Bitcoin is visibly struggling. The value of the main crypto has dropped by about 26% from its all-time highs, wiping out $400 billion in market capitalization and destroying market sentiment.

Buyers are actually frightened by Donald Trump’s aggressive tariff insurance policies that favor an increase within the US greenback index, whereas draining curiosity in speculative property. The pump, beforehand triggered by the US presidential elections, has been utterly nullified.

Nevertheless, there’s nonetheless a glimmer of hope for holders: traditionally, drawdowns like these precede a powerful rebound, which may materialize in a new market rally. Within the meantime, on-chain information and the habits of whales supply us beneficial clues about Bitcoin’s future value motion.

Why is Bitcoin happening? A complete overview

In a fragile second like this, everyone seems to be asking why Bitcoin is falling and what has triggered such a marked bear motion. The solutions are prone to be discovered outdoors the cryptographic context, throughout the extra complicated macroeconomic sphere. Actually, alongside Bitcoin, the S&P500 can also be giving disagreeable surprises, dropping over 4% within the final 5 days.

Donald Trump represents one of many fundamental actors on this monetary markets dump, as his overseas insurance policies don’t appear to have been nicely acquired by traders. Lately, the brand new president of the US introduced that from March 4th, he’ll impose commerce tariffs on Canada and Mexico, additionally doubling the common 10% tariff utilized to imports from China. The import taxes have additionally affected the European Union, which from April 2025 will face a rise on its USA exports.

All this negatively impacts the U.S. inflation, with a rise in value pressures that would make it harder for the Federal Reserve to undertake an expansive financial coverage. Consequently, there might be fewer rate of interest cuts than these anticipated only a few months in the past, influencing the pattern of speculative markets like that of Bitcoin in a bear path.

The one one who benefited from this state of affairs is the US greenback index (DXY), which on Thursday, February 27, rose by 0.77%. Often, the pattern of DXY is inversely proportional to the expansion of Bitcoin and shares. It’s no coincidence that throughout the bear market of 2022, this index reached native highs at 114 factors. Because the US greenback is the world reserve foreign money, its value modifications can have an effect on the buying energy of people and establishments and affect the demand for riskier property.

The worst buying and selling week since June 2022 for BTC

With the newest value drop, Bitcoin recorded the worst weekly efficiency since June 2022, when its worth plummeted by a few third. On that event, Coinbase was accused by the SEC of working with no license and providing unregistered securities. This time, nonetheless, we’ve Bybit, the second alternate within the crypto marketplace for spot volumes, which was hacked for $1.5 billion in $ETH by the North Koreans of the Lazarus group.

On the time of writing the article, Bitcoin marks a disastrous week of -18%, dangerously falling beneath the $80,000 help. With this sell-off, the coin has stuffed the CME hole that had fashioned in mid-November. Some analysts counsel that from right here it may check lower cost ranges, whereas others imagine {that a} bull impulse will begin from right here. Let’s bear in mind that there’s one other small CME hole at $93,000 ready to be stuffed.

Based on on-chain information, within the final 3 days the realized losses by Bitcoin merchants exceed the 3 billion {dollars} mark. This is without doubt one of the most bearish values since August 2024, when the carry commerce in yen ended and the cryptocurrency reached $49,000.

Additionally take into account that the final weekly candle of the BTC-USDT chart represents the worst ever by way of value tour, with an general amplitude of virtually $18,000.

In whole, in line with the info from TradingView, the cryptocurrency market capitalization has misplaced a whopping 1.1 trillion {dollars}, bringing the overall to 2.59 trillion {dollars}. A lot of this exodus is by retails who purchased within the final month and panicked with the market crash. Based on IntoTheBlock, presently there are nonetheless 6.34 million addresses “out of the cash” on Bitcoin, which purchased at a value between $86,000 and $106,000.

Bitfinex margin merchants benefit from reductions and go lengthy on Bitcoin

Whereas the value of Bitcoin faces a heavy retracement, some customers are taking benefit to buy out there and common their positions. Specifically, merchants on the alternate Bitfinex, identified for its presence of whale traders, appear to be betting closely on an imminent rebound of the cryptocurrency. The variety of BTC bought on Bitfinex with borrowed cash has certainly risen to greater than 60,000 BTC from 50,773 this month.

Often, the traders on this platform are inclined to precisely predict the peaks and bottoms of the cryptocurrency market. These merchants, holders of enormous quantities of bitcoin, accumulate throughout the downtrends or in rangebound phases, and promote throughout moments of heightened hype. This sample was evident throughout the market highs of 2021 and 2024. For instance, in the midst of final 12 months, their participation was very energetic, given the good speculative alternatives that arose with the summer time dip in costs.

In today, a Bitfinex whale appears to have gone procuring by buying as a lot as 4,000 BTC, equal to 323 million {dollars}. The identical consumer had amassed 70,000 BTC between $40,000 and $16,000 throughout the Luna crash and FTX in 2022, solely to promote them between $40,000 and $70,000 in 2024. His new exceptional buy means that regardless of the bear outlook, Bitcoin may get well very nicely within the coming months.

