Ethereum (ETH) is down nearly 10% on February 25. This drop has pushed its market cap beneath $300 billion, marking the primary time it has fallen to this stage since early November 2024.

A number of indicators, together with RSI and transferring averages, present bearish momentum. As ETH navigates this downturn, market watchers are searching for indicators of both a continued decline or a possible reversal.

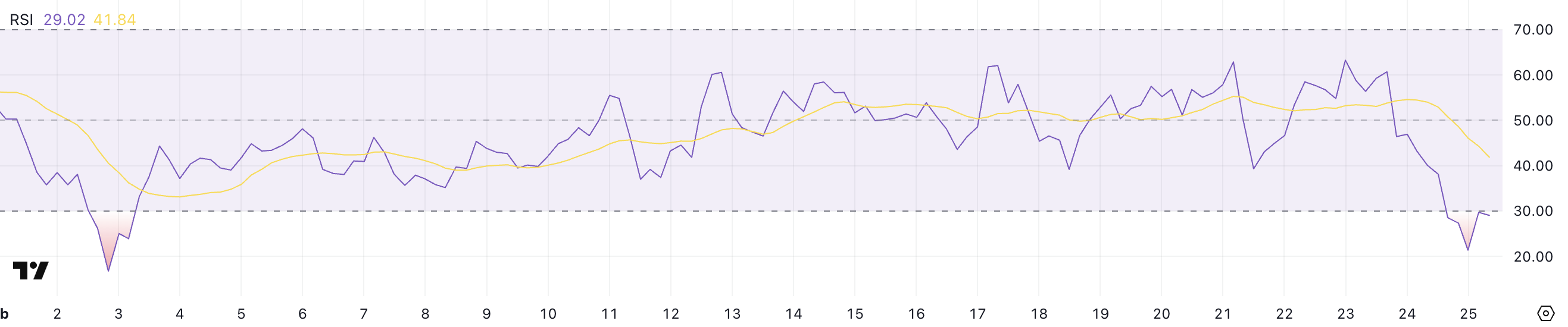

RSI Exhibits an Oversold State for Ethereum

ETH’s RSI is at the moment at 29 after dropping to 21.3 a couple of hours in the past. This marks the primary time since February 3 that ETH has entered oversold territory, indicating intense promoting stress.

RSI measures the pace and alter of value actions, serving to merchants determine overbought or oversold situations. An RSI beneath 30 sometimes indicators that an asset is oversold, whereas above 70 suggests it’s overbought.

With ETH’s RSI at 29, it signifies that promoting momentum could also be exhausted, doubtlessly setting the stage for a short-term rebound. Nevertheless, oversold situations don’t all the time assure an instantaneous value restoration.

If bearish sentiment persists, ETH may proceed to face downward stress earlier than any vital reversal happens. Conversely, if patrons step in at these oversold ranges, a aid rally may comply with.

