- BlackRock moved $204M in crypto, sparking hypothesis about rebalancing, promoting, or custody transfers.

- Arkham Intelligence information exhibits BTC and ETH had been despatched to Coinbase Prime, fueling market discussions.

- BlackRock has not issued an announcement, leaving merchants guessing about its subsequent transfer within the crypto house.

BlackRock is again within the crypto highlight after on-chain information revealed large asset transfers—shifting round $204 million in digital property in a brief interval. The strikes have sparked intense hypothesis throughout the crypto house.

What’s the play right here? No official assertion but, so the guessing recreation begins.

Rebalancing, Promoting, or Simply Custody Transfers?

Merchants and analysts are scrambling to decode BlackRock’s newest strikes, with theories starting from:

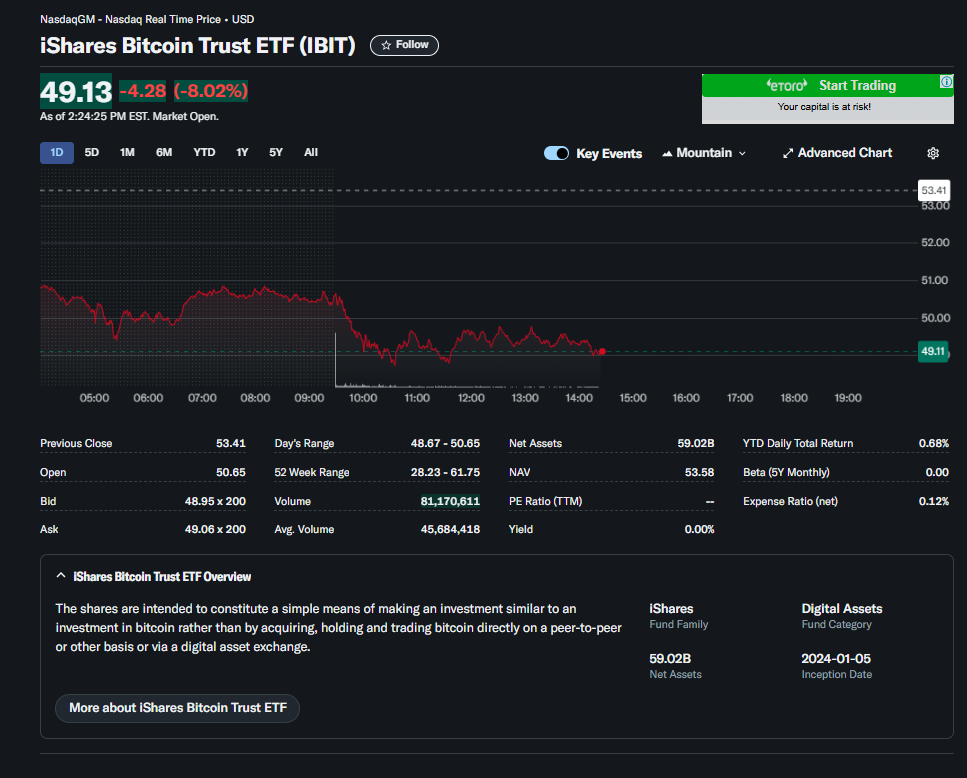

- Routine ETF rebalancing—adjusting holdings in its IBIT (Bitcoin ETF) and ETHA (Ethereum ETF).

- A possible sell-off or profit-taking occasion earlier than the following market transfer.

- Merely shifting funds for custody with out instant buying and selling intentions.

With institutional participation rising and macro circumstances shifting, BlackRock’s subsequent transfer may set the tone for crypto markets.

finance.yahoo.com

BlackRock’s Transfers Hit Coinbase—Market Reacts

Knowledge from Arkham Intelligence exhibits that each BTC and ETH from BlackRock’s ETFs had been moved to Coinbase Prime—one of many prime institutional buying and selling platforms.

- Some merchants see this as simply portfolio balancing, nothing uncommon.

- Others concern it indicators a much bigger market shift, particularly with conventional finance corporations ramping up crypto publicity.

- The transfers coincided with a crypto market pullback, fueled by Trump’s tariff threats.

Regardless of all of the hypothesis, BlackRock isn’t saying a phrase—and that silence is barely including gas to the fireplace. Whether or not that is simply ETF upkeep or an indication of larger institutional strikes, the market is watching very, very intently.