Head of Macro Analysis at World Market Investor Julien Bittel has offered an fascinating perception into the Bitcoin market following a serious worth loss up to now week. In a daring transfer, the monetary analyst has backed the premier cryptocurrency to quickly pull off a rebound linking the latest worth fall to broader macroeconomic situations.

Why Bitcoin’s Drop Under $80,000 May Have Marked The Finish Of The Promote-Off

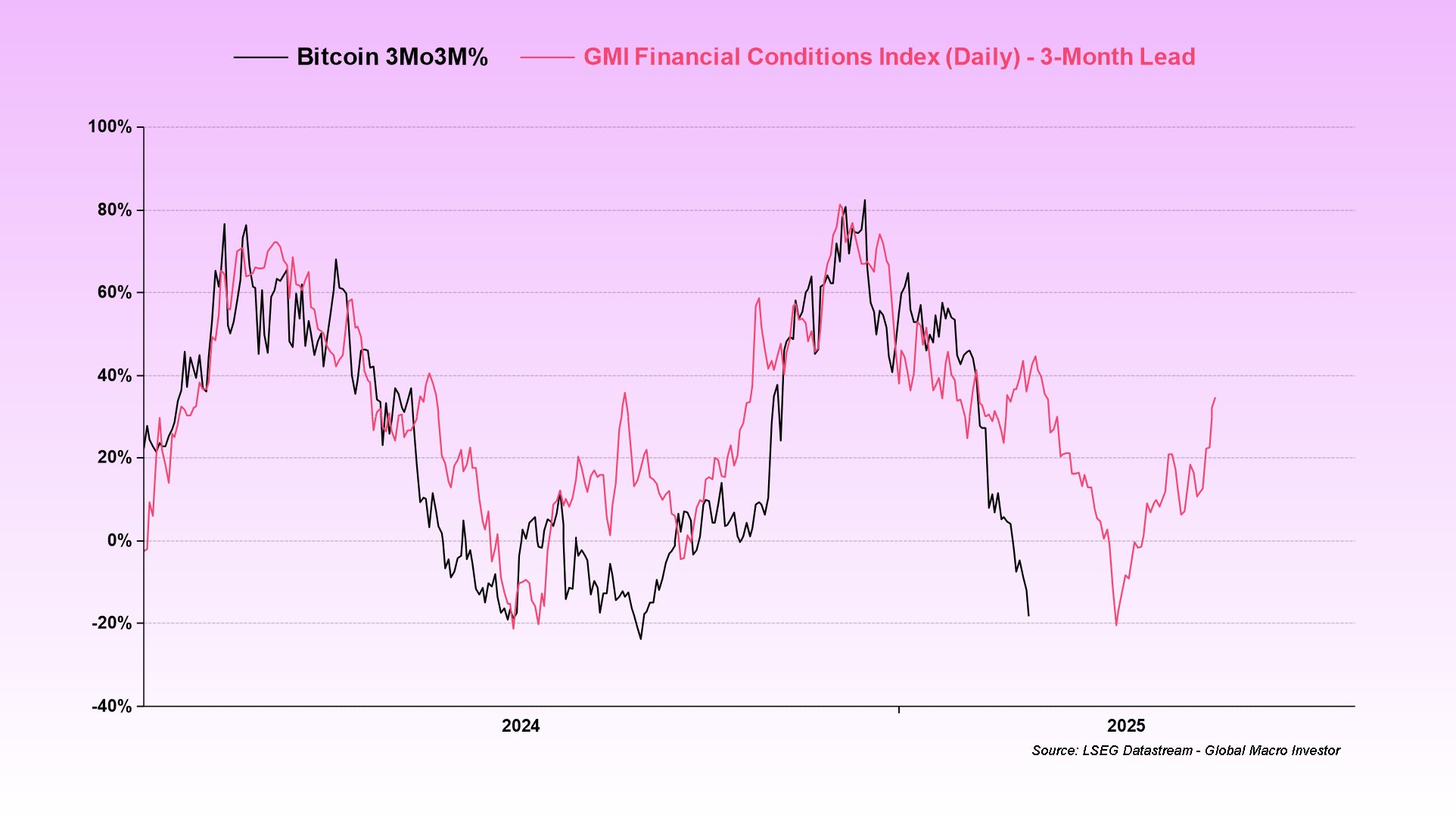

Over the previous week, the BTC market registered a major bearish worth motion, with costs falling from over $96,000 to beneath $80,000. In an X submit on February 28, Bittel attributed this worth fall to the tightening of economic situations in This autumn 2024, which has drained liquidity from the market, making it tougher for speculative property like Bitcoin to take care of upward momentum.

When market liquidity reduces, financial surprises sluggish resulting in issues a couple of potential recession and in the end inducing market uncertainty and a risk-off habits. Nonetheless, Bittel expects these buyers’ sentiment to reverse in March making a case for a Bitcoin rebound.

The analyst notes that market situations over the previous two weeks have been easing quickly as indicated by a weakening greenback, lowering bond yields, and falling oil costs. These macroeconomic developments recommend that liquidity is returning to the monetary system signaling a possible rebound in market sentiment.

Notably, with Bitcon’s latest dip beneath $80,000, Julien Bittel states the results of tightening liquidity situations have been absolutely mirrored. And whereas a possible worth fall remains to be attainable, sentiment indicators sign little room for additional draw back. For instance, Bitcoin’s Relative Power Index (RSI) has lately touched 23 representing its most oversold degree since August 2023. Such market situations again the notion of incoming worth rebound.

The BTC Market: A Contrarian Alternative?

Within the last remarks of an intriguing evaluation, Bittel has urged buyers towards being too comfortably bearish however quite pushed for a grasping mindset amidst the widespread market concern.

Notably, blockchain analytics agency Santiment notes that the “market crowd” tends to go unsuitable on predictions i.e. when merchants are forecasting Bitcoin to go decrease, costs go up and vice versa primarily based on historic knowledge. Due to this fact, the present Bitcoin market might current a singular alternative for accumulation regardless of common expectations of a sustained worth dip.

On the time of writing, Bitcoin trades at $84,750 following some worth features on Friday amidst a optimistic US inflation report. With a market cap of $1.68 trillion, the premier cryptocurrency stays the most important digital asset with a staggering market dominance of 60%.

Featured picture from The Unbiased, chart from Tradingview