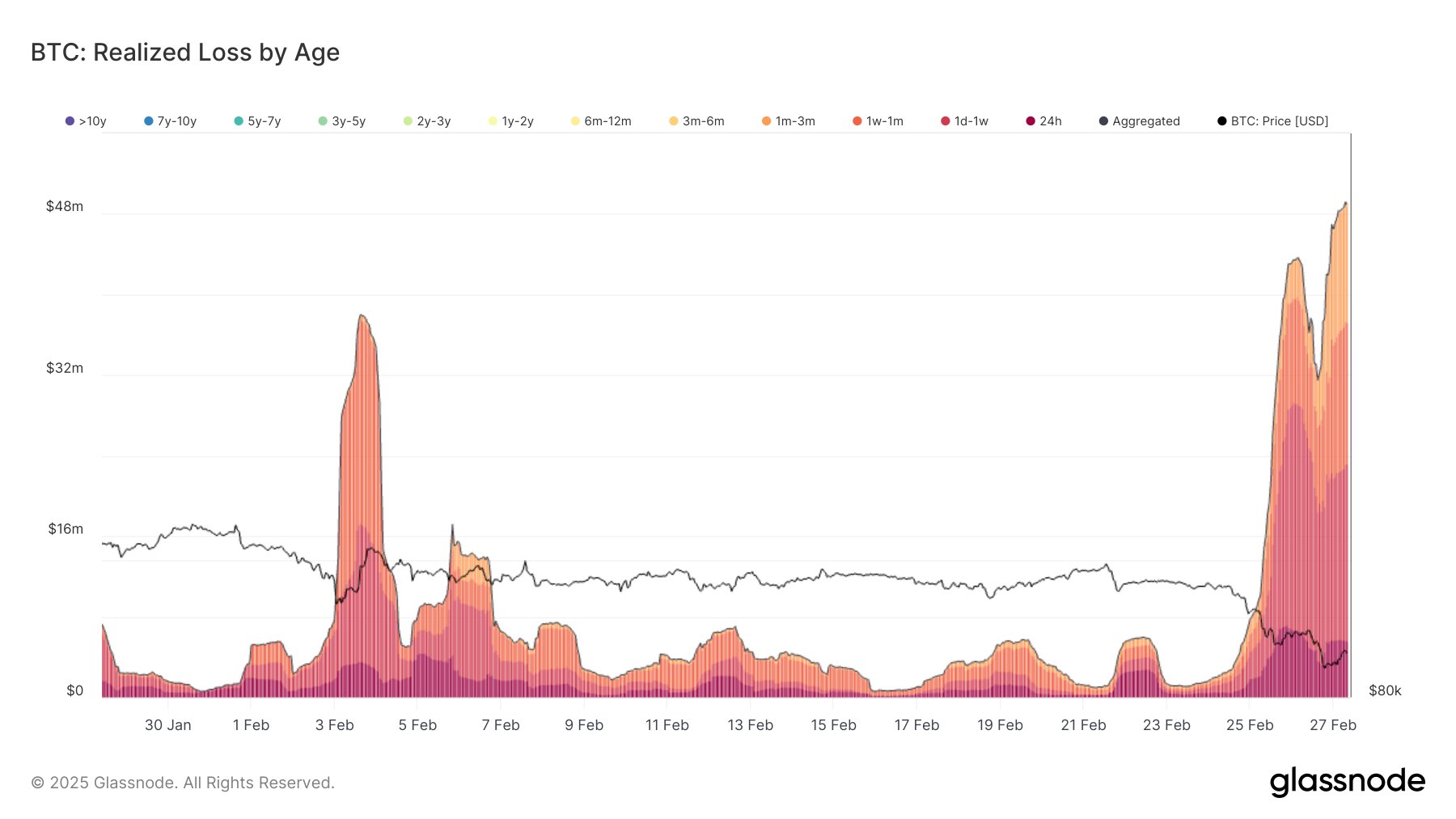

Bitcoin’s newest market downturn has hit current patrons the toughest, with over $2.16 billion in realized losses between February 25 and 27, in keeping with Glassnode.

Information reveals that short-term holders, notably those that purchased inside the previous week, accounted for the most important capitulations.

Traders holding Bitcoin for simply sooner or later to at least one week suffered probably the most, realizing $927 million in losses—42.85% of the full from short-term cohorts.

Those that held between one week and one month misplaced $678 million, whereas the one-month to three-month cohort noticed $257 million in realized losses. In the meantime, the 24-hour group recorded $322 million in exits.

Lengthy-term holders, nonetheless, remained largely unfazed. Traders who had held Bitcoin for 3 to 6 months solely noticed $6.5 million in realized losses, and people holding for six to 12 months misplaced simply $3.2 million.

This means that Bitcoin holders from the second half of 2024 or earlier are sustaining their positions, whereas newer entrants are promoting below stress.

February 26 marked probably the most important single-day sell-off in current months, with $1.13 billion in Bitcoin losses. As compared, February 3 noticed $848 million in realized losses, whereas August 6 and July 5 recorded $2.02 billion and $1.3 billion, respectively.

Regardless of the severity of the most recent downturn, long-term traders seem like holding agency, whereas current patrons bear the brunt of the crash.