Ethereum’s efficiency has been inconsistent these days, negatively impacting its public notion. Steady value drops, governance points, and excessive gasoline charges have made the crypto group query whether or not these are non permanent setbacks or indicators of deeper issues.

BeInCrypto interviewed trade leaders from Wirex, Komodo Platform, BingX, KelpDAO, and RAAC to research the components contributing to Ethereum’s decline, its present market place, and potential methods for enchancment.

Market Efficiency and Investor Sentiment

Ethereum’s 2025 is off to a rocky begin. After a failed try to interrupt by means of the $2,500 barrier, Ethereum has retreated to $2,090. In the meantime, whale addresses have been on a promoting spree, dumping a large 640,000 ETH value $1.5 billion and pushing the altcoin king farther from its goal.

The latest Bybit hack, which brought on the theft of roughly $1.4 billion value of Ethereum, didn’t assist, both. Since then, the community recorded its highest weekly outflows, at $300 million.

In the meantime, a wave of bearish sentiment and dwindling investor confidence despatched ETH spot ETF outflows to a 30-day peak of $94.27 million final week. This surge, the third largest of 2025, adopted Ethereum’s value dip to $2,251, signaling a transparent investor retreat.

“In contrast to Bitcoin, which has surged over 90% this yr, Ethereum’s efficiency feels underwhelming, main many holders to marvel when it would reclaim a brand new all-time excessive,” Vivien Lin, Chief Product Officer at BingX, instructed BeInCrypto.

Given these circumstances, a number of components have to be thought of to grasp Ethereum’s latest decline.

Exterior and Inside Elements Affecting Ethereum

Current value swings within the crypto sector have prompted hypothesis in regards to the onset of a bear market. Although the market has skilled a reprieve following President Donald Trump’s announcement of a US Crypto Strategic Reserve, the long-term influence of this restoration stays unsure.

Different components have additionally contributed to the declines in costs throughout main cryptocurrencies. Trump’s latest tariffs on Canada, Mexico, and China have brought on costs to plunge.

In the meantime, crypto markets are starting to really feel the influence of inflation on america’ financial system. In flip, merchants are more and more weary that the Federal Reserve will increase rates of interest. All of those components have affected Ethereum’s efficiency.

“The broader market stays extremely delicate to macroeconomic components like tariffs, potential curiosity fee cuts, and geopolitical tensions, all of which have added to ETH’s value uncertainty,” Lin added.

Whereas these components present perception into present market fluctuations, they don’t absolutely clarify the worth efficiency of particular person cryptocurrencies. Karlos Bujas, Graduate Buying and selling Analyst at Wirex, gave a common overview of the struggles Ethereum at the moment faces:

“Ethereum’s value struggles may be attributed to inside challenges like governance points, inefficient useful resource allocation, and waning market dominance. Critics level to the Ethereum Basis’s massive funds and underutilized treasury, which some argue have slowed innovation. Developer dissatisfaction has additionally performed a task, whereas Ethereum’s lack of political engagement, particularly in comparison with Solana and XRP, has left it at a drawback. Management divisions have added to the uncertainty, and with Ethereum dropping floor in DeFi and sustaining excessive charges, its value has remained stagnant under $3,500 since January 7, 2025,” he instructed BeInCrypto.

Exploring every of those inside challenges in better element is essential to really understanding the basis causes of Ethereum’s stagnation.

Ethereum’s DeFi Dominance and Challenges

Ethereum’s success largely hinges on its pioneering management in decentralized finance (DeFi), infrastructure, and developer ecosystem. In comparison with its rivals, Ethereum can be perceived to be extra decentralized.

The community continues to dominate the market by way of DeFi, with a present whole worth locked (TVL) surpassing $48 billion. Solana, its runner-up, lags behind with a TVL of over $7 billion.

“58% of DeFi liquidity is on Ethereum and it dominates the market throughout stablecoin market share, liquid staking, restaking and a number of different sectors of DeFi. General, Ethereum has been the finest chain for innovation in DeFi and most profitable DeFi protocols are on Ethereum and L2s,” Amitej Gajjala, Co-founder of KelpDAO, instructed BeInCrypto.

Regardless of Ethereum’s dominance in DeFi, excessive gasoline charges and sluggish transaction speeds have deterred customers from continued interplay with the community.

