Chainlink (LINK) has been displaying combined technical indicators just lately, with some indicators turning bearish whereas others recommend a possible upside forward. With its value up 11% within the final seven days, Chainlink was on its path to surpass Pi Community in market cap, however this could possibly be delayed for now.

With LINK nearly not shifting within the final 24 hours, its market cap is presently $10.3 billion, and Pi Community is round $12.7 billion. The upcoming days can be essential as a number of technical indicators attain crucial inflection factors that might decide whether or not LINK continues its rally or faces a correction.

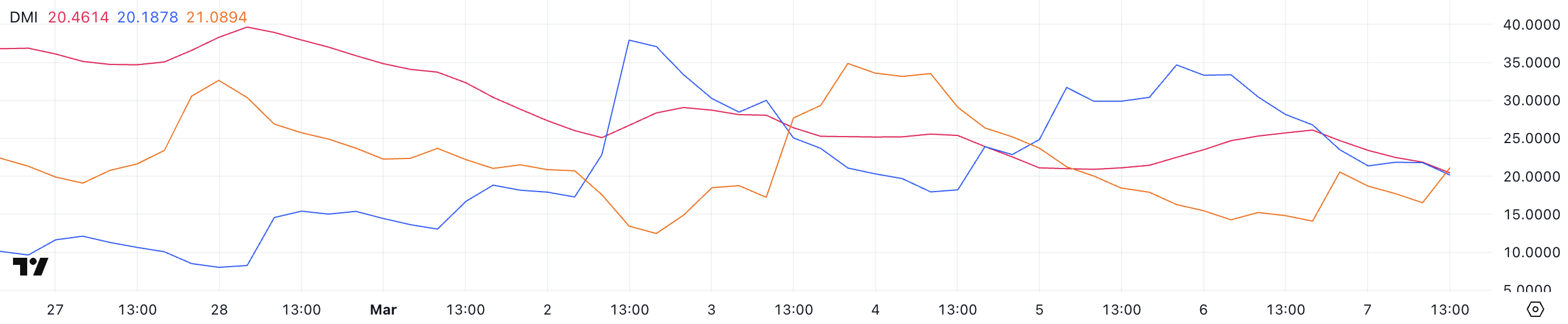

Chainlink DMI Reveals Sellers Took Management

In accordance with Chainlink’s DMI chart, its ADX (Common Directional Index) has decreased from 26 yesterday to twenty.46 at present. This decline signifies weakening development energy no matter route.

ADX is a element of the Directional Motion Index (DMI) that quantifies development energy on a scale of 0-100, with out indicating route. Usually, readings above 25 recommend a robust development, 20-25 point out a growing development, and under 20 mirror a weak or absent development.

Chainlink’s ADX shifting from above 25 to simply above 20 indicators that the earlier robust development is dropping momentum and shifting towards a extra impartial or ranging market.

The Constructive Directional Indicator (+DI) has fallen considerably from 33.3 to twenty.1, whereas the Unfavorable Directional Indicator (-DI) has elevated from 14.2 to 21. This crossover, with -DI now exceeding +DI, suggests a possible shift from bullish to bearish momentum.

Mixed with the weakening ADX, this technical image factors to a possible bearish reversal or continuation sample forming for LINK’s value. Merchants may anticipate additional draw back strain within the close to time period, although they need to monitor for stabilization or reversal indicators because the development weakens.

If ADX continues to say no under 20, LINK could enter a interval of consolidation somewhat than robust directional motion.

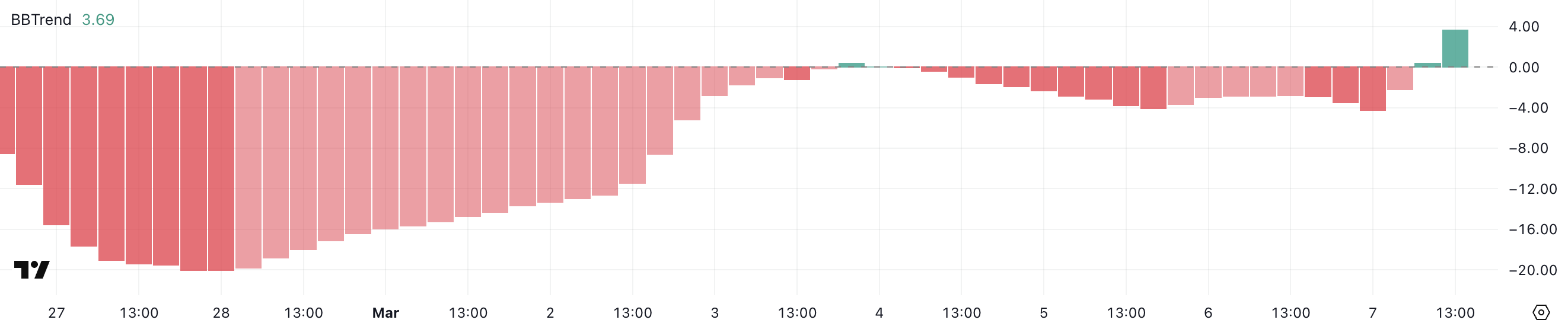

LINK BBTrend Is Now Constructive After Staying Unfavorable For A number of Days

LINK’s BBTrend has now turned constructive, reaching 3.69 after remaining in destructive territory since March 4. A considerably destructive studying of -20 was recorded on February 28.

The BBTrend (Bollinger Bands Development) indicator is a momentum oscillator that measures the connection between value and Bollinger Bands to determine development energy and route. It calculates how value is shifting relative to the Bollinger Bands, which themselves symbolize commonplace deviations from a shifting common.