The worry and greed index of Coinglass signifies a worth of utmost worry, not often observable out there. Within the final 12 months, the market has seen solely 4 days of utmost worry. In all probability the Bitfinex dealer had as a mentor the outdated baron Rothschild, who initially of the nineteenth century recited the sensible phrase “The time to purchase is when blood is working within the streets.”

Are we in the midst of a big dip or on the daybreak of a brand new bear market?

In the intervening time, predicting the long run pattern of Bitcoin is especially troublesome, particularly because of the quite a few macroeconomic variables at play. Based on varied projections, the crypto asset nonetheless has room for one final bullish push, which may culminate in a brand new all-time excessive and mark the tip of the bull run. Nevertheless, technical evaluation signifies rising management by the bears, elevating the danger of a depreciation section. If this pattern had been to consolidate, it may set off a chronic bear market.

“`html

Bitcoin wants a catalyst that may justify a powerful value rebound, restoring the everyday balances of the bull market. Certainly one of these might be the inclusion of the foreign money as a reserve asset of the US Treasury, as promised a number of occasions by Donald Trump. One other issue that would deliver liveliness again to the market is the tip of the battle between Russia and Ukraine, which would scale back geopolitical uncertainty and favor a extra secure local weather for investments.

“`

The biggest help for Bitcoin is within the $73,000 space: a break of this degree, confirmed by a decrease shut with a weekly candle, would give additional power to the bears. A restoration of the resistance at $89,000 would as an alternative create larger confidence in contemplating the present sample as a big backside assemble. The cryptocurrency is displaying its most precious attribute, in addition to essentially the most merciless, specifically unpredictability.

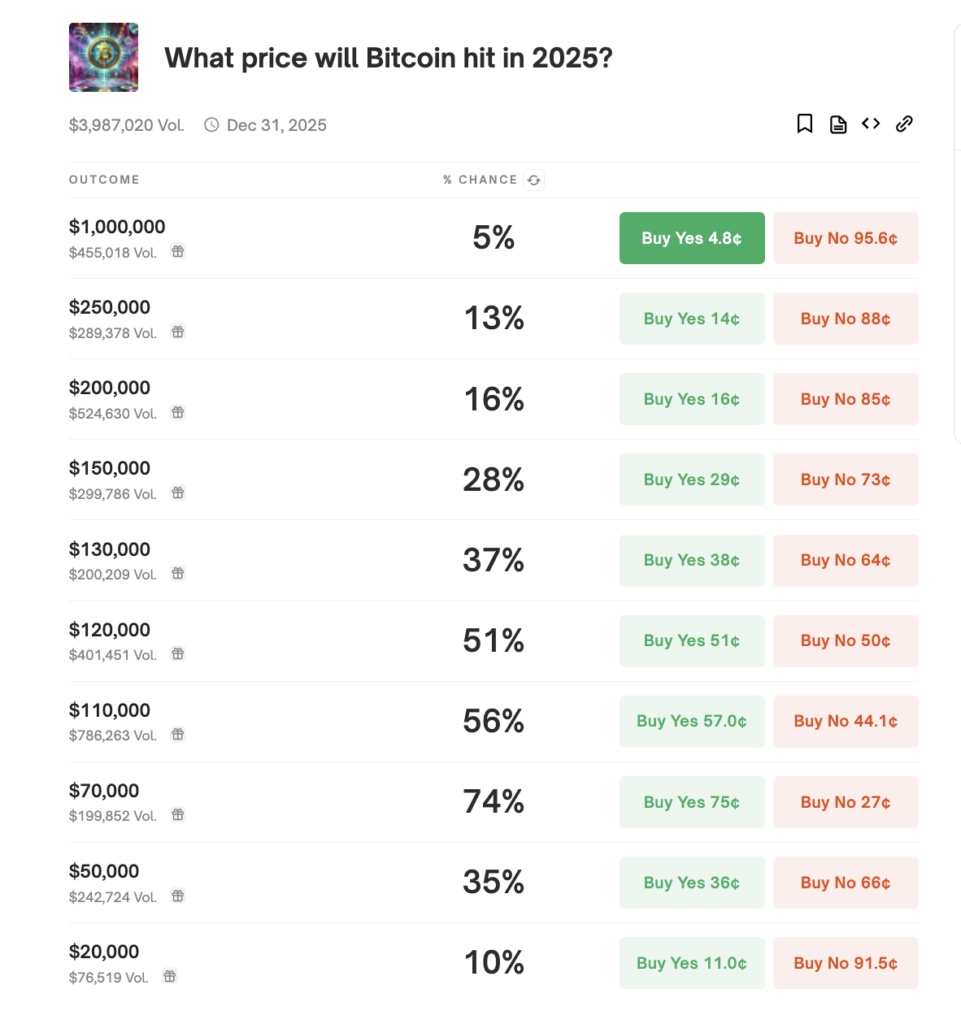

The forecasts of Polymarket counsel that something can occur in 2025, with Bitcoin probably reaching $200,000 or revisiting the highest of the bull market of 2017 at $20,000. Everybody performs their very own recreation.