Ethereum (ETH) spent most of February buying and selling inside a slim value vary, struggling to realize momentum. Nevertheless, this week’s market-wide downturn, triggered by Donald Trump’s commerce insurance policies, has pushed ETH to multi-month lows.

With bearish sentiment on the rise and ETH struggling to regain power, buyers are questioning whether or not March will deliver additional declines or a possible rebound.

ETH Struggles as Provide Grows and Promoting Stress Mounts

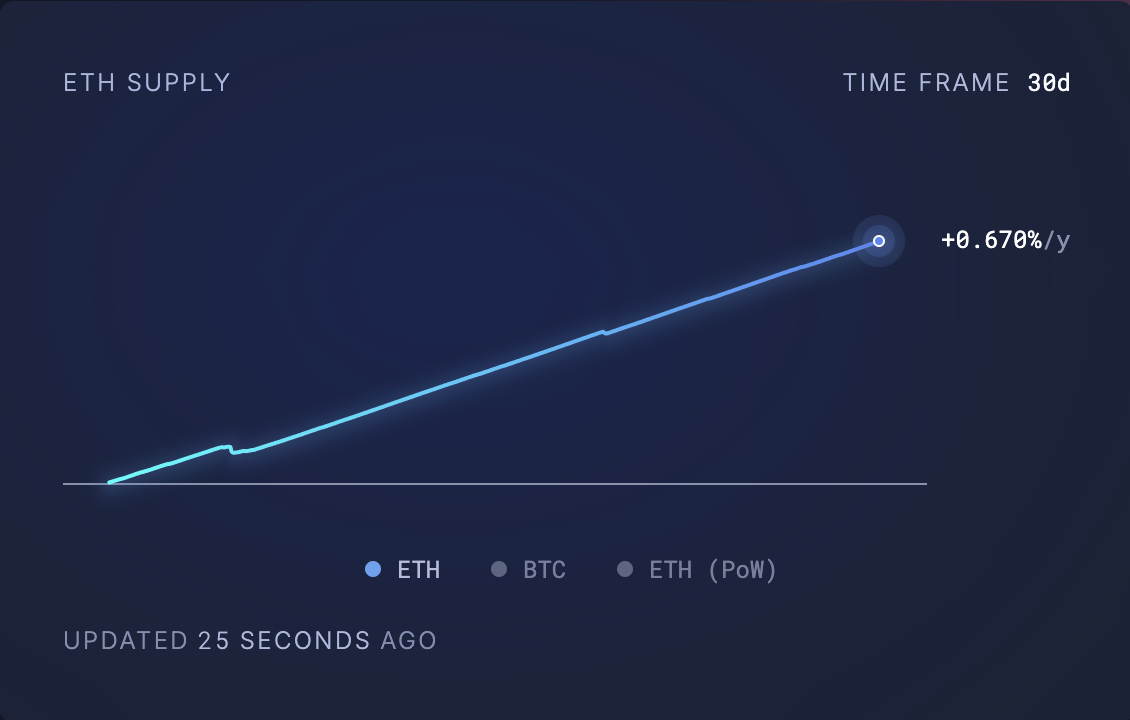

The regular surge in ETH’s circulating provide is a trigger for concern for market members in March. In line with Extremely Sound Cash, 66,350 ETH cash, valued above $138 million at present market costs, have been added to the altcoin’s circulating provide up to now 30 days.

When extra ETH tokens enter circulation, the general provide obtainable for buy will increase. If demand fails to maintain tempo, this surge in provide can exert downward strain on the coin’s value as extra tokens change into obtainable for promoting.

With an absence of robust shopping for curiosity to soak up the surplus provide, this pattern suggests ETH might face sustained weak point via March.

