TRUMP meme coin plummeted 20% on Tuesday, with its market cap falling to round $2.5 billion and buying and selling quantity dropping greater than 50% over the identical interval. The sharp decline follows a failed try to maintain its rally after the US crypto strategic reserve announcement, reinforcing bearish sentiment.

With key help at $11, TRUMP dangers buying and selling under this degree for the primary time since its launch if promoting strain continues. Nonetheless, the upcoming White Home Crypto Summit on March 7 might act as a possible catalyst for a rebound, with a breakout above $17.47 doubtlessly sending TRUMP towards $20.7 and even $24.5.

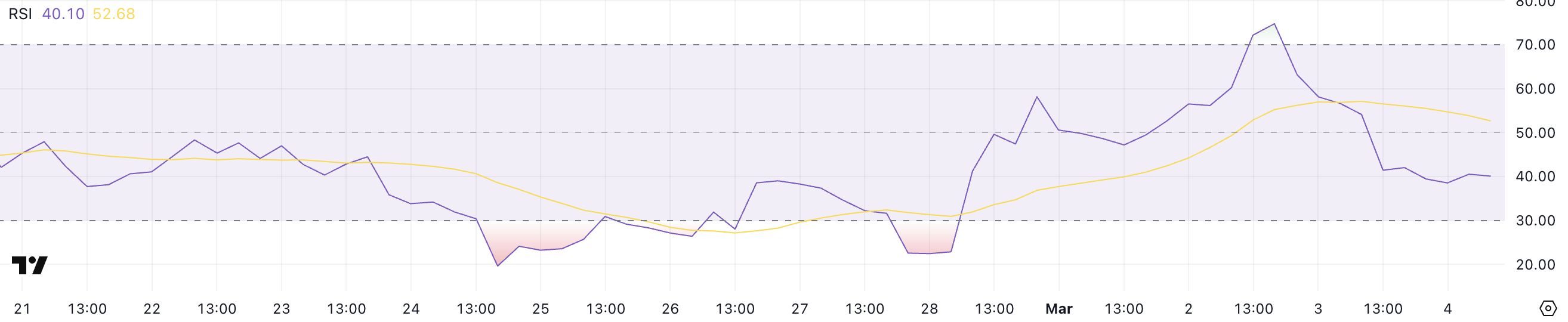

TRUMP RSI Is Again To Impartial After Surging To Overbought Ranges

The Relative Energy Index (RSI) for TRUMP has dropped to 40.1, a steep decline from 74.7 simply two days in the past, reflecting a major shift in momentum as Donald Trump confirmed tariffs on merchandise from Mexico, Canada, and China.

This fast fall signifies that TRUMP has moved out of the overbought territory, the place bullish strain was dominant, and is now approaching decrease ranges that recommend weakening demand.

On condition that TRUMP is presently buying and selling very near its historic lowest ranges, the declining RSI means that sellers have taken management, and the asset is struggling to regain upward momentum. If the downtrend continues, TRUMP might stay below strain, doubtlessly testing new lows until patrons step in to help the value.

RSI is a momentum oscillator that ranges from 0 to 100, with values above 70 indicating overbought situations and under 30 signaling oversold territory.

When an asset’s RSI drops towards 30, it means that promoting could also be overextended, rising the likelihood of a value rebound. At 40.1, TRUMP continues to be above oversold situations, however the present downtrend locations it in a precarious place.

If RSI continues to fall and breaks under 30, it might sign additional draw back, doubtlessly driving TRUMP to new historic lows. Nonetheless, if RSI stabilizes or rebounds from these ranges, it could point out a interval of consolidation earlier than any potential restoration.

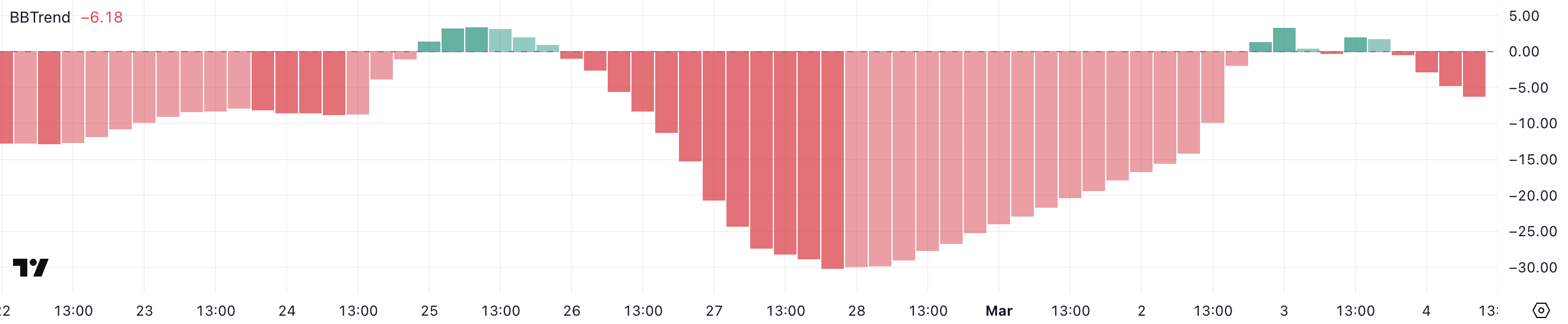

BBTrend Reveals TRUMP Has Had a Onerous Time Constructing a Robust Uptrend

The BBTrend indicator for TRUMP is presently at -6.18 and has been steadily declining within the final hours since yesterday, signaling rising bearish momentum.

This drop follows a short try at bullish energy when BBTrend touched 3.25 two days in the past, however that transfer rapidly reversed as promoting strain took over.

TRUMP has struggled to construct sustained upward momentum. Its highest BBTrend studying in latest weeks was solely 12.4 on February 18, adopted by a a lot decrease peak of three.38 on February 25. This sample suggests that every bullish try has been weaker than the earlier one, reinforcing the problem of sustaining an uptrend.

BBTrend (Bollinger Band Development) measures pattern energy and route utilizing value volatility throughout the Bollinger Bands. Constructive values point out rising bullish momentum, whereas unfavorable values recommend an rising downtrend.

With BBTrend now at -6.18 and persevering with to say no, TRUMP stays in a bearish part, struggling to seek out stability.

The constant failure to maintain optimistic momentum since mid-February means that patrons have been unable to construct energy, protecting TRUMP weak to additional draw back until the pattern reverses quickly.

Will TRUMP Profit From the White Home Crypto Summit?

TRUMP, like many different cash, surged following the U.S. crypto strategic reserve announcement, however the rally didn’t final lengthy because it rapidly entered a pointy correction.

The TRUMP meme coin is presently down 20% in simply someday, erasing a lot of its latest features and reinforcing bearish sentiment out there. A essential help degree now sits at $11, and whether it is misplaced, TRUMP might drop under this degree for the primary time since its launch day.

With such a steep decline in a brief interval, sellers stay in management, and the value motion suggests additional draw back might be attainable if demand doesn’t return quickly.

Nonetheless, TRUMP might discover renewed momentum with the upcoming first White Home Crypto Summit on March 7, which might function a catalyst for a possible restoration.

If an uptrend materializes, the primary key degree to look at is $17.47. A breakout above this resistance might ship it rallying towards $20.7.

If bullish momentum strengthens additional, the value might even take a look at $24.5, marking an nearly 100% upside from present ranges.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.