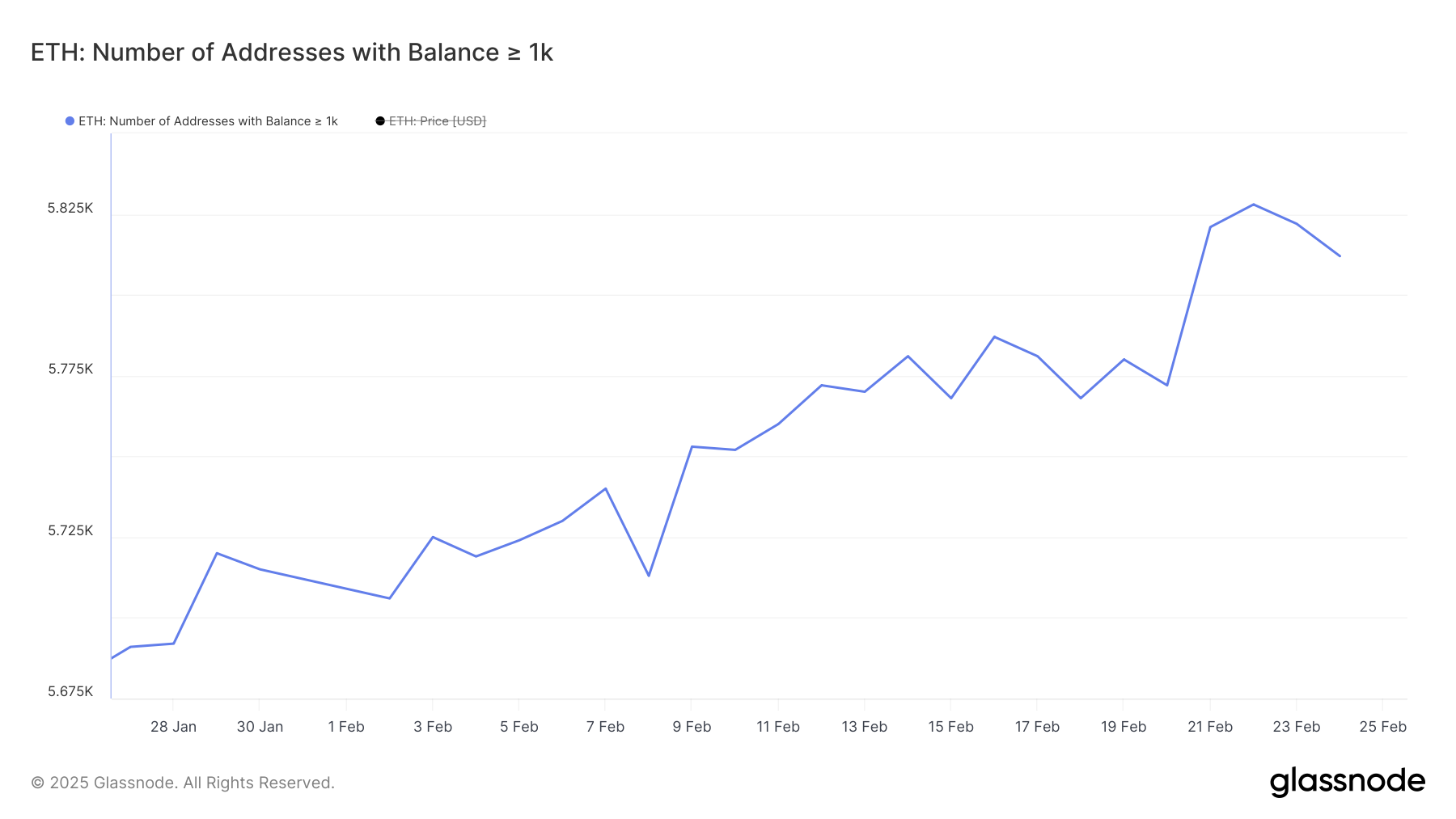

ETH Whales Dropped After Reaching Its Highest Ranges In One 12 months

The variety of ETH whales – addresses holding at the least 1,000 ETH – steadily elevated all through the final month, peaking at 5,828 on February 22, the very best stage since February 2024. Nevertheless, this upward pattern has lately reversed, with the quantity now barely declining to five,812.

This shift means that some giant holders have began to scale back their positions, doubtlessly contributing to the latest promoting stress on ETH.

Monitoring ETH whales is essential as a result of they management a good portion of the overall provide, influencing value actions with their shopping for and promoting actions. When the variety of whales will increase, it usually signifies accumulation, which might help value stability and even drive a rally. Conversely, a lower suggests distribution, doubtlessly resulting in elevated promoting stress.

The latest decline in ETH whale numbers may point out cautious sentiment, probably signaling short-term weak point.

Nevertheless, the general quantity stays comparatively excessive, suggesting that whereas some whales are offloading, a considerable quantity nonetheless maintain their positions, which may assist cushion any sharp declines.

