Berachain (BERA) is up roughly 7% within the final 24 hours, pushing its market cap above $900 million. The current value surge is supported by robust technical indicators, with RSI approaching overbought ranges and DMI exhibiting patrons firmly in management.

If the present uptrend continues, BERA might retest ranges above $8.5 and presumably problem resistance at $9. Nonetheless, if momentum fades, key help ranges at $6.18 and $5.48 may very well be examined, figuring out the subsequent directional transfer.

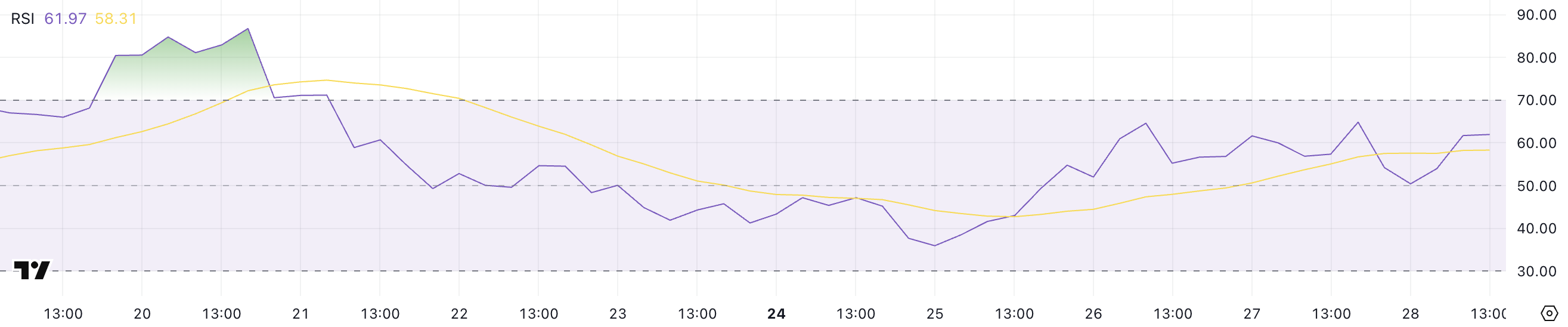

Berachain RSI Is Near 70

Berachain’s RSI is at present at 61.97, rising from 35.9 simply three days in the past after staying impartial for eight days. The Relative Power Index (RSI) is a momentum oscillator that measures the velocity and alter of value actions, starting from 0 to 100.

An RSI above 70 signifies overbought circumstances, suggesting a possible pullback, whereas an RSI under 30 alerts oversold circumstances, indicating a doable rebound. An RSI between 30 and 70 is usually thought of impartial, reflecting no robust directional bias.

With Berachain’s RSI at 61.97, the worth is approaching the overbought threshold however stays in impartial territory for now. This enhance suggests rising bullish momentum and shopping for curiosity, indicating that BERA might proceed to rise if the RSI strikes nearer to 70.

Nonetheless, if the RSI crosses into overbought territory, a short-term pullback or consolidation section might comply with as merchants take earnings. The subsequent value motion will rely on whether or not shopping for strain persists or if sellers begin to dominate because the RSI approaches overbought ranges.

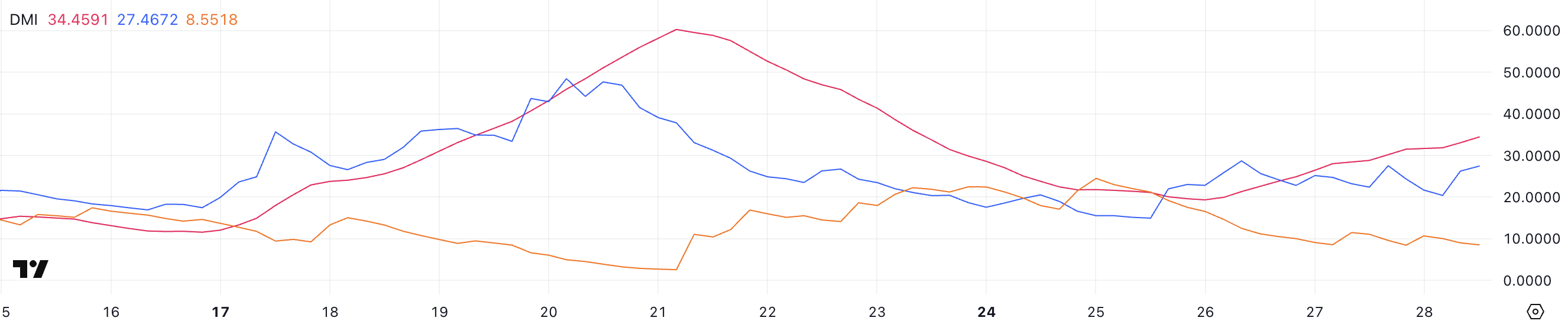

BERA DMI Exhibits Patrons Are In Management

Berachain’s DMI exhibits that its ADX is at present at 34.4, rising from 19.3 two days in the past, after beforehand reaching 60.2 per week in the past when BERA’s value surpassed $8.5. The Common Directional Index (ADX) measures the power of a pattern with out indicating its route, starting from 0 to 100.

An ADX above 25 alerts a powerful pattern, whereas values under 20 counsel a weak or non-trending market. The rise in ADX signifies that the present uptrend is gaining power, reflecting rising momentum and market conviction.

In the meantime, BERA’s +DI is at 27.4, exhibiting robust shopping for strain, whereas the -DI is at 8.55, down from 11.1 two days in the past, indicating weakening promoting strain.

This configuration confirms that BERA is in an uptrend, with patrons clearly in management. The widening hole between the +DI and -DI means that the bullish momentum is rising, making a continuation of the uptrend extra seemingly. So long as the +DI stays above the -DI and ADX stays above 25, BERA is more likely to preserve its upward trajectory.

Will BERA Reclaim Ranges Above $9 In March?

Berachain (BERA) may very well be on its option to retest ranges above $8.5, and if the present uptrend continues to realize momentum, it might rise additional to problem resistance above $9.

With a market cap of $884 million, the $1 billion threshold may very well be a vital stage to observe within the coming weeks, as breaking this milestone might entice elevated investor curiosity and shopping for strain.

Nonetheless, if the uptrend reverses, BERA might decline to check the help at $6.18.

If this stage fails to carry, the worth might drop additional to $5.48, signaling a deeper correction. These key help and resistance ranges will play a significant function in figuring out BERA’s subsequent value motion.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.