The cryptocurrency market has skilled a pointy downturn, with Bitcoin’s value dropping beneath $83,000. This decline has led to a wave of liquidations totaling $1 billion over the previous 24 hours, as leveraged merchants confronted vital losses amid the market correction.

Based on Coinglass, a complete of 305,170 merchants have been liquidated throughout this era, reflecting the influence of Bitcoin’s newest decline in value on investor positions.

Detailing The Whole Liquidations

Nearly all of liquidations got here from lengthy positions, the place merchants had wager on Bitcoin’s value growing. Because the market moved in opposition to them, pressured sell-offs occurred, accelerating the downward momentum.

Information from Coinglass exhibits that lengthy liquidations accounted for over 80% of the whole, reaching $833.24 million, whereas brief liquidations have been considerably decrease at $170.08 million.

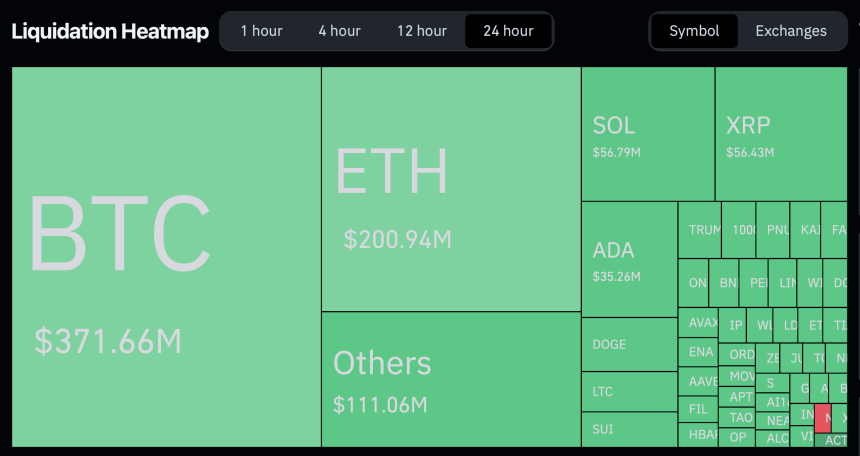

Among the many affected crypto exchanges, Bybit and Binance recorded the best liquidation volumes, with $411.54 million and $242.25 million, respectively. Bitcoin itself accounted for the most important share of the whole liquidations, contributing $371.66 million.

Ethereum (ETH) was the second most impacted cryptocurrency, with $200.94 million in liquidations, whereas different crypto property collectively accounted for over $100 million. The one largest liquidation order came about on Bitfinex, with a $13.40 million BTC place being forcefully closed.

The excessive liquidation quantity means that many merchants have been caught off guard by Bitcoin’s value drop. With lengthy positions dominating liquidations, it signifies that market sentiment was largely bullish earlier than the downturn.

Market Outlook: Can Bitcoin Get well Quickly?

Regardless of the sharp downturn, some analysts stay optimistic about Bitcoin’s long-term trajectory. Crypto analyst Javon Marks famous that regardless of the latest decline, indicators nonetheless recommend Bitcoin could possibly be gearing up for a bigger bullish rally.

Indicators are nonetheless pointing in direction of a monumental bullish rally for Bitcoin.$BTC

— JAVON

MARKS (@JavonTM1) March 4, 2025

In the meantime, RektCapital identified that Bitcoin’s decline has resulted in a completely stuffed CME hole between $84,650 and $93,300, which might doubtlessly result in a value reversal within the close to time period.

Moreover, Ki Younger Ju CEO of on-chain information supplier platform CryptoQuant has not too long ago revealed that the “market will seemingly stay gradual till sentiment within the US improves.”

Based on Ju, there was no vital on-chain exercise, and key indicators are impartial which signifies that the bull cycle continues to be very a lot intact.

#Bitcoin market will seemingly stay gradual till sentiment within the U.S. improves.

There’s no vital on-chain exercise, and key indicators are impartial, suggesting the bull cycle continues to be intact. Fundamentals stay sturdy, with extra mining rigs coming on-line.

If the cycle ends… https://t.co/fSWl26d0gx pic.twitter.com/byWdweZhSQ

— Ki Younger Ju (@ki_young_ju) March 4, 2025

Featured picture created with DALL-E, Chart from TradingView

MARKS (@JavonTM1)

MARKS (@JavonTM1)