At this time, over $3 billion price of Bitcoin and Ethereum choices expire. It is going to see over $2.5 billion price of BTC and practically $500 million price of ETH contracts settled. How will the costs of each property react?

These choices’ expiry will happen at 8:00 UTC on Deribit, probably inspiring volatility throughout the crypto market.

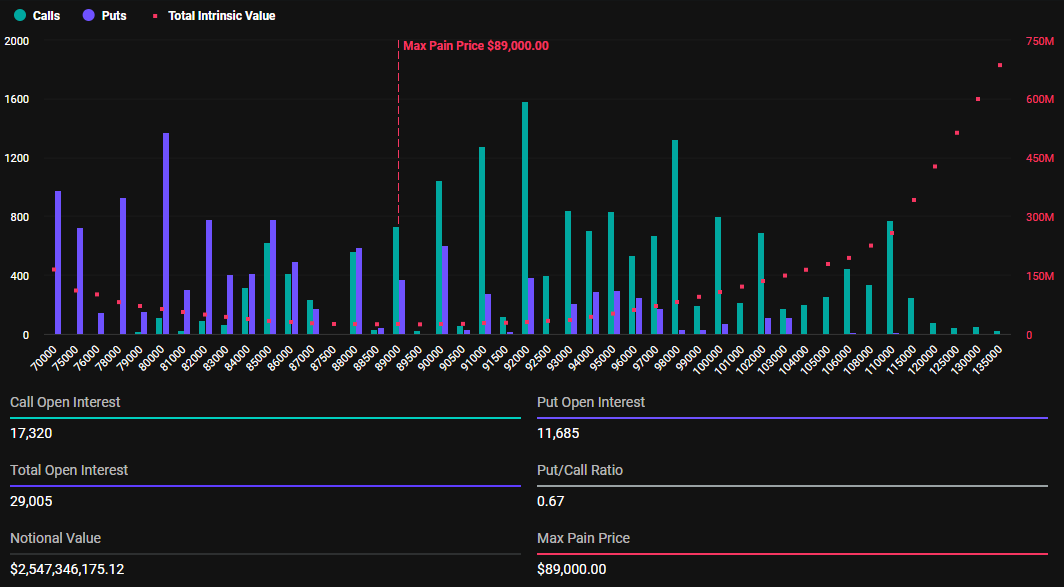

Bitcoin Faces $89,000 Max Ache in At this time’s Choices Expiry

At this time, March 7, 29,005 Bitcoin contracts with a notional worth of $2.54 billion are set to run out. Based on Deribit information, Bitcoin’s put-to-call ratio is 0.67. The utmost ache level—the worth at which the asset will trigger monetary losses to the best variety of holders—is $89,000.

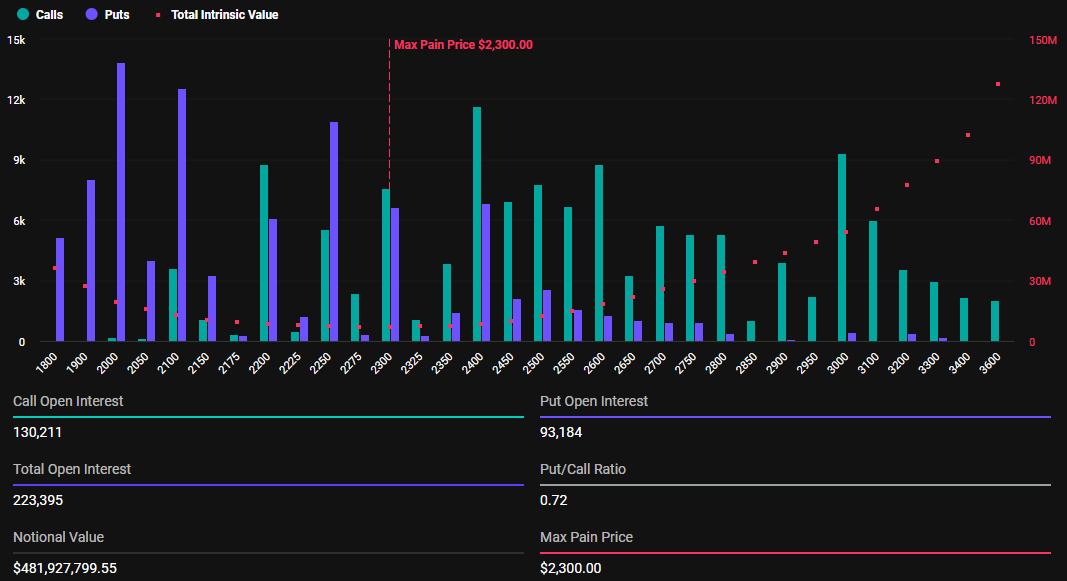

Moreover, Ethereum sees the expiration of 223,395 contracts with a notional worth of $481.9 million. The utmost ache level for these contracts is $2,300, with a put-to-call ratio of 0.72.

The utmost ache level within the crypto choices market represents the worth degree that inflicts probably the most monetary discomfort on choice holders. On the identical time, the put-to-call ratios, beneath 1 for each Bitcoin and Ethereum, point out a better prevalence of buy choices (calls) over gross sales choices (places).

Crypto choices buying and selling software Greeks.reside offered insights into the present market sentiment. They cited an general bearish market sentiment, with merchants expressing frustration over excessive volatility and uneven value motion.

Bitcoin’s sharp intraday swings, akin to current strikes of $6,000, have led to what merchants describe as “rip-off each methods” circumstances. Based on analysts at Greeks.reside, this makes it troublesome to determine a transparent directional pattern.

“Most merchants are watching the 87,000-89,000 vary as key resistance, with 82,000 famous as a current backside, although there may be important disagreement on whether or not a sustainable backside has been discovered,” wrote Greeks.reside.

Additional, the pronounced put skew displays the broader pessimism, as merchants proceed to favor draw back safety regardless of occasional upward strikes. The analysts additionally observe that merchants are adjusting their methods amidst the excessive volatility.

“A number of merchants are promoting calls at 89,000-90,000 vary as a most popular technique on this setting, with one dealer reporting they’re at -260% on calls purchased at decrease ranges,” Grreeks.reside added.

The idea that the market is presently in a liquidity-driven part has led to a concentrate on fast entries and exits. This degree of warning comes as longer-term positions stay susceptible to abrupt swings. Exterior macro components, akin to shifting commerce insurance policies and tariff bulletins, add to the uncertainty.

In consequence, many merchants are selecting to remain on the sidelines, ready for clearer alerts earlier than committing to new positions.

“With markets on edge, the place do you assume value motion will land? Above or beneath max ache?” Deribit posed in a publish on X (Twitter).

Nonetheless, merchants should keep in mind that choice expiration has a short-term impression on the underlying asset’s value. Usually, the market will return to its regular state shortly after and presumably even compensate for robust value deviations.

Merchants ought to keep vigilant, analyzing technical indicators and market sentiment to navigate potential volatility successfully. In the meantime, these developments come after US President Donald Trump signed the strategic Bitcoin reserve order.

Notably, the order was in need of particular particulars, with many questions prone to be answered later in the course of the White Home Crypto Summit.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.