“Simply after I thought I used to be out, they pulled me again in.” This iconic line from such a cinematic masterpiece as “The Godfather” appears to completely describe what is occurring on the worth chart of Bitcoin (BTC) proper now.

When the sell-off that market contributors witnessed earlier this week ended with the liquidation of $1.5 billion in perpetual futures, many hoped that the worst was over.

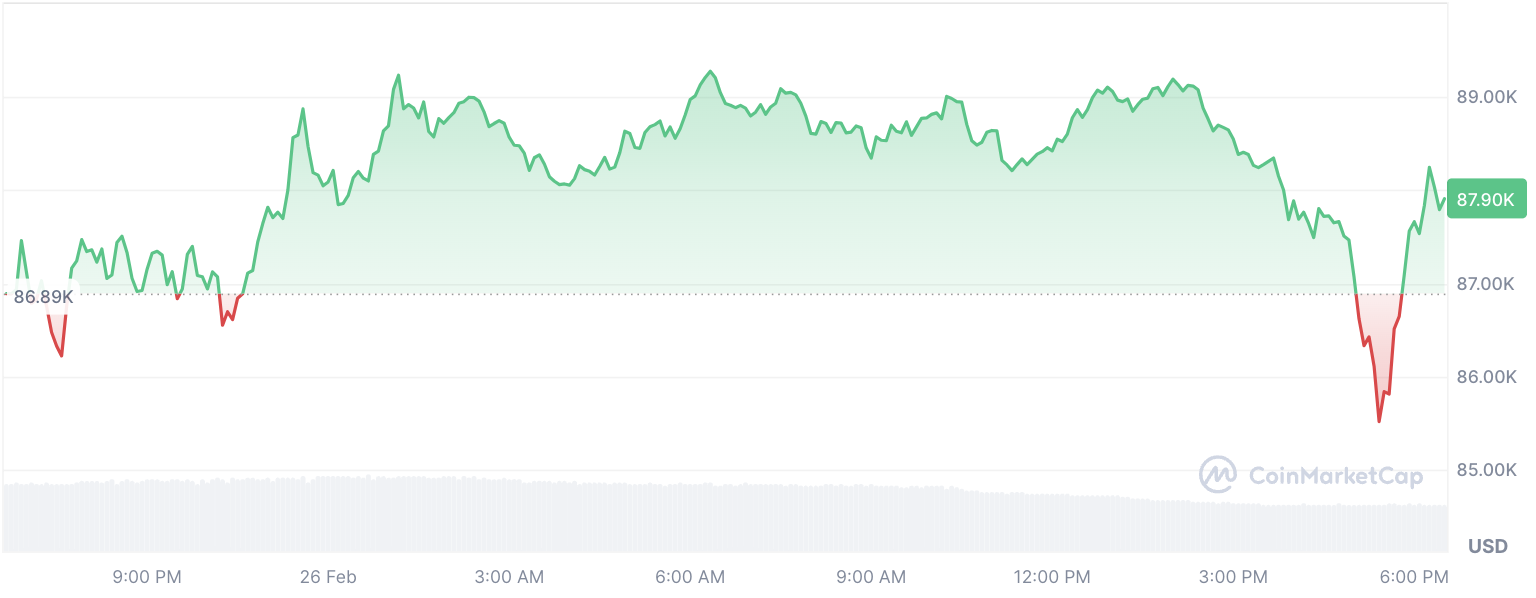

Nonetheless, immediately’s buying and selling session exhibits that this is probably not the case. Because the U.S. inventory market opened within the inexperienced, up 0.52%, the value of Bitcoin out of the blue plunged 1.48% to as little as $85,400.

To place it in perspective, that is the bottom the main cryptocurrency has traded in three months, since November. Which means all of the positive factors, particularly the pump that took Bitcoin to a brand new all-time excessive of $109,588, have been “efficiently” erased.

