Bitcoin ETFs noticed a file $2.7 billion in outflows this week, signaling an impending bear market. Company Bitcoin holders are feeling the ache, and liquidations are spiking all throughout the crypto business.

Moreover, the Federal Reserve Financial institution of Atlanta predicted that the US GDP would lower by 1.5% in Q1 2025, fueling additional financial pessimism.

Is Bitcoin Heading for a Bear Market?

The US spot Bitcoin ETF market, which grew so shortly in its first 12 months, is seeing large outflows. Earlier this week, it hit a brand new file for outflows, approaching $1 billion. Now that now we have many of the week’s knowledge, it displays the rising issues amongst institutional buyers.

Over the previous week, Bitcoin ETFs had $2.7 billion in internet outflows, a troubling signal of a bear market. For comparability, that is the biggest weekly internet outflow since March 2024.

Fears of a bear market are gripping your complete crypto house, even hitting company Bitcoin holders. Technique (previously MicroStrategy) not too long ago spent almost $2 billion on BTC, and this didn’t assist its inventory worth.

Immediately, commerce knowledge exhibits that it has fallen 57% since final November. Metaplanet fell 54% from its peak, and Tesla has been falling too. All these companies maintain big quantities of Bitcoin.

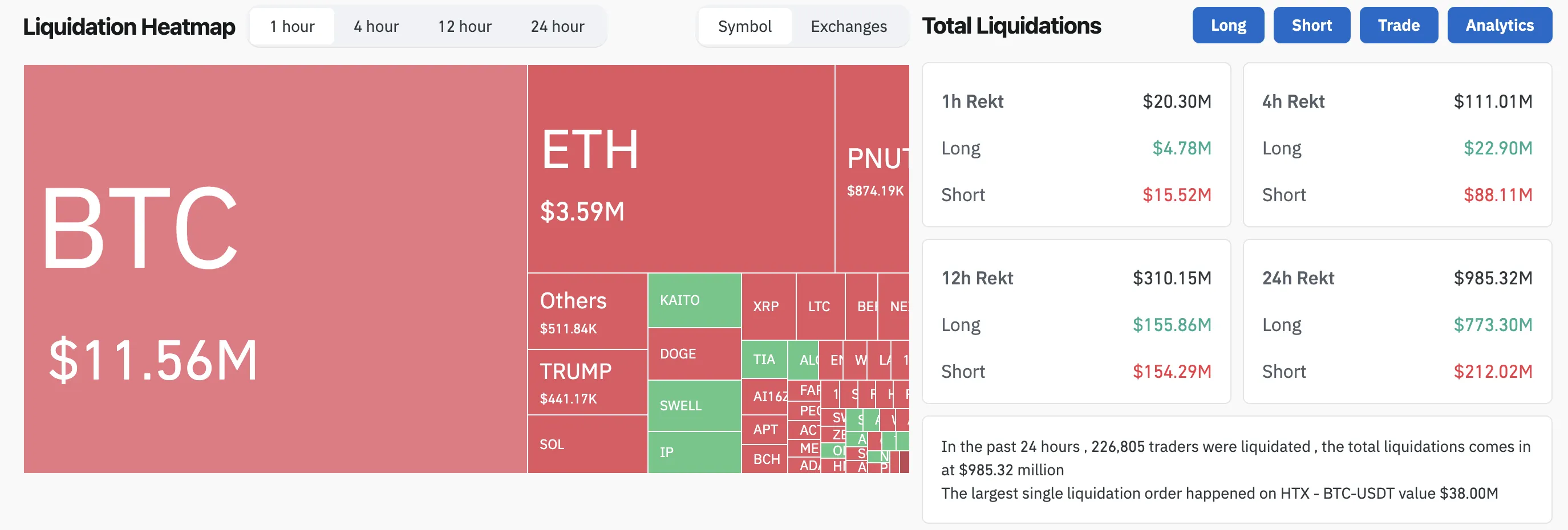

Bitcoin could also be feeling the brunt of this potential bear market, however liquidations are spiking all throughout the crypto sector. In line with the most recent knowledge, almost $1 billion was liquidated within the final 24 hours. Merchants are presently exhibiting Excessive Concern, the bottom degree for the reason that 2022 FTX collapse.

A couple of outstanding figures are wanting on the brighter aspect. Michael Saylor urged the group to not panic promote, telling his followers to “promote a kidney if you happen to should, however maintain the Bitcoin.”

Arthur Hayes, former CEO of BitMEX, amended his latest prediction that BTC will drop and bounce again. Nevertheless, he maintains that Bitcoin will rebound after a bear market.

“We’re making decrease lows on this present wave. I used to be tempted so as to add threat this morning, however taking a look at this worth motion I feel now we have yet another violent wave down under $80,000, probably over the weekend, then crickets for some time. Maintain on to your butts!” Hayes claimed by way of social media.

Darkish financial portents have been current for just a few days now, and a market correction appears inevitable. This afternoon, the Federal Reserve Financial institution of Atlanta claimed that the US GDP is on observe to say no by 1.5% in Q1 2025.

Even a disproven rumor may trigger plenty of issues. General, the present macroeconomic elements level in the direction of a short-term bearish cycle for Bitcoin and your complete market.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.