“Ethereum has been dropping floor in DeFi, significantly to Solana, on account of its excessive transaction charges and governance challenges. On-chain exercise has dropped by 38%, and key protocols like Uniswap have seen vital declines. In the meantime, Solana’s decrease charges and quicker transactions have attracted liquidity, additional boosted by Trump’s memecoin launch in January 2025,” Bujas mentioned.

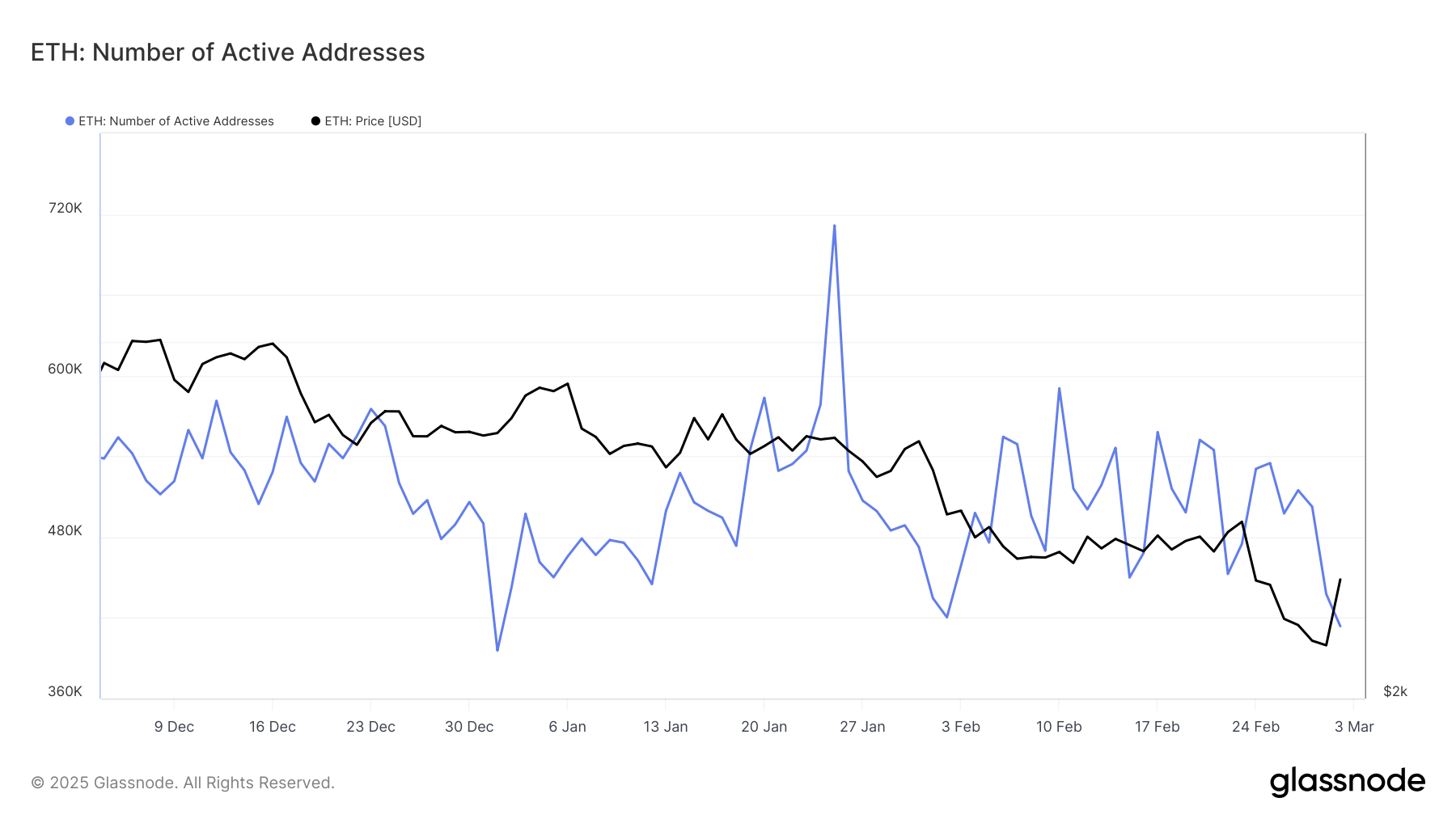

Typically talking, Ethereum has seen a decline in person exercise. In keeping with knowledge from Glassnode, the variety of energetic Ethereum addresses has been significantly risky over the previous few months.

