The SEC dropped its investigation into Uniswap Labs, inflicting the UNI token to briefly soar whereas bearish circumstances nonetheless dominate the market. Regardless of the volatility, it has been a optimistic month for the decentralized trade, because it launched the v4 improve and Unichain mainnet this month.

Uniswap’s CEO Hayden Adams claimed that TradFi laws aren’t relevant to the crypto area and that new ones are required. Now that one other enforcement case has been dropped, strain is constructing to create these friendlier laws.

SEC Vs Uniswap Ends With out Any Enforcement

When the SEC despatched a Wells Discover to Uniswap final 12 months, it kicked off a year-long investigation. The Fee claimed it was an operated unregistered dealer, trade, and clearing company and issued an unregistered safety.

In response, the business rallied behind it. This probe, which was thought-about integral to the way forward for DeFi, has now been dropped by the SEC.

“It is a large win, not only for Uniswap Labs however for DeFi as a complete. I’m grateful that the brand new SEC management is taking a extra constructive strategy, and I look ahead to working with Congress and regulators to assist create guidelines that really make sense for DeFi. The perfect days for DeFi are forward,” claimed Uniswap CEO Hayden Adams.

The quiet finish to the Uniswap case is a part of a brand new development on the SEC. Since President Trump’s time period started final month, the Fee has been dropping crypto enforcement fits left and proper. In the previous couple of days, it dropped a serious swimsuit towards Coinbase, whereas ending investigations into Opensea and Robinhood.

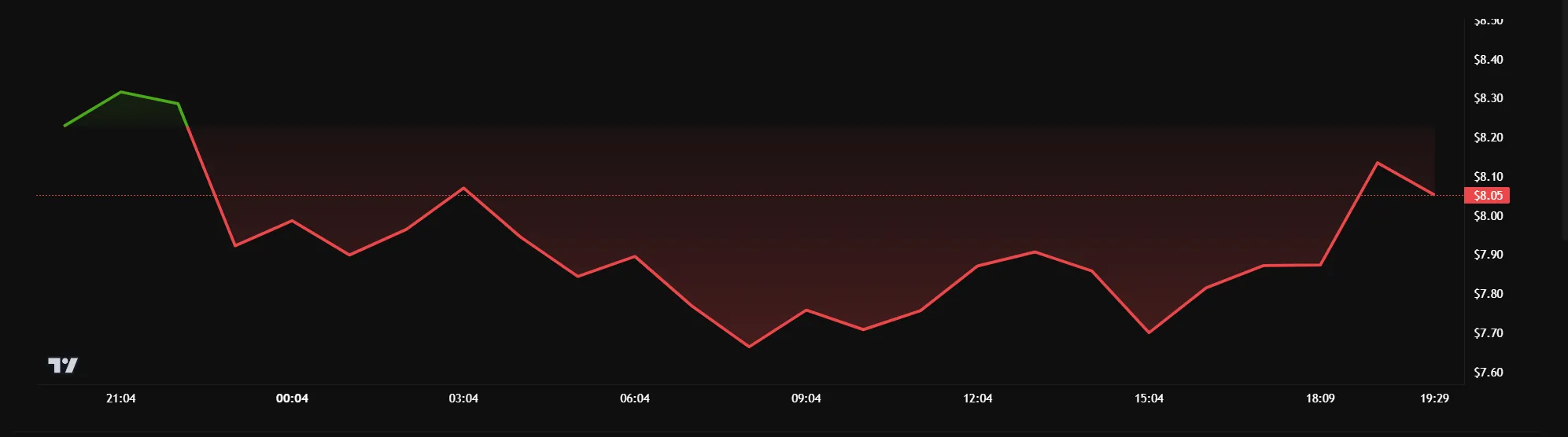

Now that the SEC has dropped its case, Uniswap’s UNI token can breathe just a little simpler. Over the previous month, its worth has suffered a 30% drop. Even the long-awaited v4 replace and the Unichain launch didn’t have any notable impression.

Regardless of the stale worth actions, UNI jumped briefly after the SEC’s announcement, indicating some optimistic outlook. Additionally, the token’s every day buying and selling quantity surged over 140% right now, based on CoinMarketCap knowledge.

A New Future for Crypto Enforcement

It will likely be fascinating to see how this improvement matches right into a broader mosaic of federal crypto coverage.

In his assertion, Adams claimed that “decentralized expertise and self-custody are inherently completely different” from TradFi and that they need to be held to completely different laws. It is a widespread chorus, and the SEC is working to obtain constructive business suggestions.

To sum it up, The SEC is dropping plenty of enforcement circumstances made beneath Gary Gensler’s interpretation of the regulation, and Uniswap is a part of that development.

Nonetheless, because the Fee adjustments its focus, it additionally places strain on creating this constructive new regulatory atmosphere. Crypto has an actual likelihood to chart its personal future, however it should adjust to the brand new guidelines it helps create.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.