- Bitcoin has dropped over 15% since Trump’s tariff threats, hitting as little as $86,400.

- Market uncertainty and fears of a “Trumpcession” have pushed traders to drag $3.5 billion from Bitcoin ETFs.

- Whereas Bitcoin struggles, world traders are hedging with fiat alternate options just like the euro, gold, and the Japanese yen.

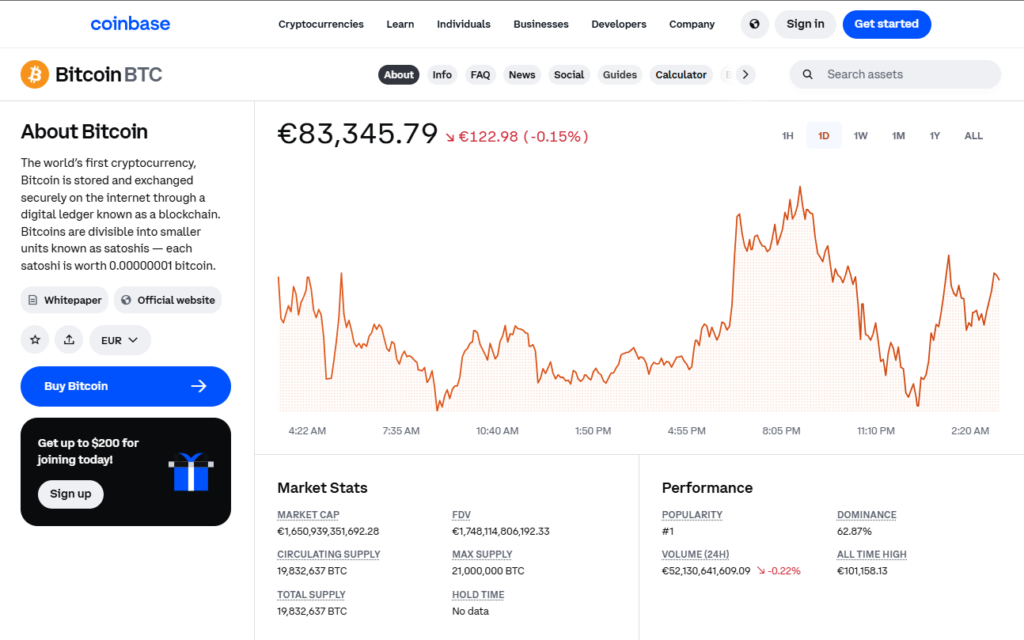

Bitcoin has taken successful, dropping over 15% since Feb. 3, the day President Trump threw out recent tariff threats towards China, Mexico, and Canada. By March 5, it was buying and selling as little as $86,400. In the meantime, traders have yanked greater than $3.5 billion from U.S.-based spot Bitcoin ETFs, in accordance with Farside Traders knowledge.

Financial uncertainty spooks risk-on merchants

The U.S. slapped a 25% tariff on Canada and Mexico and a ten% tariff on China on March 4, setting off alarms about provide chain chaos and rising prices. Some concern this might result in a so-called “Trumpcession.”

Usually, when markets panic, threat property take successful. Again in August 2019, Trump’s China commerce struggle sparked an 800-point Dow drop—however curiously, Bitcoin soared as Chinese language merchants used it to bypass capital controls. That didn’t final lengthy, although, as Beijing cracked down on Bitcoin buying and selling and OTC desks quickly after.

This time round, Bitcoin is performing extra like a typical threat asset. Its 30-week correlation with the Nasdaq is sitting at a excessive 0.91, that means it’s shifting in sync with conventional equities. And with JPMorgan now turning “tactically bearish” on U.S. shares because of commerce struggle fears, Bitcoin might really feel extra strain if that correlation holds.

coinbase.com

Bitcoin by no means sleeps—24/7 volatility

In contrast to conventional inventory markets that take weekends off, Bitcoin trades across the clock, reacting immediately to macroeconomic shifts. When Trump’s tariff plans had been confirmed over a weekend in early February, crypto merchants wasted no time offloading BTC earlier than Wall Road even had an opportunity to react.

This knee-jerk selloff drove Bitcoin right down to $91,000 on Feb. 3, marking a three-week low. The broader crypto market bled over $1 trillion in market cap from its December highs by late February. But, the volatility works each methods—when Trump introduced plans for a U.S. Bitcoin reserve on March 3 (additionally a Sunday), BTC spiked 9.58%, its greatest each day achieve since Nov. 11, 2024.

The takeaway? Coverage shifts—particularly after they break on weekends—can ship crypto costs into wild swings, with fewer merchants obtainable to stabilize the market.

World traders are hedging elsewhere

Usually, tariffs ought to enhance the U.S. Greenback Index (DXY) by lowering imports and driving demand for home items. However this time? Not fairly. DXY peaked round Trump’s tariff announcement and has been sliding ever since—mirroring Bitcoin’s decline, which defies the same old narrative that BTC is a hedge towards financial uncertainty.

So the place’s the cash flowing? Into fiat alternate options. The euro has strengthened since Feb. 3, suggesting world traders are shifting capital into extra steady currencies somewhat than riskier property like Bitcoin. Gold, one other traditional hedge, has additionally been on the rise since Trump’s announcement, and the Japanese yen (JPY), a conventional protected haven, has climbed 4.5% in the identical interval.

If the tariffs fire up widespread fears of an financial slowdown, merchants might proceed dumping threat property—together with Bitcoin. And if traders additionally begin avoiding the greenback over recession fears, Bitcoin might not see the safe-haven bid some anticipate.

Remaining Ideas

Bitcoin’s knee-jerk response to Trump’s tariffs reveals simply how carefully it’s tied to macroeconomic uncertainty. Whereas some argue it may gain advantage long-term if inflation rises, the rapid response from traders has been one among panic. With Bitcoin buying and selling 24/7, that fear-driven volatility can hit even tougher in comparison with conventional markets.

As at all times, markets will modify, and Bitcoin’s narrative as both a hedge or a threat asset will proceed evolving. However for now, merchants are watching world coverage shifts like hawks—as a result of in crypto, timing is all the pieces.