Hedera (HBAR) is down greater than 4% within the final 24 hours, with its market cap now at $8.4 billion. Regardless of a short-term spike earlier at the moment, HBAR’s BBTrend stays adverse, signaling persistent bearish momentum.

Nevertheless, the Ichimoku Cloud signifies a possible bullish reversal if shopping for curiosity strengthens. If short-term EMA strains cross above long-term ones, HBAR may take a look at resistance at $0.24 and probably rise above $0.30 for the primary time since February 1.

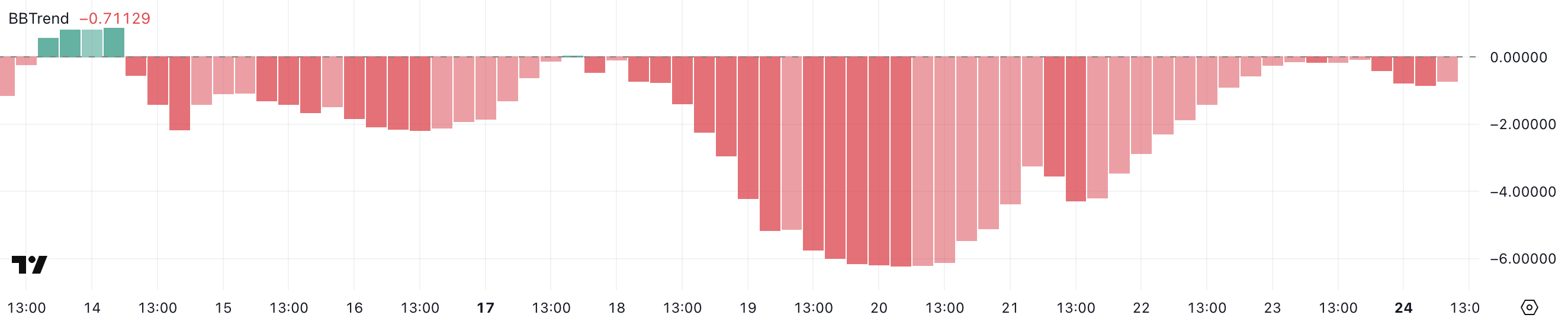

HBAR BBTrend Reveals a Failed Bullish Pattern Try

HBAR’s BBTrend is presently at -0.71 and has remained adverse since February 18, indicating a persistent bearish momentum. The indicator hit a adverse peak of -6.21 on February 20 earlier than regularly recovering to -0.06 yesterday, solely to drop once more.

BBTrend, or Bollinger Band Pattern, measures the momentum and route of worth actions relative to the Bollinger Bands. A adverse worth means that the value is trending towards the decrease band, signaling bearish sentiment, whereas a constructive worth signifies bullish momentum towards the higher band.

Hedera’s BBTrend at -0.71, dropping from -0.06 yesterday, means that bearish momentum is regaining power after a quick restoration try. This reversal signifies renewed promoting strain, probably resulting in additional worth declines if the adverse development continues.

The lack to keep up a constructive shift indicators weak spot in shopping for curiosity, rising the chance of continued draw back motion for HBAR. If BBTrend stays adverse, HBAR may face extra promoting strain till a transparent reversal emerges.

HBAR Ichimoku Cloud Reveals a Bullish Pattern May Type, However It’s Not Established But

The Ichimoku Cloud chart for HBAR exhibits that the value has lately damaged above the cloud, which is usually a bullish sign. Nevertheless, the cloud forward is skinny and barely bearish, indicating weak resistance.

The blue Tenkan-sen line is above the purple Kijun-sen line, suggesting short-term bullish momentum. But, the shut proximity of those strains indicators a scarcity of robust development conviction.

The inexperienced Chikou Span line is above the value, confirming bullish sentiment, however it’s near the candles, indicating indecision. The breakout above the cloud must be sustained for a continued uptrend. If the value falls again under the cloud, it may invalidate the bullish breakout.

Total, whereas the chart exhibits a short-term bullish sign, the weak cloud and slim hole between the Tenkan-sen and Kijun-sen recommend warning, because the development will not be strongly confirmed.

Hedera (HBAR) May Rise Again To $0.3 If This Occurs

HBAR’s EMA strains point out that the bearish development stays dominant, with short-term strains positioned above long-term ones, signaling continued promoting strain.

Nevertheless, the Ichimoku Cloud suggests the opportunity of a bullish reversal.

If the short-term EMA strains cross above the long-term ones, it may set off shopping for curiosity, main HBAR to check the resistance at $0.24. Breaking above this stage may push the value to $0.29, and if the momentum continues, HBAR may rise to $0.32, marking its first transfer above $0.30 since February 1.

Conversely, if the present downtrend persists, HBAR worth may retest the assist at $0.19. A break under this stage would point out elevated bearish momentum, probably resulting in a drop to $0.179.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.