The chief govt of market intelligence agency CryptoQuant is doubling down on his place that Bitcoin (BTC) stays in a bull market.

In a brand new thread, Ki Younger Ju tells his 410,300 followers on the social media platform X that Bitcoin’s surge on Sunday is confirming his perception that Bitcoin’s bull market is much from over – so long as it doesn’t fall considerably beneath the $75,000 stage.

“Made a daring name figuring out I may very well be manner off, however glad I acquired it proper.”

Bitcoin surged over the weekend from round $84,000 to round $94,000, after President Trump introduced a crypto strategic reserve for the US that can embody the flagship digital asset.

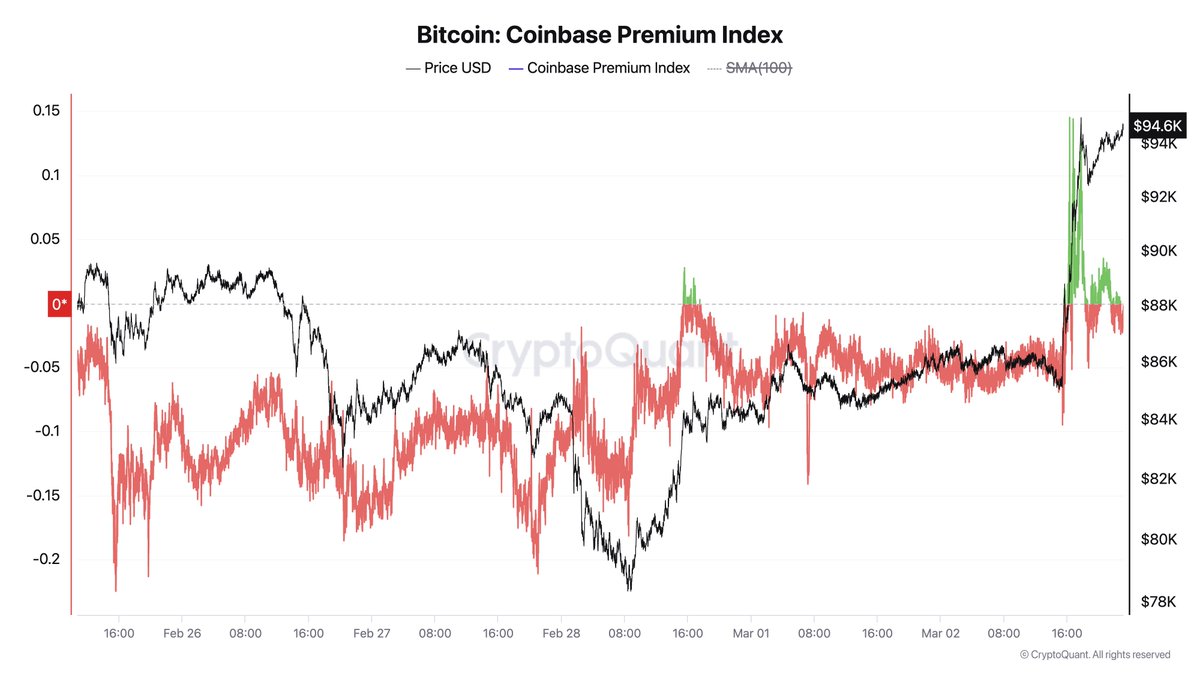

Ki Younger Ju additionally says that deep-pocketed buyers utilizing the highest US crypto change Coinbase have been propelling Bitcoin to larger worth ranges over the weekend.

“Coinbase whales led this Bitcoin surge.”