When BBTrend is constructive, it suggests costs are shifting above the center band and probably towards the higher band, indicating bullish momentum.

Conversely, destructive readings recommend bearish strain with costs shifting under the center band towards the decrease band. The latest shift to a constructive 3.69 BBTrend worth for LINK might sign rising bullish momentum after a interval of downward strain.

This reversal, coming after an prolonged destructive interval that bottomed at -20, may point out a significant change in market sentiment.

Nonetheless, merchants ought to verify this sign with different indicators, because the comparatively modest constructive studying of three.69 suggests the bullish momentum continues to be growing somewhat than strongly established.

Will Chainlink Go Again To $20 In March?

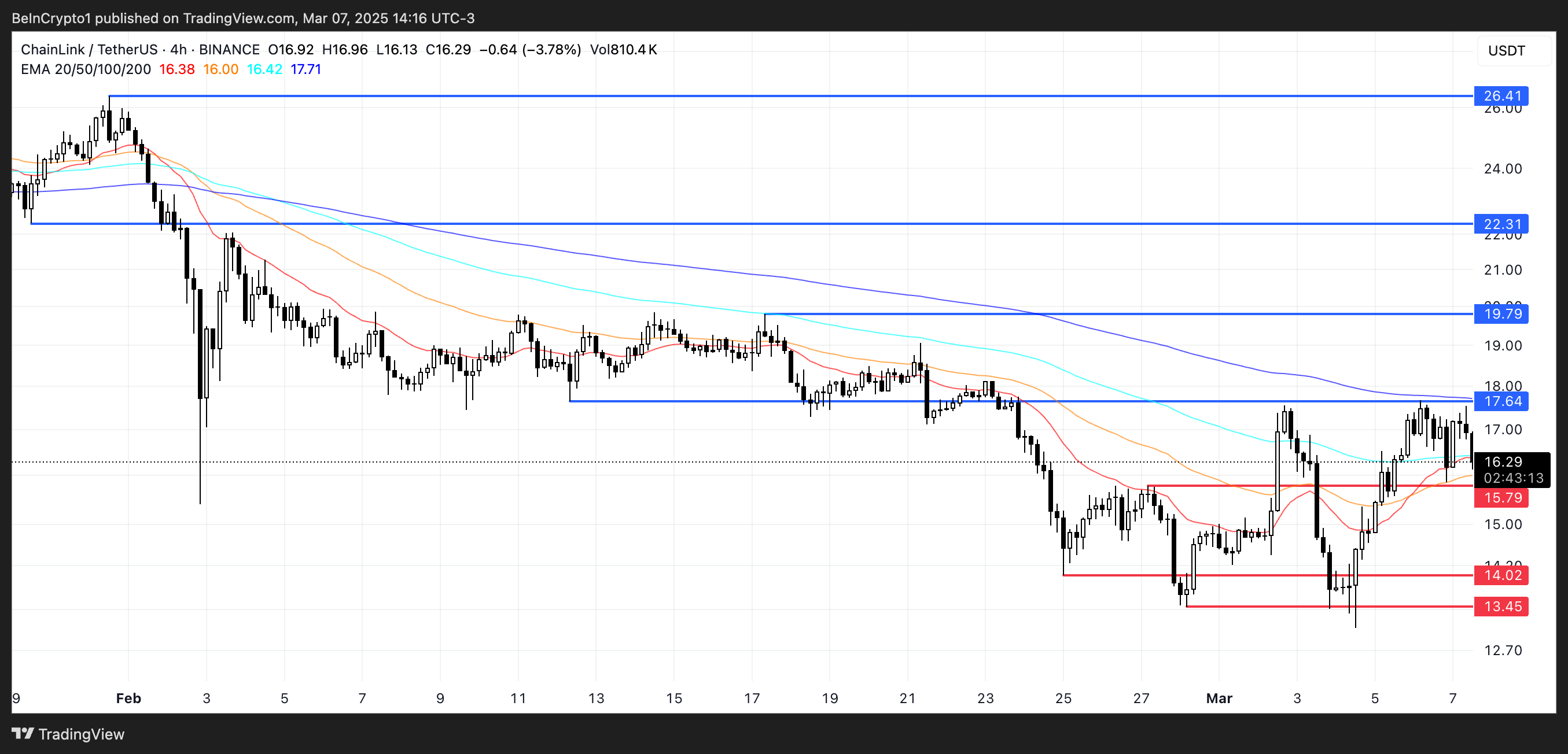

LINK EMA (Exponential Transferring Common) strains are presently trending downward, probably forming a demise cross within the close to future.

If this bearish sample materializes and Chainlink value breaks under the crucial assist stage at $15.79, we might see additional draw back motion.

On this situation, LINK may decline to check psychological and technical assist ranges at $14 and probably even $13.45, representing important drops from present costs.

Conversely, the latest constructive shift in BBTrend suggests rising shopping for strain could also be constructing. If this bullish momentum continues to strengthen, LINK might problem the fast resistance at $17.64.

A decisive break above this stage would open the trail to check greater resistance zones at $19.79 and, subsequently, $22.31. In a strongly bullish situation the place upward momentum accelerates, Chainlink might probably attain $26.4, which might mark its first time buying and selling above $25 in over a month.

This technical setup presents a transparent inflection level for LINK, with convincing breaks of both the assist at $15.79 or resistance at $17.64, possible figuring out the following important value motion.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.