Este artículo también está disponible en español.

This week’s market correction has seen Bitcoin (BTC), the most important cryptocurrency by market capitalization, retest a few of its key assist ranges. As the worth begins to recuperate from the latest lows, some analysts take into account the weekend would possibly carry some bullish aid for buyers.

Associated Studying

Bitcoin Recovers From $78,000 Drop

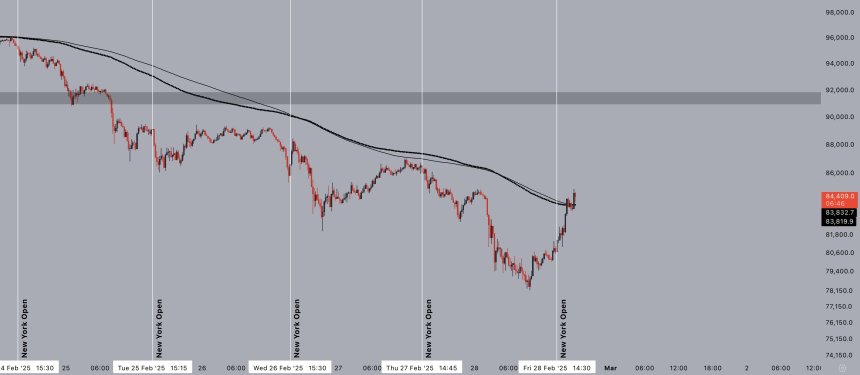

Bitcoin has skilled important promoting stress during the last week, fueling doubts a few potential market prime. The flagship crypto has dropped 21% from final week’s excessive of $99,000, dipping under the $80,000 degree for the primary time since November.

The correction additionally noticed BTC drop almost 30% from its January all-time excessive (ATH) and commerce under its post-US election value vary. Every week after the market bleeding began, Bitcoin hit a brand new three-month low, retesting the $78,000 assist on Friday morning.

Numerous market watchers famous that BTC’s most up-to-date decline reached and partially crammed its November 2024 CME Hole between $78,000 and $80,700. Rekt Capital identified that Bitcoin is experiencing a “robust rebound towards the partially crammed CME Hole and is doing so on above-average vendor quantity.”

The flagship crypto has surged round 7% from at this time’s lows, hovering between the $83,000 and $84,000 assist zone for the previous few hours.

To the analyst, the CME Hole assist and sell-side quantity will likely be two key indicators to concentrate to over the weekend as fixed, uninterrupted BTC sell-side stress is unsustainable, and vendor exhaustion probably accelerates within the subsequent few days.

Bitcoin is lastly beginning to expertise above-average vendor quantity. There’s nonetheless scope for extra vendor quantity to return in, however the possibilities of Vendor Exhaustion occurring are growing. And Vendor Exhaustion tends to precede value reversals.

Is A Weekend Rebound Coming?

Crypto analyst Jelle highlighted that Bitcoin has completed “three drives in deeply oversold territory” this week and is retesting the native lows earlier than at this time’s drop, which suggests {that a} “weekend aid appears possible.”

The analyst acknowledged that reclaiming the $84,500 assist is vital for BTC’s restoration as “the previous two retests ended up leading to new lows.”

Nonetheless, he famous that at this time’s rebound appears totally different attributable to BTC “touching the 200-ema cluster” for the primary time this week and breaking above it. To Jelle, this might sign an “fascinating weekend,” with the brand new CME Hole at $93,000 open.

Rekt Capital identified that Bitcoin “has crammed each CME Hole that has fashioned since mid-March 2024” and that solely the newly fashioned CME Hole between $92,800 and $94,000 stays open after this retrace. If BTC continues this sample, the worth might see a rebound to fill the brand new hole quickly.

Associated Studying

The analyst has outlined two potential situations for BTC’s present “draw back deviation.” Based on the publish, Bitcoin’s value might revisit $93,500 by the tip of the week if the deviation “is to finish up as a draw back wick.”

In the meantime, if the deviation is “to finish up because the Submit-Halving deviation that includes Weekly Candle Closes under the Re-Accumulation vary,” BTC’s value might revisit the $93,500 degree within the subsequent two to 3 weeks as “a part of a post-breakdown aid rally.”

As of this writing, Bitcoin trades at $85,120, a 0.5% improve within the each day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com