimed.

At this time’s acquisition is the agency’s largest buy in over two months. Regardless of the outward bullish look, nevertheless, some considerations are starting to floor.

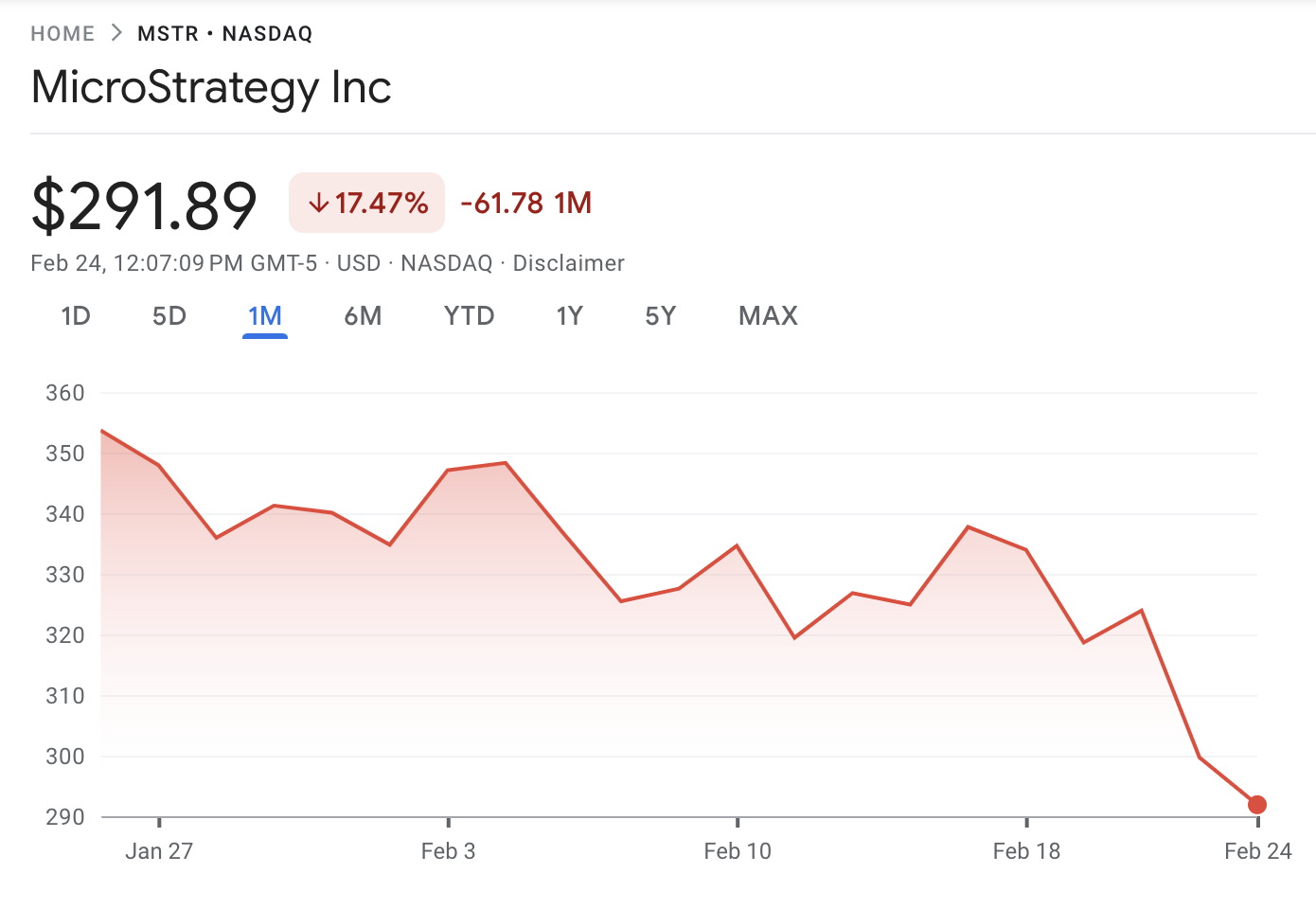

Saylor has continued these huge Bitcoin purchases for months, however there have been a number of important pauses in February. Regardless of the most recent buy, the corporate’s inventory MSTR has underperformed thus far this yr.

There are doubtless just a few the reason why MSTR has seen a decline within the inventory market. Final yr, MicroStrategy’s inventory efficiency confirmed a transparent correlation with Bitcoin’s market development.

Nevertheless, Bitcoin’s personal worth has suffered not too long ago due to bearish market situations, and this hasn’t helped Saylor’s firm.

Extra to the purpose, these huge inventory gross sales are impacting Technique itself. For instance, the agency carried out one other $2 billion sale in January, and immediately’s sale included one other non-compulsory providing of as much as $300 million.

Technique additionally launched a brand new perpetual safety, diversifying its choices. BlackRock alone holds 5% of the corporate, a transparent signifier of how a lot inventory the agency has offered.

Rumors have been constructing that these Bitcoin purchases could also be making a tax dilemma, and Saylor appears content material to maintain plowing forward with acquisitions.

Total, Saylor continues to be taking a look at the long run. Offloading enormous portions of shares is visibly impacting MSTR. But, this might considerably change when Bitcoin enters one other bullish cycle.

Beforehand, BeInCrypto analysts famous that BTC provide on exchanges has plummeted to 2.5 million, which suggests a provide shock is imminent. MicroStrategy or Technique’s continued purchases might add to this strain.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.