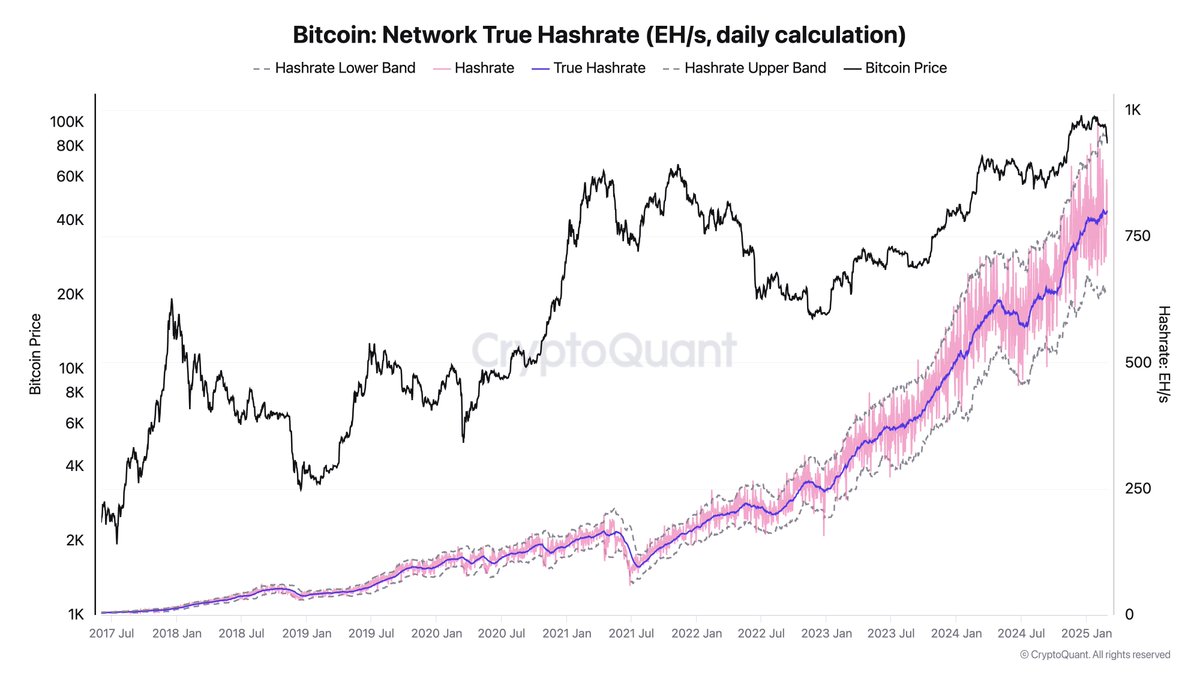

The CEO factors to different metrics that he says proceed to sign bullishness, together with Bitcoin’s hash charge.

The hash charge measures the computational energy utilized by miners to safe the BTC community. A better hash charge signifies a stronger community and higher safety.

“The chart that backs my perception in Bitcoin. When funding in its community safety stops, it has seemingly absorbed sufficient capital. That’s the time to promote.”

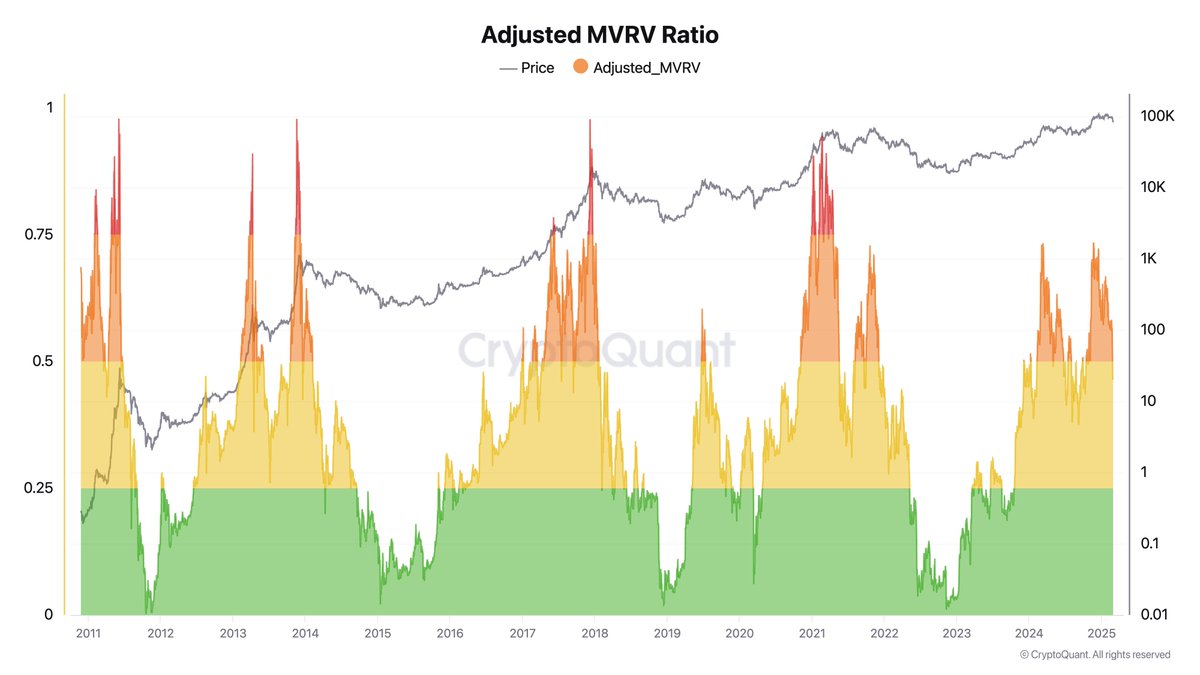

He additionally says that Bitcoin’s Market Worth to Realized Worth (MVRV) indicator reveals the worth of the flagship crypto asset is prone to go up primarily based on historic priority.

MVRV is the ratio of Bitcoin’s market capitalization relative to its realized capitalization (the worth of all BTC on the worth they have been purchased at) and is used to evaluate whether or not the crypto asset is undervalued or overvalued.

“Bitcoin on-chain indicators really feel like this – like one thing unfinished.”

The flagship digital asset did retrace on Monday amid the Trump tariff information that prompted a sell-off within the inventory market. Bitcoin is buying and selling for $83,284 at time of writing, down 10.4% within the final 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney