Berachain (BERA) has suffered a steep decline over the previous week, shedding 30% of its worth as bearish sentiment plagues the final market.

Previously 24 hours alone, the token has slid one other 6%, deepening considerations of additional draw back. With rising bearish bias towards the altcoin, this may be the case within the close to time period.

BERA Faces Mounting Draw back Threat

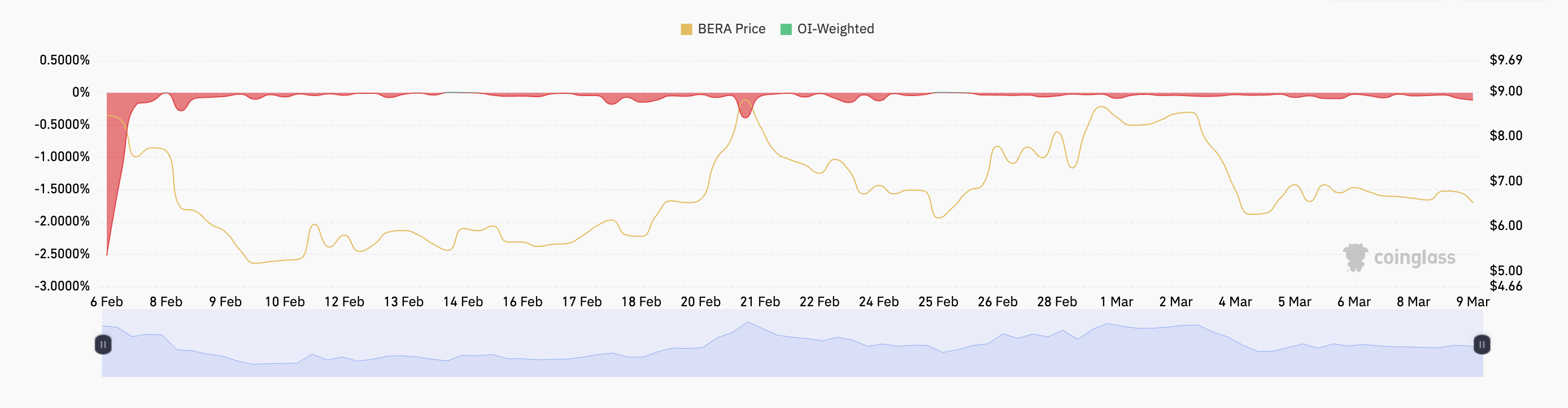

Berachain’s sharp decline has triggered a surge in brief positions throughout its futures market. This rise in demand for shorts is clear in its funding price, which has been damaging because the token’s launch on February 6. At press time, that is at -0.11%.

The funding price is a periodic payment exchanged between lengthy and brief merchants in perpetual futures contracts to maintain costs aligned with the spot market.

A damaging funding price signifies that brief merchants are paying lengthy merchants, indicating a stronger demand for brief positions.

As with BERA, if an asset experiences an prolonged interval of damaging funding charges, it suggests sustained bearish sentiment. It signifies that the token’s merchants constantly wager on additional value declines. This extended negativity might enhance BERA’s value volatility and prolong its value fall.

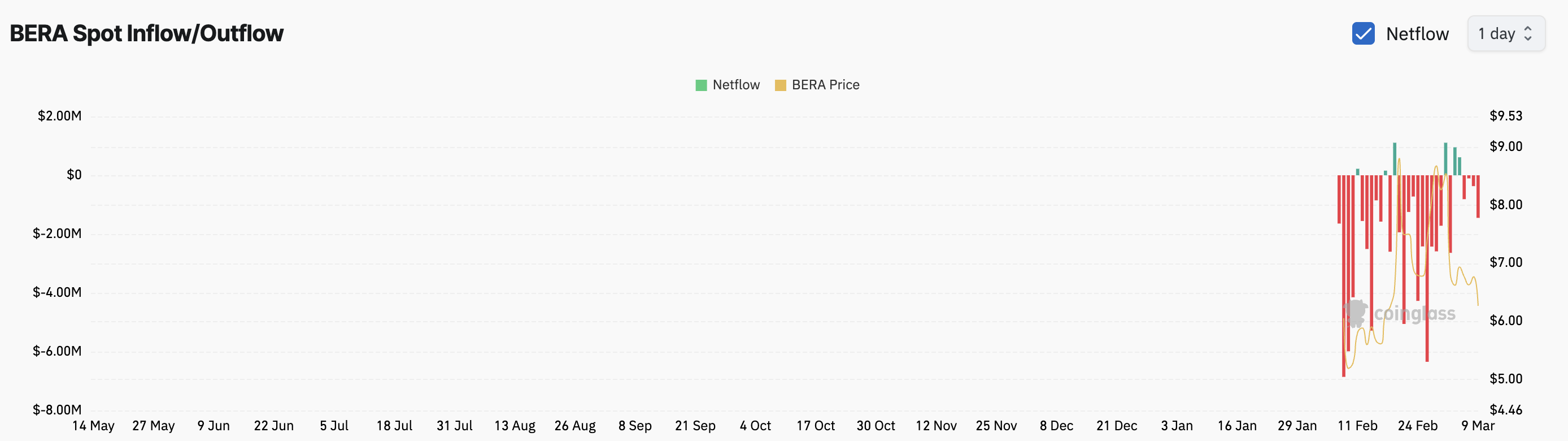

As well as, BERA has famous vital fund outflows from its spot markets over the previous few days. Per Coinglass, the altcoin has famous virtually $2 million in spot market outflows right this moment alone.

When an asset experiences spot outflows like this, it alerts a surge in promoting stress. It signifies a bearish development as buyers cut back publicity or take earnings, probably resulting in additional value declines.

BERA at a Crossroads—Break Beneath $6.07 or Rally Towards $7.36?

Berachain trades at $6.14 at press time, resting barely above assist at $6.07. If the bearish bias towards the altcoin strengthens, its value might break under this assist flooring, inflicting the token to commerce at a low of $5.35.

If the bulls fail to defend this stage, BERA might slip to its all-time low of $4.74.

Then again, if market sentiment improves and BERA’s demand soars, its value might rally to $7.36.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.