Upbit, one of many largest Korean crypto exchanges by buying and selling quantity, faces a three-month particle suspension for violating trade rules.

This improvement is the end result of regulatory clampdowns on the platform following South Korea’s transfer to open an antitrust investigation in opposition to Upbit alternate.

Upbit Suspended Amid Regulatory Violations in South Korea

South Korean authorities sanctioned Dunamu Firm, the proprietor of Upbit Alternate, for violating rules associated to digital asset buying and selling. Native media reported on Tuesday that the violations included partaking in transactions with unregistered digital asset companies.

Reportedly, Upbit Alternate additionally failed to stick to correct buyer verification procedures and uncared for to report suspicious transactions. Consequently, Upbit faces a partial suspension of enterprise operations for 3 months.

Particularly, the authorities banned new prospects from transferring digital belongings between March 7 and June 6, 2025.

Moreover, the alternate is topic to personnel actions and a monetary penalty. This improvement might hurt Upbit’s heft amongst Korean crypto exchanges.

In an official announcement on its web site, Upbit acknowledged the violations. The alternate additionally dedicated to taking corrective actions to conform totally with authorized rules.

The corporate regretted the inconvenience it triggered customers and guaranteed them of enhancements to its transaction administration. Upbit additionally stated it might monitor the system to stop future infractions.

“…We deeply sympathize with the aim of the monetary authorities’ current sanctions, that are geared toward stably establishing the anti-money laundering system and strengthening the authorized compliance system by means of strict self-discipline on digital asset operators,” learn an excerpt within the assertion.

Regardless of the sanctions, current Upbit prospects can proceed buying and selling with out restrictions. Whereas new customers can commerce, they’re briefly restricted from transferring digital belongings, together with deposits and withdrawals, to exterior wallets. Upbit additionally emphasised that the imposed sanctions could be topic to adjustments by means of regulatory procedures.

South Korea Tightens Regulatory Grip

In the meantime, this regulatory crackdown is a part of a broader effort by authorities to implement stricter compliance measures in South Korea’s crypto sector. The current penalties comply with months of elevated scrutiny on Upbit.

The South Korean authorities launched an antitrust investigation into Upbit 5 months in the past. Authorities examined whether or not the alternate had engaged in monopolistic practices. Moreover, only a month in the past, Upbit’s operations had been briefly suspended amid allegations of 700,000 KYC (Know Your Buyer) violations.

This was a continuation of issues raised three months earlier than that. As BeInCrypto reported, South Korea’s monetary regulator flagged Upbit for 600,000 potential KYC violations, prompting additional regulatory motion.

As Upbit navigates this era of regulatory scrutiny, South Korea is tightening its regulatory grip. The nation plans to introduce the second a part of its crypto regulatory framework in H2 2025.

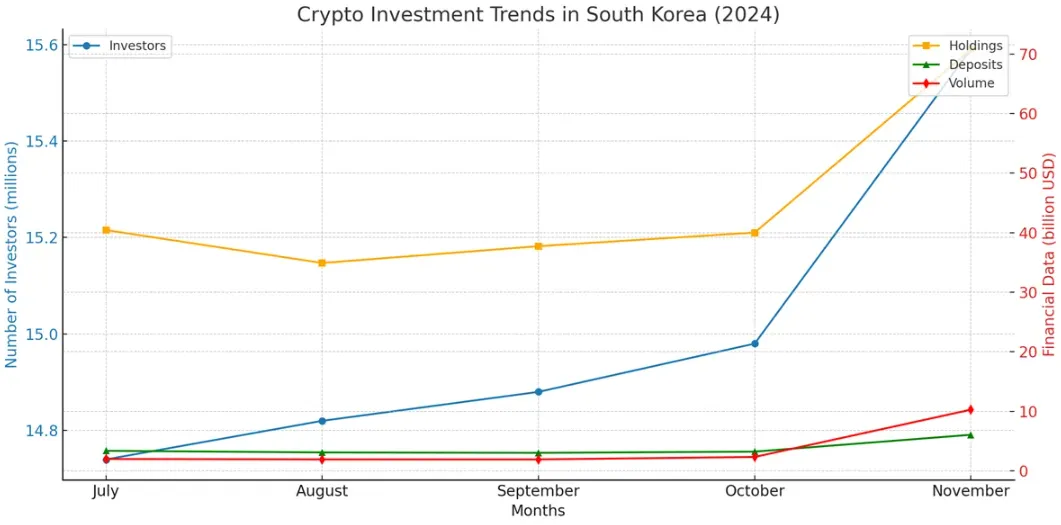

These changes come because the nation’s populace contains a notable variety of crypto market individuals. Particularly, as of November, over 30% of South Korea’s inhabitants invested in crypto.

Whereas Upbit now faces intensified scrutiny, the corporate has additionally taken steps to adjust to altering rules. Seven months in the past, it turned the primary alternate in South Korea to subject a public disclosure below the newly applied Digital Asset Person Safety Act.

This transfer was seen as a proactive step in aligning with the nation’s new regulatory framework and bettering transparency throughout the cryptocurrency trade.

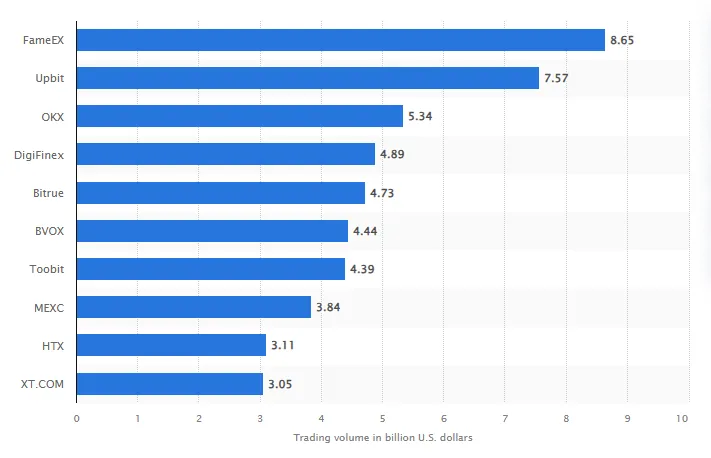

Regardless of these regulatory challenges, Upbit has traditionally maintained a robust place out there. Two years in the past, it outperformed main international exchanges resembling Coinbase and OKX, main in buying and selling volumes amongst Korean exchanges whereas its US rivals struggled. This dominance displays the platform’s important consumer base and affect throughout the cryptocurrency trade.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.