Ethereum’s most up-to-date peak was on January 25, when the community registered 711,578 energetic addresses. On March 2, that quantity dropped to 413,754, representing a 53% lower.

Scalability Points and Layer-2 Options

Restricted transaction capability inside Ethereum’s community structure creates scalability points, resulting in congestion and excessive transaction charges. When person demand will increase, transaction instances sluggish, and charges rise for these interacting with dApps.

Through the years, Ethereum has launched a number of reforms to attempt to curb the extent of those points.

“Regardless of modifications to Ethereum’s structure, together with a transition from proof-of-work to proof-of-stake, scaling points stay, which has led to a disaster of confidence in Ethereum amongst crypto buyers,” Kadan Stadelmann, Chief Expertise Officer at Komodo Platform, instructed BeInCrypto.

When these modifications proved inadequate, Ethereum additionally launched a Layer-2 ecosystem. These protocols supply near-term scalability enhancements by dealing with transaction processing exterior the principle Ethereum community. Nevertheless, this resolution has been met with criticism.

“The failure to make Ethereum scalable for the myriad dApps and DeFi purposes being constructed upon the community has brought on a proliferation of layer two applied sciences, which have their personal tokens, which saps demand from the Ethereum mainnet. For occasion, whereas Polygon is a layer two community, its token has outperformed ETH, making it in impact competitors for Ethereum, at the identical time it will increase Ethereum’s scalability. What’s extra, layer two protocols such as Polygon—as nicely as Optimism and Arbitrum—introduce centralization to a community constructed on the promise of decentralization,” Stadelmann added.

Over time, these points have led to elevated competitors from different networks.

Competitors and the Ethereum Basis’s Response

Ethereum has explored different DeFi treatments to keep up its place, significantly as networks like Solana have began to problem its DeFi dominance.

“Ethereum is dropping floor to rivals—primarily Solana. Solana was constructed with scalability in thoughts, permitting large DeFi initiatives to be launched on prime of the community. Its success in the DeFi sector over Ethereum is evidenced by the truth that President Donald J. Trump launched his digital collectibles on Solana, not Ethereum,” Stadelmann mentioned.

Just a few days after Trump launched his meme coin on Solana, the Ethereum Basis transferred 50,000 ETH to a multi-signature pockets to help DeFi protocols.

This motion was taken following public scrutiny of the Basis’s treasury administration. Supplying ETH into these protocols generates yield on DeFi deposits, successfully appreciating the treasury’s worth with no need to promote property.

Some members of the group lauded the transfer.

“This effort by the ETH Basis to positively affect its repute in the house and improve the value of Ethereum is an important step in the proper path. Due to the sheer improve in DeFi competitors, everybody is attempting to make a product higher than the final, so doing this was a good transfer. I imagine this was a profitable transfer as simply a few hours after the deployment, Ethereum’s Relative Energy Index (RSI) went from 65 to 72, including elevated buying stress,” Lin instructed BeInCrypto.

Gajjala agreed, including:

“It is positively a very constructive transfer from the Basis. It signifies belief in the DeFi protocols and additionally alerts belief and credibility amongst DeFi protocols to the broader market together with establishments,” he mentioned.

Nevertheless, others criticized the Ethereum Basis for a way lengthy it took to make the transfer.

“It is nice this occurred however was lengthy overdue. The complete worth driver of ETH is DeFi and its monetary purposes. For no matter motive, this went over the ETH Basis’s head and they’ve been dumping tokens for masking basis bills when the optimum resolution can be taking a mortgage on a protocol like AAVE. To me, the thought of this transfer was to present help for the ‘area of interest’ that drives most of ETH’s worth. After it had largely neglected DeFi,it’s good to be acknowledged by the Ethereum Basis. Though profitable, the lateness of this transfer has, nonetheless, left a unhealthy style in some builders’ mouths,” Kevin Rusher, Founding father of real-world asset platform RAAC, instructed BeInCrypto.

To that time, Bujas contended:

“Whereas the transfer might have supplied non permanent liquidity help, it doesn’t absolutely tackle deeper considerations like excessive charges, competitors, and governance points. Its long-term influence will rely upon whether or not it could drive sustained engagement in DeFi. Nevertheless, with out elementary enhancements, this capital injection alone is unlikely to reverse Ethereum’s downward trajectory,” he mentioned.

The episode additionally illustrated the disagreement over the Ethereum Basis’s administration of the community’s future.

