One other wave of ache has hit crypto merchants. China simply slapped tariffs on U.S. agricultural items, value almost $22 billion. Markets didn’t take it effectively. The S&P 500 dipped decrease, and crypto worn out 4 months of good points in hours.

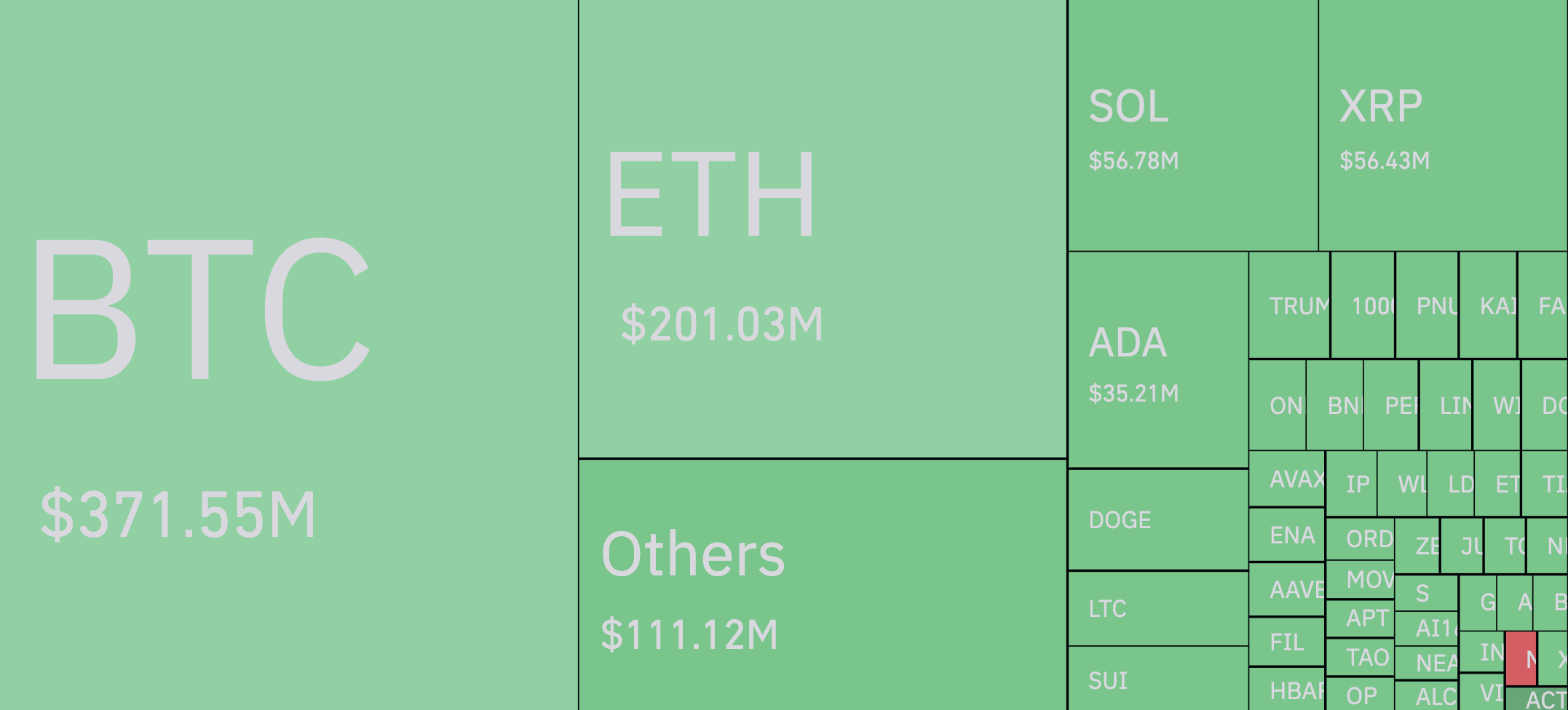

Liquidations surged. In 24 hours, the crypto market noticed $1 billion in liquidations, based on CoinGlass. The worst half? Most of it hit lengthy positions. XRP, Cardano (ADA) and Dogecoin bulls felt the influence the toughest. About 70% of liquidations had been longs, leaving solely 30% in shorts. It’s a main reminder of how briskly leverage can flip towards merchants.

This was not only a crypto story, although. Equities weren’t spared both. The S&P 500’s drop mirrored broader market fears – commerce tensions, financial uncertainty, risk-off sentiment creeping again in. All of it fed right into a cycle of promoting. And crypto, nonetheless tethered to macro traits, took successful together with it.

XRP, ADA, DOGE – these names have seen regular accumulation over the previous months. That momentum is gone, at the very least for now. Liquidations unraveled leveraged positions, leaving merchants reassessing their publicity.

The temper has shifted, with confidence shaken. A market that had been clawing its method again is now dealing with renewed volatility. Crypto merchants are watching and ready. Will there be a bounce? Or will uncertainty preserve costs below stress?

One factor is obvious: danger stays. Leverage cuts each methods, and this time, it’s crypto bulls paying the value.