The on-chain analytics agency Glassnode has damaged down which Bitcoin investor cohorts bought on the greatest loss in the course of the newest worth crash.

Latest Bitcoin Consumers Have Mixed Realized $2.16 Billion In Loss Just lately

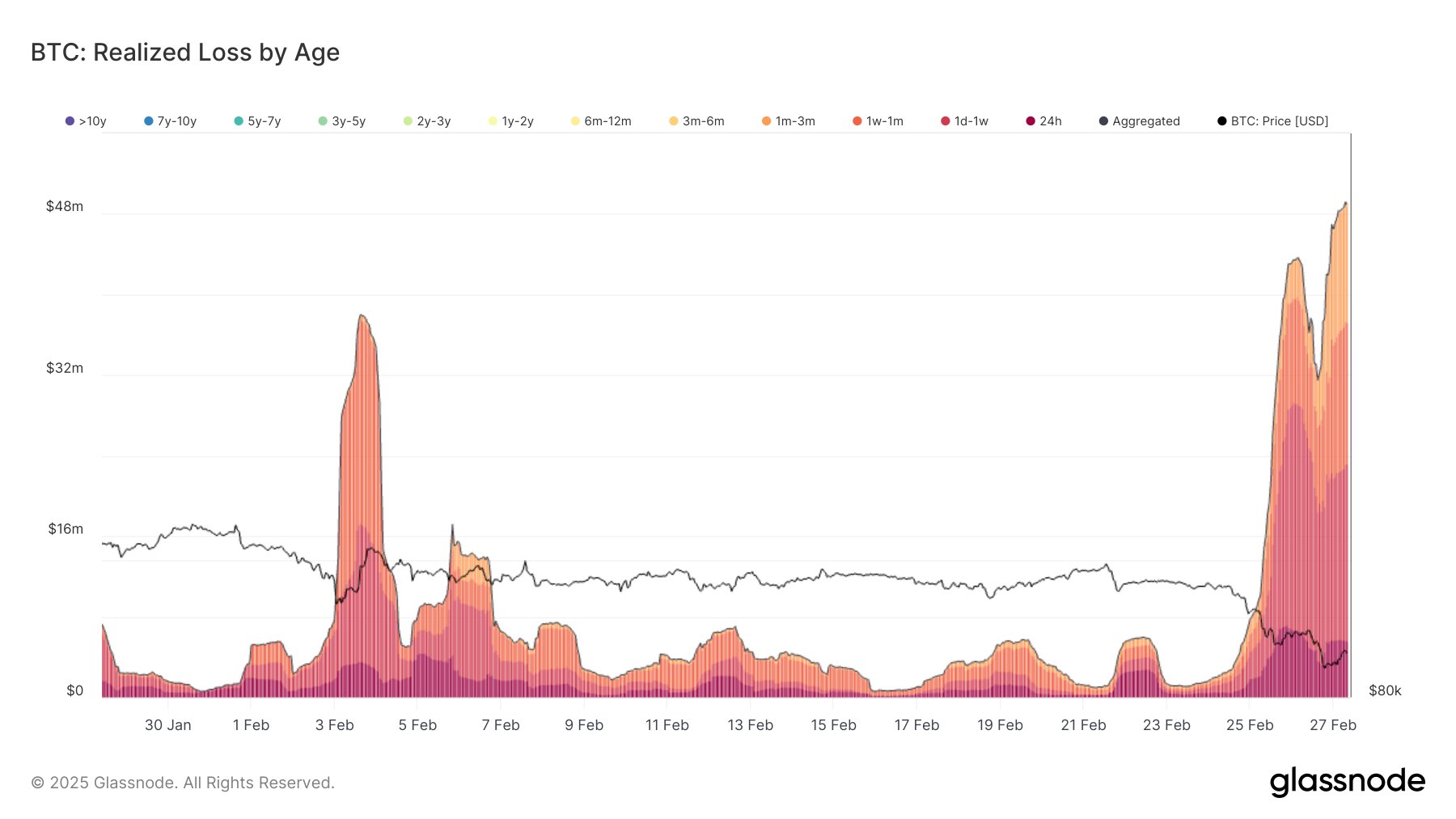

In a brand new publish on X, Glassnode has mentioned what the capitulation occasion triggered by the Bitcoin worth crash has been like. The indicator of relevance right here is the “Realized Loss,” which measures the whole quantity of loss that the buyers as an entire are ‘realizing’ via their transactions.

The metric works by going via the switch historical past of every coin being bought on the community to see what worth it was moved at previous to this. If this earlier worth for any coin was greater than the worth at which it’s being bought now, then the token’s sale could possibly be assumed to be resulting in loss realization.

The Realized Loss provides up the distinction between the 2 costs for all such tokens to calculate the whole for the community. One other metric often called the Realized Revenue retains observe of the cash of the other sort.

Usually, any sudden drop within the BTC worth throws the buyers right into a panic and a few loss-taking tends to happen, particularly from the latest consumers, who don’t are usually too resolute. The most recent crash has been no exception to this. “Between Feb 25-27, over $2.16B in realized losses got here from the newest market entrants,” notes the analytics agency.

Beneath is the chart posted by Glassnode that reveals the development within the Bitcoin Realized Loss for the assorted BTC investor cohorts over the previous month.

Appears like just some teams have made up for the overwhelming majority of the whole market loss | Supply: Glassnode on X

As is seen within the above graph, the older BTC cohorts have hardly participated in any loss-taking just lately. This is smart, as even after the crash, BTC is buying and selling at increased costs than it was just a few months in the past, so those that have been holding for a very long time would nonetheless be above water.

Out of the youthful teams who’ve certainly bought at massive losses, the numbers seem like this: $322 million for twenty-four hours, $927 million for 1 day to 1 week, $678 million for 1 week to 1 month, and $257 million for 1 month to three months.

The cohort that stands out amongst these is the 1 day to 1 week one, which made up for greater than 42% of the capitulation occasion. Thus, it could seem that the consumers who simply obtained in inside the previous week ended up dumping the toughest.

As for the way the most recent selloff compares traditionally, here’s a wider view of the Realized Loss chart:

The worth of the metric seems to have spiked just lately | Supply: Glassnode on X

BTC Value

On the time of writing, Bitcoin is buying and selling round $86,200, down nearly 12% prior to now week.

The value of the coin has plunged throughout the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com