Bitcoin’s (BTC) worth has hit a three-month low, reversing its post-election good points following Donald Trump’s victory.

Whereas preliminary market sentiment blamed the downturn on US President Donald Trump’s tariffs and the current Bybit hack, analysts are actually pointing to a extra structural trigger.

Why Bitcoin Is Crashing, Analyst Provides New Perspective

Crypto analyst Kyle Chasse ascribes the continued crypto market crash to unwinding the money and carry commerce that has been suppressing BTC’s worth for months. He explains that hedge funds have exploited a low-risk arbitrage commerce involving Bitcoin spot ETFs (exchange-traded funds) and CME futures.

“Bitcoin is crashing. Questioning why? The money & carry commerce that’s been suppressing BTC’s worth is now unwinding,” he acknowledged.

The technique concerned shopping for Bitcoin spot ETFs reminiscent of these from BlackRock (IBIT) and Constancy (FBTC). It additionally concerned shorting BTC futures on the CME and farming the unfold for an annualized return of roughly 5.68%.

In response to the analyst, some funds used leverage to spice up double-digit returns. Nonetheless, this commerce is now collapsing, inflicting large liquidity withdrawals from the market and sending Bitcoin’s worth into free fall.

The collapse of the money and carry commerce has led to over $1.9 billion in Bitcoin bought prior to now week. This marks a big decline in CME open curiosity as hedge funds unwind positions. It has additionally induced a double-digit proportion drop in Bitcoin’s worth inside days.

In response to Chasse, hedge funds by no means guess on Bitcoin’s long-term worth appreciation. As an alternative, they have been farming a risk-free yield utilizing arbitrage. Now that the commerce is lifeless, they’re quickly pulling liquidity, intensifying Bitcoin’s sell-off.

“Why is that this taking place? As a result of hedge funds don’t care about Bitcoin. They weren’t betting on BTC mooning. They have been farming low-risk yield. Now that the commerce is lifeless, they’re pulling liquidity—leaving the market in free fall,” the analyst added.

Earlier than the money and carry unwind was recognized, many merchants blamed Trump’s aggressive tariffs. Extra just lately, tariffs towards the European Union sparked market fears. The current Bybit hack additionally contributed to soured investor sentiment.

Whereas Bitcoin stays beneath stress, Kyle Chasse sees a path ahead. Extra cash and carry unwinding is anticipated, that means pressured promoting will proceed till all hedge fund positions are cleared. Volatility will possible improve as leveraged positions get liquidated, resulting in sharp swings in Bitcoin’s worth.

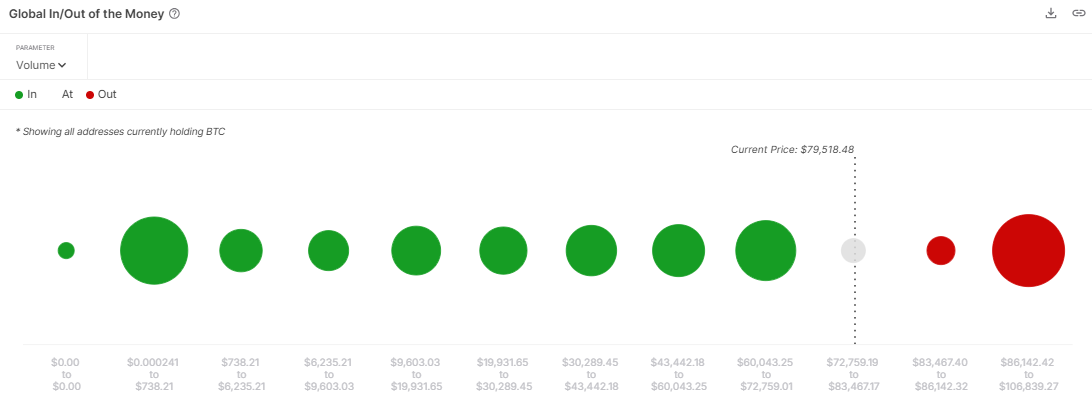

If the analyst’s perspective is true, Bitcoin would wish actual, long-term holders to step in and soak up the promoting stress. In response to technical evaluation, Bitcoin’s subsequent goal could possibly be round $70,000, a key help stage which may stabilize the market.

Round this stage, 6.76 million addresses maintain roughly 2.64 million BTC tokens acquired at a median worth of $65,296. Due to this fact, this zone could supply vital help for Bitcoin worth, as holders stop additional losses.

The analyst acknowledges that ETF-driven demand was partly actual however closely influenced by arbitrage gamers searching for fast earnings. For now, the market is present process a painful however essential reset. With it, merchants and buyers ought to brace for volatility in what might lay the groundwork for Bitcoin’s subsequent directional bias.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.