- Almost $870 million in crypto positions had been liquidated as Bitcoin and Ethereum confronted their greatest single-day drops of the yr.

- Trump’s new tariffs on Canada, Mexico, and China added strain to international markets, worsening the crypto sell-off.

- Bitcoin dangers deeper losses if it fails to carry the $76K assist, whereas Ethereum eyes a possible slide towards $1,990.

Almost $870 million in crypto positions vanished up to now 24 hours as Bitcoin (BTC) and Ethereum (ETH) endured their steepest single-day drops of the yr.

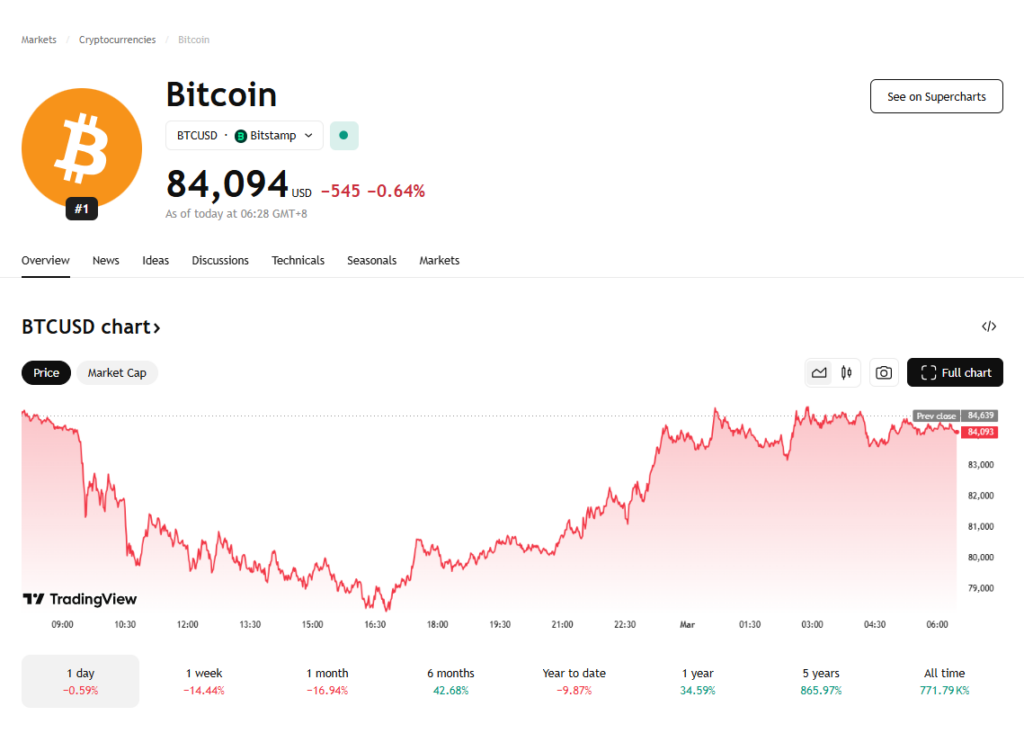

On Feb. 28, BTC plunged beneath $80,000, whereas ETH tumbled to a one-year low of $2,075, triggering a cascade of compelled liquidations throughout the market.

Market Meltdown: Bitcoin and Ethereum Plunge, Liquidations Soar

Merchants scrambling to unwind leveraged positions solely worsened the massacre, amplifying sell-offs and intensifying losses. A staggering 216,516 merchants confronted liquidations, with the biggest single order—a hefty $38 million—on HTX’s BTC-USDT pair. Lengthy positions took the brunt, with $767.51 million worn out, whereas quick positions misplaced a extra modest $103.19 million.

Bitcoin alone accounted for $414.80 million in liquidations, adopted by Ethereum at $205.56 million. Amongst altcoins, Solana (SOL) suffered $35.82 million in losses, trailed by XRP ($22.32 million) and Dogecoin (DOGE) ($17.71 million).

tradingview.com

Trump’s Tariff Conflict Sends Shockwaves Via Crypto

The sell-off deepened as U.S. President Donald Trump introduced contemporary tariffs on Canada, Mexico, and China, rattling monetary markets.

Set to take impact on March 4, the brand new tariffs embody a 25% levy on Canadian and Mexican imports, together with a ten% enhance on Chinese language items—stoking inflation fears and fueling issues over potential financial slowdowns.

Inventory Market Takes a Hit Alongside Crypto

World markets felt the tremors, with the S&P 500 shedding 1.6%, erasing its year-to-date beneficial properties, whereas the Nasdaq 100 nosedived 2.8%, dragged down by an 8.5% drop in Nvidia (NVDA) shares.

Confidence within the post-election crypto rally seems to be waning, as leveraged merchants betting on continued upside discovered themselves caught in a relentless downward spiral.

Bitcoin has now slid 27% from its all-time excessive of $109,350, whereas Ethereum has tumbled over 40% from its December peak.

Eyes on the Fed: Inflation Information May Set the Tone

Traders now await the Federal Reserve’s core PCE inflation report, due later right now, hoping for insights into potential financial coverage shifts in response to ongoing volatility.

If inflation stays stubbornly excessive, markets might brace for extended uncertainty, holding crypto costs underneath sustained strain.

Bitcoin’s Technical Setup: Rebound or Additional Ache?

BTC’s correction has introduced it to an important technical crossroads, with the 50-week exponential transferring common (EMA) round $76,000 performing as a key assist stage.

Traditionally, BTC has used this EMA as a dynamic assist flooring throughout bull cycles, making its capacity to carry above it a pivotal consider sustaining the long-term uptrend.

On the weekly timeframe, the Relative Energy Index (RSI) has dipped to 44.05, a stage that beforehand triggered robust rebounds in March 2020 and June 2021. If historical past repeats, this might mark a possible bounce zone.

Nonetheless, an extra RSI decline into oversold territory might push BTC towards the 0.786 Fibonacci retracement stage at $57,691—a traditionally robust assist space.

If the 50-week EMA fails, BTC might enter a deeper correction, with the 200-week EMA at $48,070 as the final word assist zone.

For now, if BTC stabilizes within the $75K–$78K vary, it could point out a short-term backside, probably setting the stage for a restoration towards the $90K–$95K resistance zone.

Ethereum’s Downtrend: Extra Losses Forward?

ETH’s breakdown indicators bother, with technical indicators hinting at a continued slide towards $1,990 within the quick time period.

The breach of a crucial trendline—supporting ETH since mid-2022—suggests a structural market shift.

Compounding the bearish outlook, ETH has slipped beneath its 50-week EMA at $2,920, with the 200-week EMA at $2,290 briefly offering assist. Nonetheless, Ethereum’s incapability to carry above these ranges has heightened dangers of additional draw back.

The RSI has dropped to 36.72, creeping towards oversold territory. Traditionally, dips beneath 40 have led to reduction rallies, however muted shopping for strain suggests bearish momentum could persist.

The subsequent key assist zone lies on the 0.236 Fibonacci retracement stage at $1,993—a stage of prior consolidation in the course of the 2021–2022 market cycle.

If this fails, ETH might plunge towards $1,450, a stage aligned with its 2022 bear market lows.