The yr 2025 continues to be a wild journey for the cryptocurrency market, and Bitcoin (BTC) particularly. From loopy back-to-back worth swings of 10% every, liquidations of a minimum of $1 billion virtually each weekend, and main occasions just like the creation of the Strategic Bitcoin Reserve by america of America, not many perceive the place this market goes.

It’s secure to say that instability is probably the most secure factor available on the market proper now. What’s unhealthy about it’s that in a interval of such uncertainty, not many traders favor to be concerned in a curler coaster and, judging by current traits, really feel higher on the sidelines. This tendency is kind of noticeable whenever you check out the Bitcoin ETF house.

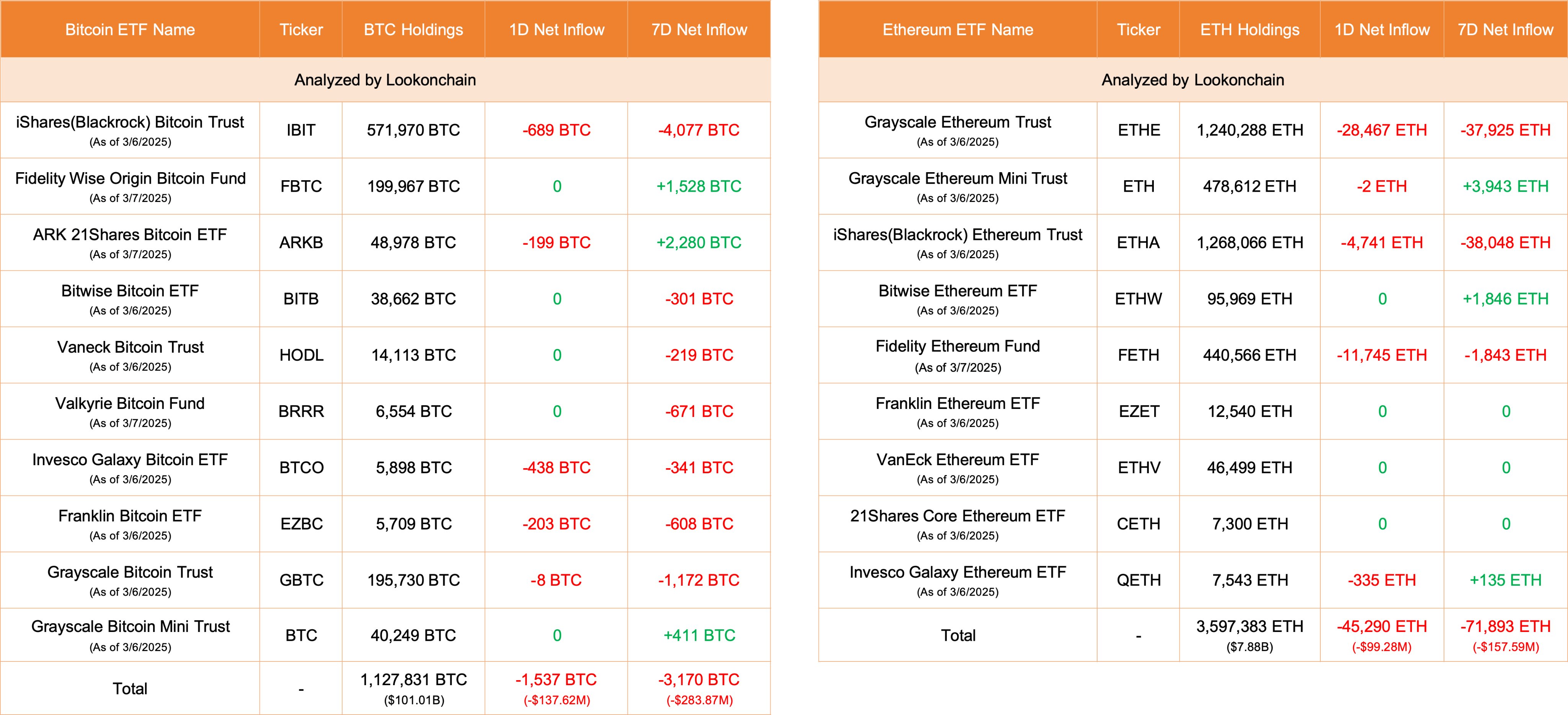

For instance, in accordance with the most recent information introduced by Lookonchain, within the final 24 hours, these crypto-oriented funding merchandise skilled one other spherical of outflows with a internet determine of -$137.62 million, or -1,537 BTC in equal.

It was simply final week when the market noticed over $2.9 billion in outflows, and it appears that evidently this development has not but reversed.

The biggest outflows over the course of the final day had been noticed in IBIT, a Bitcoin ETF from BlackRock. Throughout the interval below assessment, the $10 trillion monetary mastodon misplaced 689 BTC from its accounts, which is about $61.7 million.

This determine displays the actions of IBIT ETF holders, who had been really promoting.

Because it stands, BlackRock nonetheless owns 571,970 BTC, which is price $51.23 billion at present costs. The overall for all Bitcoin ETF issuers is nearly double that – 1,127,831 BTC, or $101 billion.