The crypto neighborhood is on edge following Mt. Gox’s important Bitcoin (BTC) switch. In line with knowledge from Arkham Intelligence, the defunct change has moved Bitcoin price $1 billion.

The transaction has ignited hypothesis about potential promoting strain that would destabilize Bitcoin’s worth amid already risky market situations.

Mt. Gox Transfers 12,000 Bitcoin

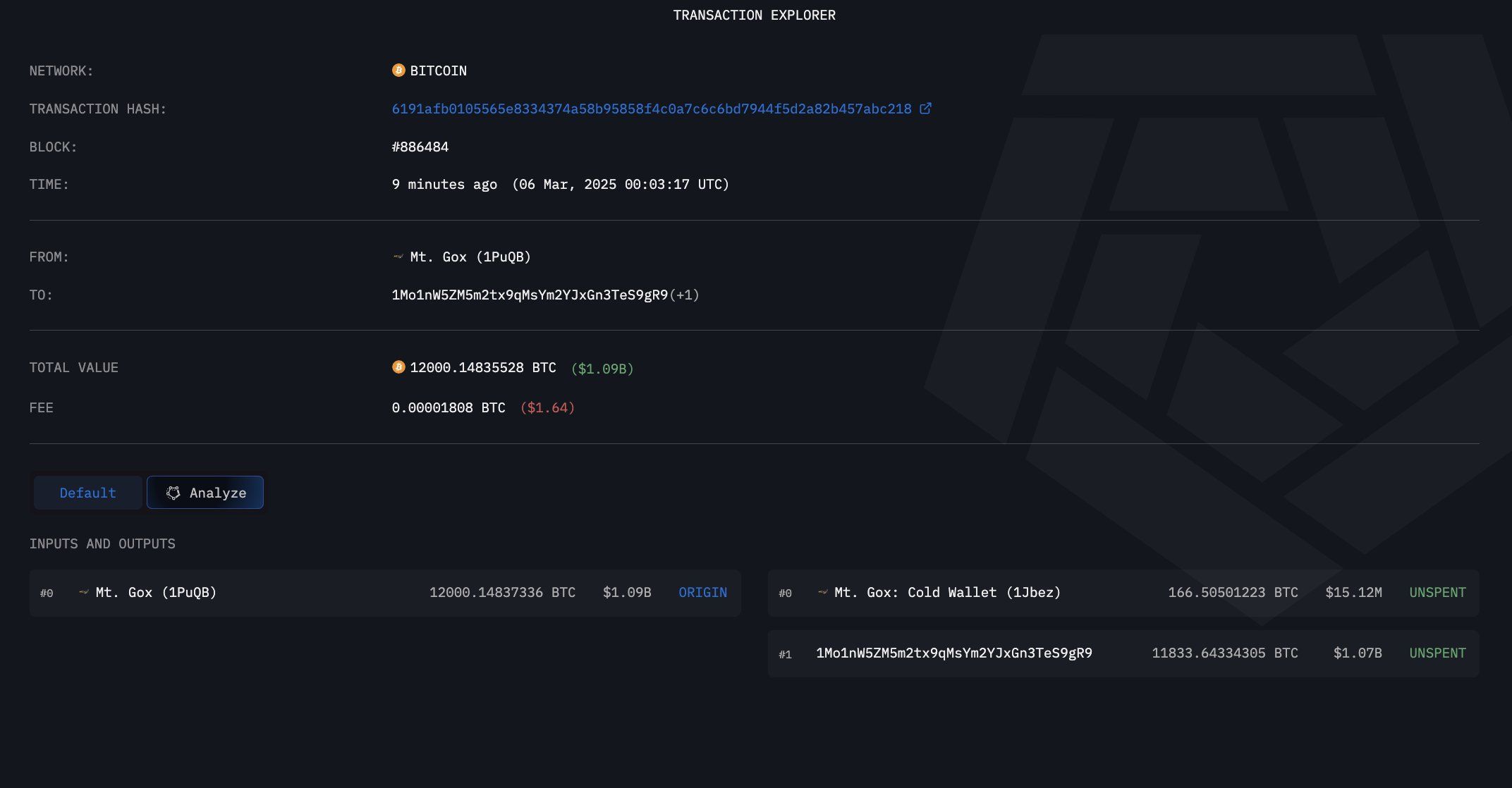

Arkham’s blockchain explorer exhibits that Mt. Gox transferred 12,000 BTC.

“Mt. Gox transferring $1billion BTC,” Arkham alerted customers on X.

Mt. Gox despatched 11,833.6 BTC, price roughly $1 billion, from its pockets (1PuQB) to a brand new tackle (1Mo1n). Moreover, it transferred 166.5 BTC, price $15.1 million, to its chilly pockets (1Jbez). No additional motion occurred after these transactions.

This marks the primary important Bitcoin motion from Mt. Gox-linked wallets in a month. It got here after a smaller shuffle of simply 4 BTC between chilly wallets in February.

Mt. Gox, as soon as the world’s largest Bitcoin change, collapsed in 2014 after an enormous hack. The safety breach resulted within the lack of roughly 850,000 BTC. The change filed for chapter, leaving collectors in limbo for years.

Nevertheless, Mt. Gox started reimbursing collectors final 12 months. In line with Arkham knowledge, Mt. Gox-linked entities now maintain 36,080 BTC, valued at round $3.2 billion.

In the meantime, the switch has sparked widespread concern on social media. Customers are speculating that these actions may set off a sell-off.

“Appears to be like like they’re about to dump,” one consumer wrote on X.

Nevertheless, Fefe Demeny, the host of Crypto Banter, alleged that the US authorities holds the transferred Bitcoin from Mt. Gox’s wallets, because it had beforehand seized these property.

He speculated that this could possibly be a strategic transfer forward of the upcoming White Home Crypto Summit. This summit, the primary of its type, is scheduled for March 7.

Key dialogue factors are anticipated to incorporate regulatory readability for digital property, the creation of a US crypto reserve that features Bitcoin together with different digital property, and potential reforms to crypto tax insurance policies.

In line with Demeny, Trump may use the summit to stipulate a plan that guarantees by no means to promote the seized BTC whereas committing to making a Strategic Bitcoin Reserve.

Demeny believes this initiative would stir pleasure inside the crypto neighborhood and assist enhance market sentiment. The federal government may then leverage the already seized Bitcoin for the reserve with out the necessity for any further purchases.

“If this seems to be true I consider we are going to see an enormous dump quick time period,” he wrote.

In the meantime, Bitcoin has been grappling with market volatility, pushed by components reminiscent of new US commerce tariffs and broader financial uncertainty. The truth is, final week, the Crypto Concern and Greed Index reached its lowest stage since 2022.

Nevertheless, Bitcoin (BTC) skilled a notable surge on March 5, rising above $90,000. This was pushed by hypothesis that it could obtain particular therapy in Trump’s proposed US crypto reserve plan.

This upward motion follows a quick dip beneath $80,000 simply 5 days in the past. As of the newest replace, Bitcoin was buying and selling at $91,368, reflecting a 3.0% achieve prior to now 24 hours. Whether or not these good points will result in a sustained bullish rally or if the market will as soon as once more take a nosedive stays unsure.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.