The Crypto Worry and Greed Index reached “Excessive Worry” at the moment, its lowest stage for the reason that FTX collapse in 2022. Between ETF outflows, Trump tariffs, and extra, bearish sentiment is in every single place.

In lower than one month, Bitcoin went from over $100,000 to beneath $85,000, and this has sparked numerous worry. Nonetheless, even when a crash is imminent, analysts predict the market to rebound stronger by mid-2025.

Worry And Greed Index on Crimson Alert

For the crypto neighborhood, there’s numerous nervousness within the air proper now. The worth of Bitcoin has been an vital bellwether for bearish sentiment, as excessive ETF outflows Monday changed into all-time file losses.

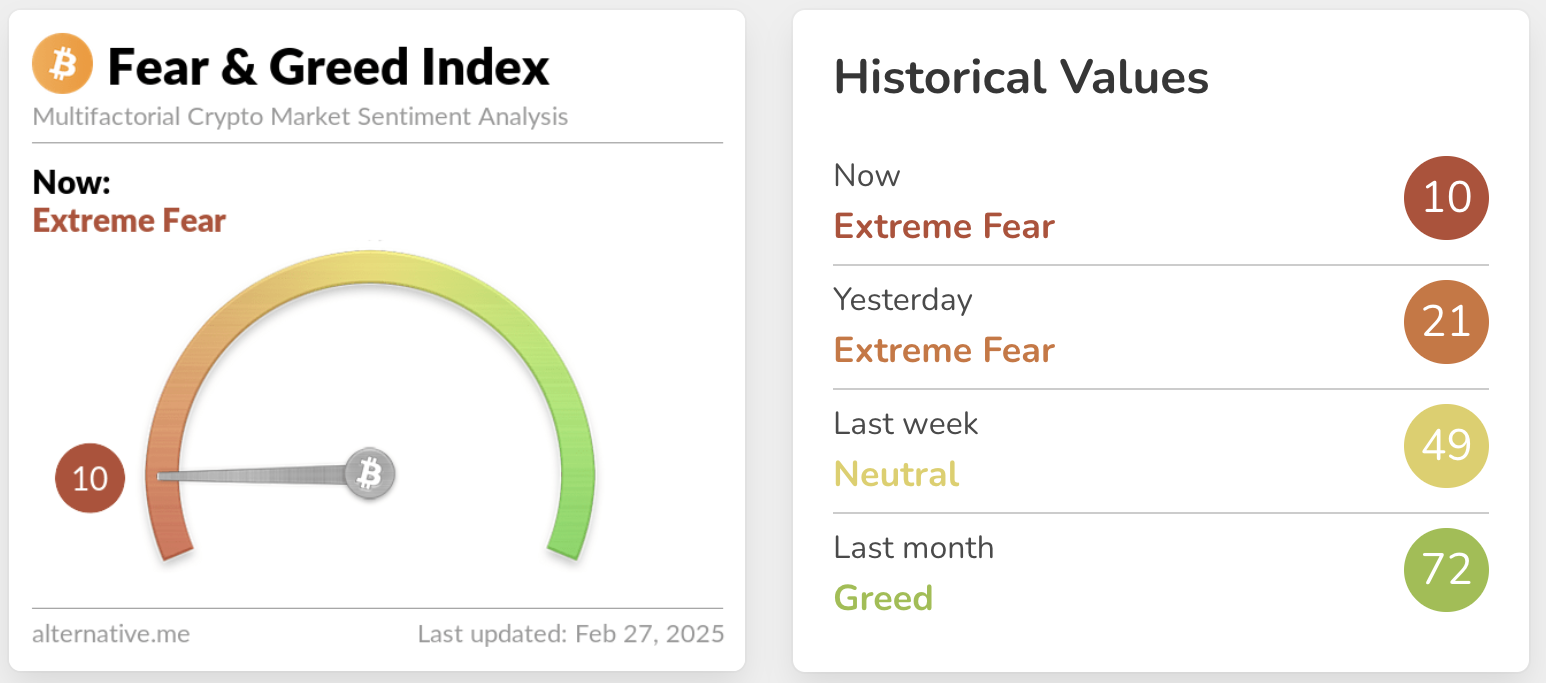

Now, the Crypto Worry and Greed Index has turned in direction of worry at an alarming charge, fully outpacing delicate anxieties from earlier within the month.

The Crypto Worry and Greed Index is a vital barometer for market sentiment, monitoring investor conduct patterns within the mixture. It’s now in a state of “Excessive Worry,” and its lowest stage for the reason that 2022 FTX collapse.

As crypto liquidations are on the rise, consultants are starting to brazenly state {that a} main correction is imminent. How did we get right here?

A number of key components have contributed to this panic. For one factor, blatant scams are saturating the meme coin house proper now, scaring hordes of potential buyers and diminishing crypto’s credibility.

Moreover, many main establishments wager closely on crypto and aren’t getting the most effective returns. Technique just lately spent $2 billion on BTC, however its inventory value solely suffered for it.

Moreover, Donald Trump’s proposed 25% EU tariffs are including large quantities of worry to the Index. He postponed tariffs on Canada and Mexico in early February, inflicting crypto to breathe straightforward.

Nonetheless, at the moment the US president confirmed that the tariffs are coming again stronger than earlier than. Different companies which have closely invested in Bitcoin, like Tesla, are cratering alongside the US Greenback.

Regardless of all these indicators and portents, neighborhood leaders are urging calm. The Crypto Worry and Greed Index is swinging closely in direction of bearishness. So what? These property are very unstable, and we’ve seen loads of main crashes earlier than.

As monetary knowledgeable Robert Kiyosaki put it, there are nonetheless strong causes to consider in Bitcoin’s fundamentals:

“Bitcoin crashing, bitcoin is on sale, I’m shopping for. The issue shouldn’t be Bitcoin, the issue is our Financial System and our felony bankers. When Bitcoin crashes, I smile and purchase extra. Bitcoin is cash with integrity,” he claimed on social media.

Briefly, the Index could also be reporting excessive ranges of worry within the crypto neighborhood, however statistically, there is no such thing as a higher funding choice on the desk.

“Large Bitcoin outflows from Coinbase Superior—two days in a row. This sort of aggressive accumulation screams establishments or ETF patrons stacking onerous. Since Coinbase is the go-to for US establishments, this seems to be like long-term holding. If spot demand retains rising, we may very well be taking a look at a severe provide squeeze,” wrote analyst Kyle Doops.

Crypto is extremely related to macroeconomic components, and these tariffs and chaotic political developments are impacting the present market sentiment.

But, any impending pro-crypto growth, resembling extra ETF approvals and regulatory readability, can usher in a contemporary bullish cycle.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.