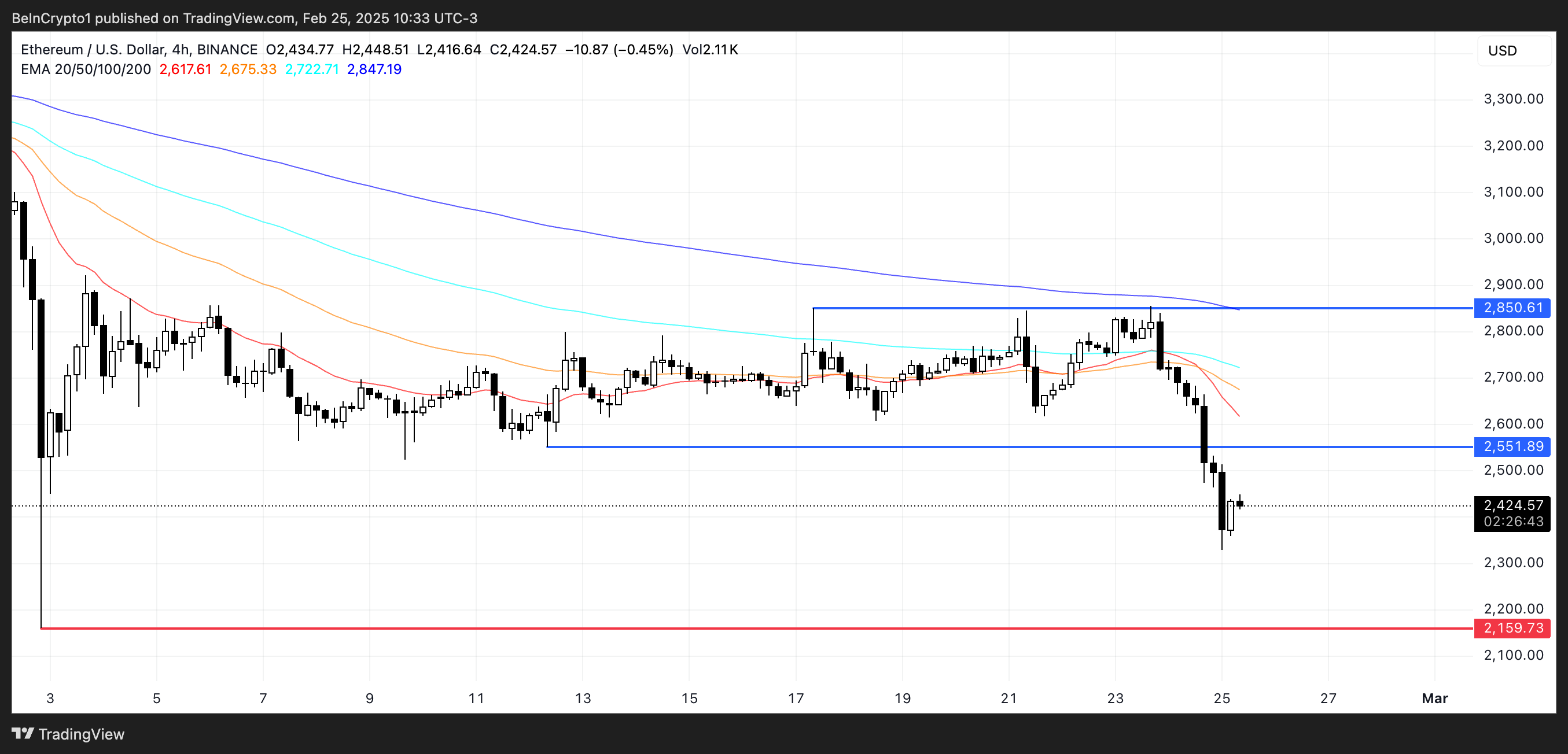

Ethereum May Drop Under $2,200 Quickly

Ethereum value lately fashioned a demise cross, the place the short-term transferring common crossed beneath the long-term transferring common, signaling a bearish pattern.

Following this sample, Ethereum’s value dropped beneath $2,500, reflecting elevated promoting stress. If this downtrend continues, ETH may decline additional to $2,159, falling beneath $2,200 for the primary time since December 2023. This demise cross signifies that bearish momentum is dominating, and warning is warranted as downward stress may persist.

Nevertheless, if Ethereum manages to reverse this pattern, it may try to interrupt by means of the resistance at $2,551. Efficiently overcoming this stage may pave the best way for a rally towards $2,850.

For this reversal to happen, shopping for stress would wish to extend, pushing the short-term transferring common again above the long-term one. Till that occurs, the demise cross means that the bearish sentiment stays sturdy.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.