Worst February

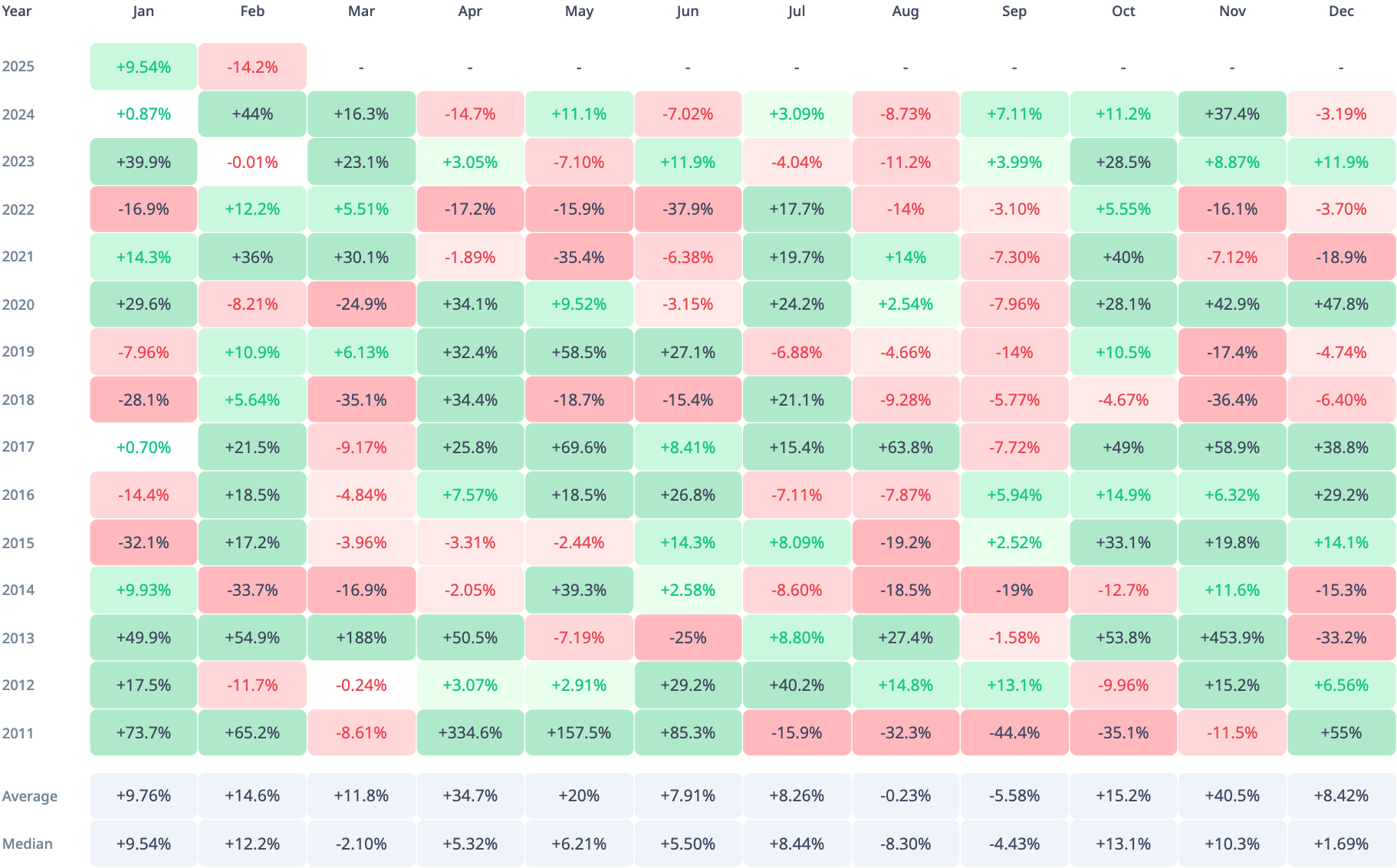

Including to the sentiment is that this February is definitely the worst for BTC in virtually 11 years. In response to information from CryptoRank, the final time the scenario with the key cryptocurrency was this ugly in February was in 2014, when Bitcoin recorded a 33.7% correction. After that, there haven’t been such dangerous second months of the yr, till the present yr.

With March subsequent on the menu, the typical return for the primary month of spring is 11.8%, in response to value historical past. The median, nevertheless, differs considerably and is -2.10%.

Drawing a conclusion from all of those numbers may imply that historic tendencies don’t predict the way forward for the cryptocurrency market. However utilizing them as one of many benchmarks won’t be a nasty thought, and so they may present some attention-grabbing insights.