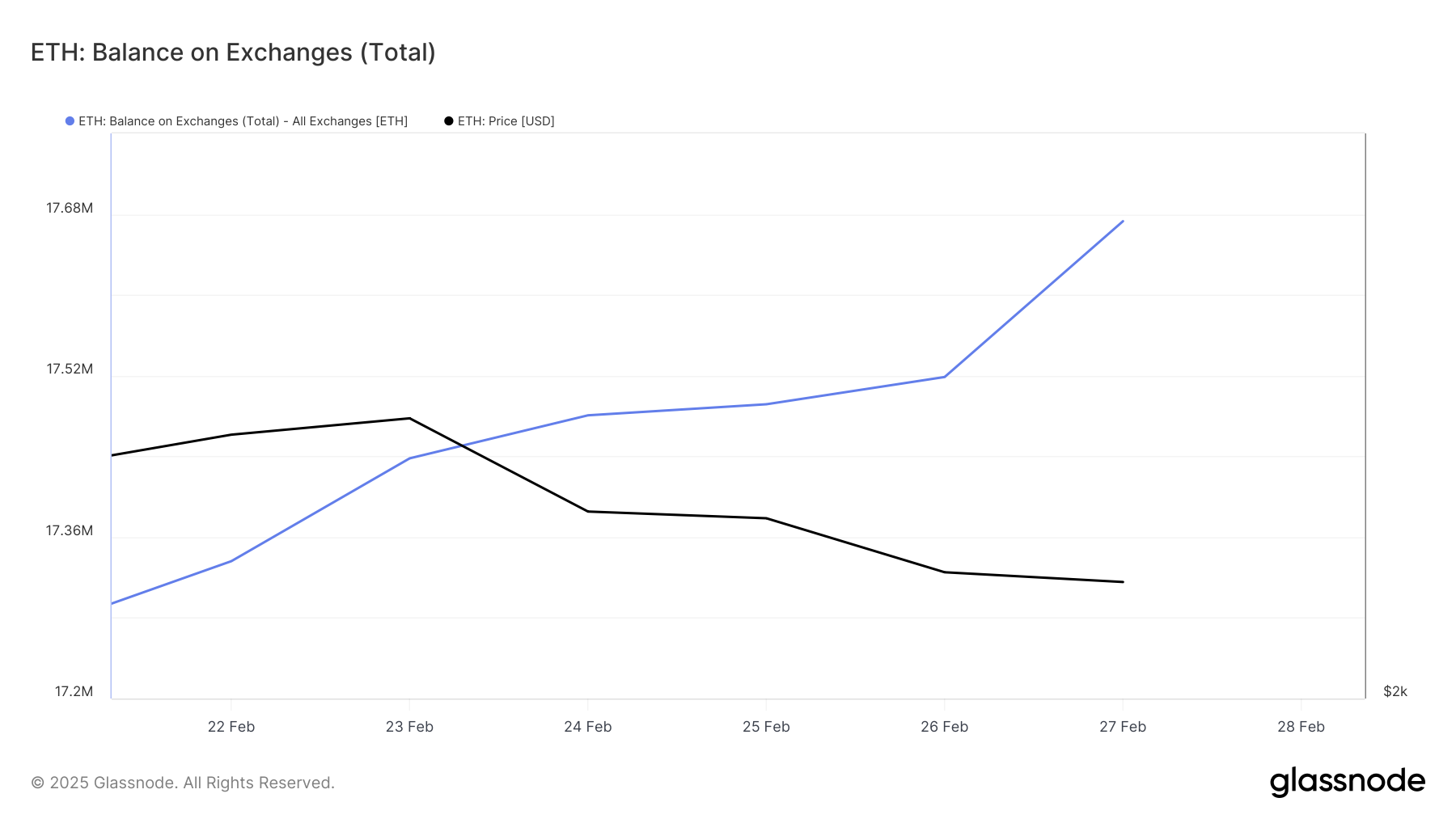

Furthermore, ETH’s rising trade stability is one more reason to fret. After it plummeted to a year-to-date low of 17.27 million ETH on February 21, it has since rocketed. At press time, 17.67 million ETH cash are held on trade pockets addresses, climbing 2% over the previous seven days.

ETH’s trade stability tracks the variety of cash held on trade addresses. When this stability spikes, a considerable amount of ETH is being moved onto exchanges, usually signaling that holders are making ready to promote.

