Bitcoin has struggled to regain bullish momentum, weighed down by world commerce struggle fears and the uncertainty surrounding US President Donald Trump’s govt order to ascertain a Strategic Bitcoin Reserve final Thursday. Whereas the announcement was anticipated to spice up confidence, macroeconomic circumstances proceed to dictate market developments, maintaining BTC beneath key resistance ranges.

Regardless of the constructive information, broader market considerations—notably rising tariffs and financial instability—have saved buyers on edge. The crypto market stays extremely reactive to macroeconomic shifts, and for now, these exterior pressures are stopping BTC from gaining upside traction.

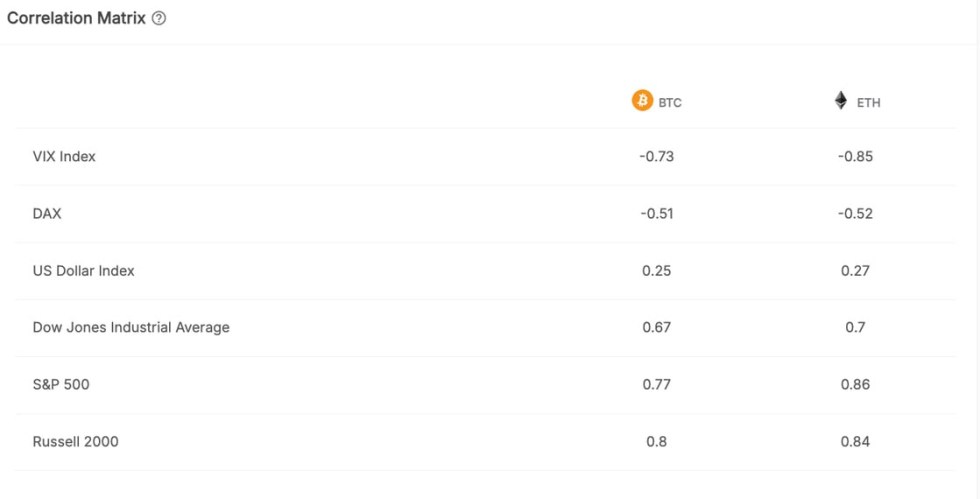

Based on on-chain metrics, Bitcoin and Ethereum have as soon as once more turn into extremely correlated with the US inventory market, indicating that conventional monetary developments are having a stronger affect on crypto costs. With shares dealing with uncertainty, Bitcoin’s potential to interrupt out of its present vary stays questionable.

May these macroeconomic developments push the market even decrease, or is Bitcoin making ready for a shock reversal? With volatility growing, the approaching days might be essential in figuring out BTC’s subsequent transfer. Merchants and buyers at the moment are watching intently to see whether or not BTC can shake off its inventory market correlation or if extra draw back is forward.

Bitcoin Struggles With Macroeconomic Uncertainty

Even with constructive information, equivalent to Trump’s Strategic Bitcoin Reserve announcement, the market has did not regain bullish momentum. As a substitute, concern over world commerce wars and financial instability continues to weigh closely on sentiment. Traders are hesitant to tackle extra danger, maintaining BTC caught in a spread with no clear indicators of an imminent breakout.

Based on IntoTheBlock, Bitcoin and Ethereum have as soon as once more turn into extremely correlated with the US inventory market, a development that has traditionally led to increased volatility in crypto. Tariff-related considerations have been pushing down equities, and since BTC is shifting in sync with conventional markets, additional declines in shares may drag BTC even decrease.

If the inventory market continues to set recent lows, Bitcoin and the whole crypto sector may face one other wave of promoting strain. Till macro circumstances enhance, BTC stays weak to additional draw back danger. Traders and merchants are intently monitoring value actions, as Bitcoin’s subsequent massive transfer will probably be influenced by broader monetary markets reasonably than crypto-specific catalysts.

BTC Trades Under $88K

Bitcoin (BTC) is presently buying and selling at $86,300, with bulls defending the essential $85,000 assist degree whereas struggling to reclaim $90,000. This tight vary has saved Bitcoin caught in a interval of uncertainty, with neither aspect gaining clear dominance.

If BTC loses the $85,000 mark, promoting strain may intensify, probably resulting in a pointy drop beneath $80,000. This degree would function a key psychological and technical assist, and a breakdown may set off a deeper correction, extending the present bearish development.

Then again, if bulls handle to push BTC above $90,000, momentum may shift quickly in favor of patrons. A breakout above this resistance would sign renewed power, doubtlessly fueling a quick rally towards $100,000. Given Bitcoin’s historical past of robust actions following key degree breakouts, reclaiming $90K can be a serious turning level.

With BTC at a crucial inflection level, the subsequent few days will decide whether or not bulls regain management or if bears drive costs decrease, testing deeper demand zones.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.