MORPHO jumped almost 10% earlier than seeing corrections, as Coinbase listed the token. The trade just lately put MORPHO on its roadmap alongside two meme cash with little worth impression, however the precise listings have boosted all three belongings.

Morpho’s builders additionally introduced that its good contracts had been independently vetted and have been deployed on a number of main blockchains.

Coinbase Lists MORPHO

Coinbase, the biggest crypto trade within the US, has a historical past of impacting crypto costs after itemizing bulletins. The “Coinbase Impact” is well-documented, with loads of examples.

Two weeks in the past, Coinbase put PENGU, POPCAT, and MORPHO on its itemizing roadmap to little fanfare; the previous two noticed massive positive aspects upon the precise itemizing. Now, it’s Morpho’s flip.

“Coinbase will add assist for Morpho (MORPHO) on the Ethereum (ERC-20 token) and Base networks. Buying and selling will start on or after 9AM PT on 27 February, 2025, if liquidity circumstances are met. As soon as enough provide of this asset is established buying and selling on our MORPHO-USD buying and selling pair will launch in phases,” the trade claimed on social media.

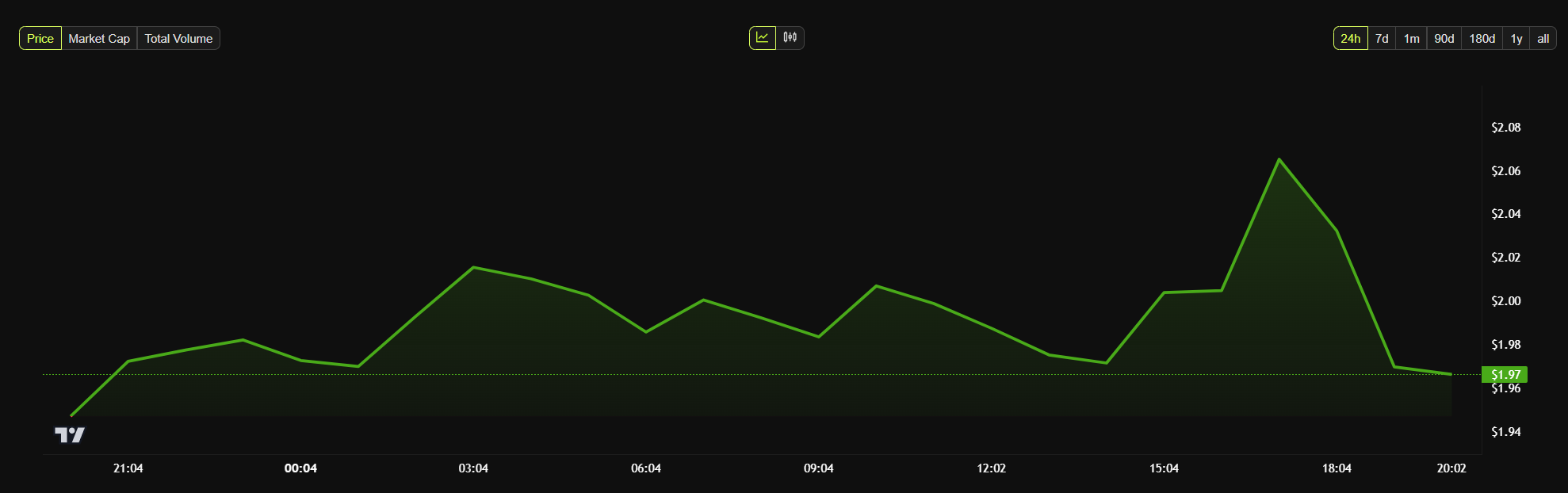

Coinbase’s token itemizing has had a major impression on MORPHO. The blockchain undertaking was a excessive performer in January, even coming into a serious partnership with Coinbase. Though its token worth dropped considerably in early February, immediately’s itemizing prompted a spike of almost 10% earlier than one other drop.

Morpho’s builders ready a couple of bulletins to accompany this Coinbase itemizing. The agency claimed that its good contracts are actually deployed on a number of main blockchains.

These contracts have been vetted by unbiased third-party audits, which embody a $2.5 million bug bounty. That is removed from the biggest bounty in crypto historical past, however it’s nonetheless fairly substantial.

With these developments, the corporate needs to emphasise its deal with transparency and credibility. Morpho is a decentralized, noncustodial lending platform constructed on Ethereum that optimizes lending swimming pools by facilitating environment friendly peer-to-peer interactions.

The protocol guarantees to enhance rates of interest for debtors and lenders by matching liquidity immediately whereas nonetheless counting on underlying lending swimming pools as a fallback, making certain each safety and capital effectivity.

The ecosystem additionally features a governance framework, the place the native MORPHO token performs a key function in decision-making and incentivization.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.