- Michael Saylor’s Technique purchased $2 billion value of Bitcoin, bringing its complete holdings near 500,000 BTC.

- The acquisition was funded by way of a $2 billion convertible notice providing, a part of the corporate’s $42 billion “21/21 Plan.”

- Technique now holds an unrealized revenue of $14.8 billion, with BlackRock growing its stake to five%.

Michael Saylor’s Technique (previously MicroStrategy) simply went on one other Bitcoin procuring spree—this time, dropping a staggering $2 billion to push its complete holdings simply shy of 500,000 BTC.

“We now maintain 499,096 BTC, acquired for $33.1 billion at a median worth of $66,357 per Bitcoin,” Saylor introduced in a Feb. 24 X put up.

The place’s the Cash Coming From?

This newest purchase wasn’t out of pocket—it was fueled by a $2 billion senior convertible notice providing.

- The notes have a 0% coupon and mature in 2030—which means buyers don’t get curiosity, however they will convert them to shares.

- Every $1,000 notice converts to 2.3072 shares of Technique’s inventory at a worth 35% greater than the market fee.

- Web proceeds totaled $1.99 billion after charges, all earmarked for Bitcoin acquisition and common company use.

This aggressive funding transfer is a part of Technique’s bigger “21/21 Plan”, which goals to boost $42 billion over three years to maintain stacking Bitcoin.

To date? They’ve already locked in $20 billion.

Unrealized Positive aspects & Institutional Consideration

Regardless of posting a $670 million web loss in This autumn 2024, Technique is sitting on a large unrealized revenue—roughly $14.8 billion on its Bitcoin holdings.

And establishments? They’re paying consideration.

- Twelve North American states maintain $330 million in Technique inventory by way of pension funds or treasuries.

- BlackRock simply upped its stake to five%, strengthening its grip on the corporate.

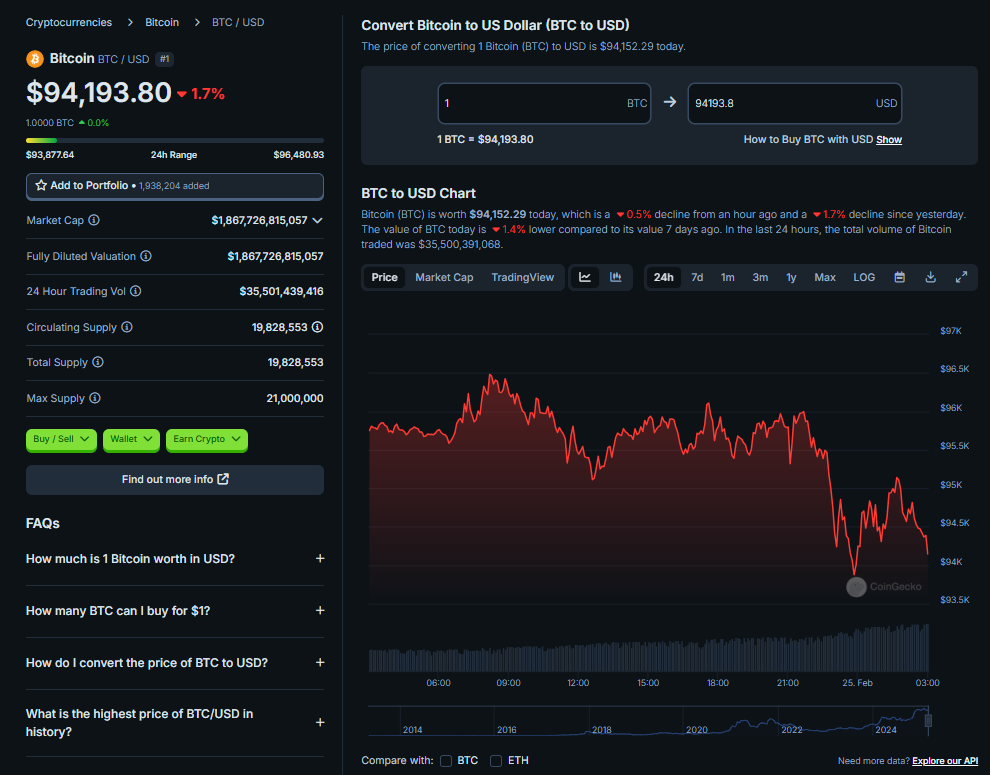

With Bitcoin pushing towards $100K and Technique nearing 500,000 BTC, one factor’s clear—Saylor isn’t slowing down anytime quickly.