In accordance with Timothy Peterson, writer of Metcalfe’s Regulation as a Mannequin for Bitcoin Worth, the crypto business could possibly be getting ready to one other bear market.

This evaluation comes because the Federal Reserve (Fed) maintains its cautious stance on rates of interest regardless of persisting financial uncertainties.

Analyst Explains How a Bear Market Might Unfold

In his current evaluation, shared on X (Twitter), Peterson warned that the market is presently overvalued. This, he says, makes it weak to a downturn. Whereas such a decline wants a set off, he means that the Fed’s choice to maintain rates of interest regular could possibly be sufficient to set it off.

“It’s time to speak in regards to the subsequent bear market. There’s no cause to assume it couldn’t occur now. The valuation justifies it. What it wants is a set off. I believe that set off could also be so simple as the Fed not chopping charges in any respect this yr,” wrote Peterson.

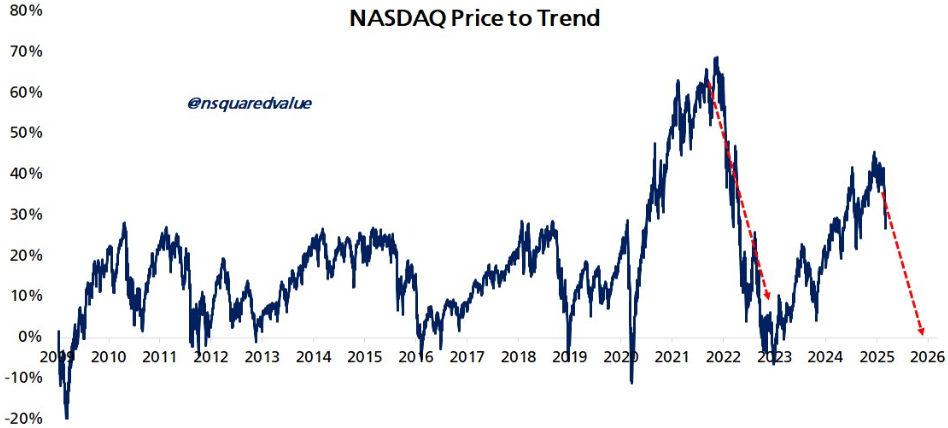

Peterson’s evaluation attracts parallels between previous market downturns and present circumstances. Utilizing the NASDAQ as a reference level, he estimates {that a} bear market may final anyplace from 7 to 14 months.

On condition that the NASDAQ is presently 28% overvalued, he anticipates a decline of about 17%, bringing the index down to fifteen,000.

Making use of these projections to Bitcoin, Peterson expects a roughly 33% drop, pushing Bitcoin’s worth right down to round $57,000.

“Multiply by 1.9. 17% drop in NASDAQ = 33% drop in BTC -> $57k,” Peterson added.

Nevertheless, he notes that opportunistic buyers may step in early. Such an intervention may stop the Bitcoin worth from falling that low, probably discovering help round $71,000.

This aligns with a current evaluation from Arthur Hayes. As BeInCrypto reported, the BitMex founder claimed Bitcoin may hunch to $70,000 earlier than a possible rebound.

Analysts additionally highlighted Bitcoin’s air hole under $93,198, with little to no important help till across the $70,000 vary.

Fed’s Position within the Market Downturn

In the meantime, a few month in the past, Fed Chair Jerome Powell mentioned that the central financial institution is in no rush to chop rates of interest. He reiterated these remarks throughout his speech final week. talking at a coverage discussion board in New York, Powell emphasised the necessity for persistence.

“We don’t have to be in a rush, and are nicely positioned to attend for higher readability,” Powell said.

Powell’s remarks come amid financial uncertainty fueled by President Donald Trump’s coverage adjustments in commerce, immigration, fiscal coverage, and regulation. With inflation hovering round 2.5%, the Fed is targeted on addressing these challenges cautiously.

Regardless of market expectations for price cuts this yr, Powell has made it clear that the Fed will wait and see earlier than adjusting financial coverage.

Including to issues about an impending Fed-inspired downturn, Bitcoin lately dropped following the Fed’s warning of a potential recession. The Fed projected a 2.8% decline in GDP for the primary quarter (Q1) of 2025, triggering fears of financial instability. This had influenced investor sentiment negatively.

Regardless of these warnings, Peterson stays unconvinced {that a} full-fledged bear market is imminent. He argues that present market circumstances aren’t as euphoric as these of earlier bubbles. The analyst additionally explains that bearish sentiment amongst buyers may point out a long-term shopping for alternative quite than a promote sign.

BeInCrypto information reveals Bitcoin was buying and selling for $86,026 as of this writing, down 0.1% since Sunday’s session opened.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.