This enhance in sell-side liquidity has added to the downward strain on the coin’s value, particularly as promoting exercise continues to outweigh shopping for demand. If sustained within the coming days, it’s going to worsen bearish sentiment, as extra merchants will look to dump holdings slightly than accumulate, exacerbating the value decline.

A Shopping for Alternative?

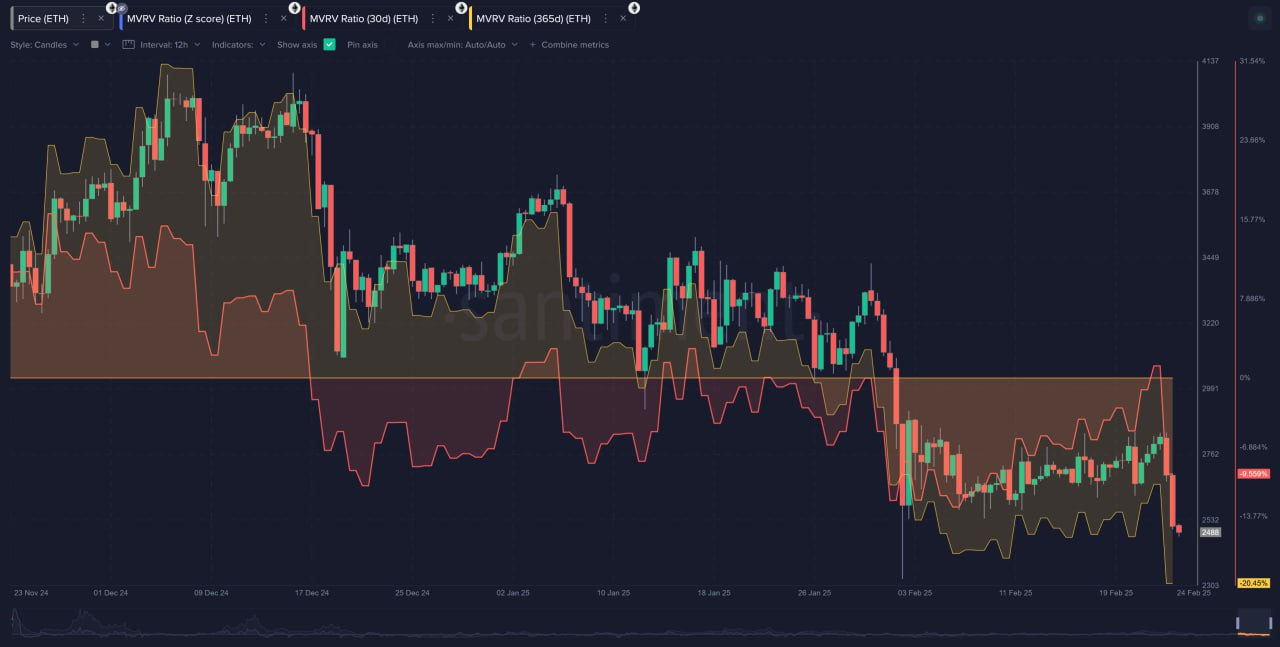

Regardless of ETH’s efficiency, some analysts consider this might current a shopping for alternative for these trying to ebook positive aspects in March. In an interview with BeInCrypto, Santiment analyst Brian Quinlivan opined that ETH’s present value ranges might supply a beautiful entry level for long-term buyers.

In line with Quinlivan, each short-term and long-term ETH holders are deeply within the pink, a situation hardly ever seen among the many high 50 cryptocurrencies. Traditionally, such moments of capitulation have preceded main value rebounds, as accumulation from massive buyers tends to comply with intervals of heavy promoting.

“The asset (ETH) may be one of many higher performers in 2025 because of its underwhelming efficiency in 2023 and 2024 relative to different alts and high caps. Each the short-term and long-term holders for Ethereum are effectively into the negatives, which isn’t the case for many high 50 tokens. So including on to your place is doing so throughout a de-risked time in comparison with the typical second in ETH’s historical past,” Quinlivan famous.

Disclaimer

According to the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.