Management Adjustments and Neighborhood Reactions

Over the previous yr, the Ethereum Basis has confronted elevated scrutiny over its passivity and considerations amongst group members about its spending and operational priorities. So, its present efforts purpose to strengthen the Basis’s ties inside the Ethereum ecosystem and rebuild belief.

The Ethereum Basis’s switch of 35,000 ETH to Kraken, revealed by Lookonchain, sparked group criticism on account of a scarcity of transparency. Whereas the Basis cited funds wants and regulatory constraints, the group remained divided on the best way to deal with monetary selections.

A number of different points additionally divided the group over the Basis’s affect in Ethereum’s ecosystem. Criticisms embody the Basis’s management being held accountable for Ether’s relative underperformance in comparison with different cryptocurrencies. Moreover, the Ethereum community has skilled a discount in new developer acquisition, with Solana exceeding Ethereum’s developer development.

Some inside the Ethereum group referred to as for the resignation of then-Government Director Aya Miyaguchi as they held her answerable for Ethereum’s challenges.

“There has been criticism that Miyaguchi is not dealing with the challenges with common operations nicely, main to some of the staff leaving. There have additionally been efforts to create a extra even management construction with twin leaders, taking extra management away from simply one particular person. On the opposite, some are glad with her management and the Basis’s roadmap. It is really tough to make all gamers in an ecosystem glad, so there have been management shifts and discussions to handle these points for long-term success,” Lin defined.

Although Ethereum Co-founder Vitalik Buterin introduced on January 18 that the Ethereum Basis was present process a major management transformation, these modifications have been solely introduced final week.

After seven years as Government Director, Miyaguchi turned President on February 25. Shortly after, the Ethereum Basis fashioned the Silviculture Society, a 15-member council, to handle management considerations and uphold core values.

Yesterday, the Basis appointed Hsiao-Wei Wang and Tomasz Stanczak as co-Government Administrators. Though group opinions on the brand new management stay break up, Gajjala harassed that these modifications want time to provide results.

“Change administration would take time and I might urge the group to remain affected person as a few of these take time to implement,” he mentioned.

In anticipation of this new chapter in Ethereum’s management, trade specialists emphasised precedence areas for enchancment.

Specialists’ Suggestions for Ethereum’s Future

Stadelmann and Bujas agreed that Ethereum wants to enhance its scalability to keep up its aggressive edge over different networks that present reduction on this space.

“The perceived obstacles to scalability on the Ethereum community have led to a decline in Ethereum’s dominance in the crypto markets. Whereas discussions up to now revolved round a flippening between Ethereum and Bitcoin, whereby Ethereum would overtake Bitcoin’s market share, discussions right this moment revolve round a flippening of Ethereum by Solana. Largely pushed by memecoins, Solana has surged in opposition to Ethereum in phrases of market share in latest years. Solana’s common every day transaction quantity has grown far past Ethereum’s— a surprising indictment of Ethereum’s development or lack thereof,” Stadelmann mentioned.

If Ethereum doesn’t resolve these points now, it would face a snowball impact sooner or later.

“Whereas Ethereum is more likely to profit from the final development of the crypto market, its struggles with charges, governance, and innovation might restrict its future upside. The ETH/BTC value has been bearish since 2022, with Ethereum lagging behind Bitcoin, signaling challenges in its development potential. As Ethereum’s rivals enhance their networks and capitalize on political alternatives, Ethereum should evolve to keep up its place,” Bujas mentioned.

In the meantime, different leaders stay bullish, declaring that Ethereum has the sources and resilience to keep up its standing because the second-largest cryptocurrency decisively.

“We want look solely at the explosion of stablecoins on ETH and World LibertyFi shopping for ETH en-masse to perceive Ethereum’s very important function and plain worth all through the crypto ecosystem. For extra examples we are able to look to Blackrock launching stablecoins and partnering with Elixir to make the most of Curve Finance as infrastructure. Certain, rivals to Ethereum are going to eat into some of its market share- this is the signal of a wholesome, non-monopolistic market– however take a look at the place the majority of liquidity and severe gamers lie– it’s in ETH on Ethereum. Ethereum is a decentralized, credibly impartial community–one thing that can not be mentioned for many chains,” Rusher mentioned.

The community’s sustained success will rely considerably on how the Ethereum Basis manages its management throughout this era of intense competitors within the cryptocurrency sector and whether or not it’s ample to retain investor confidence.

Disclaimer

Following the Belief Mission tips, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.