- Ethereum dips nearer to $2,000 as bearish sentiment dominates the market.

- Fibonacci retracement suggests a possible reversal, however momentum stays weak.

- A break under key help may set off a deeper sell-off.

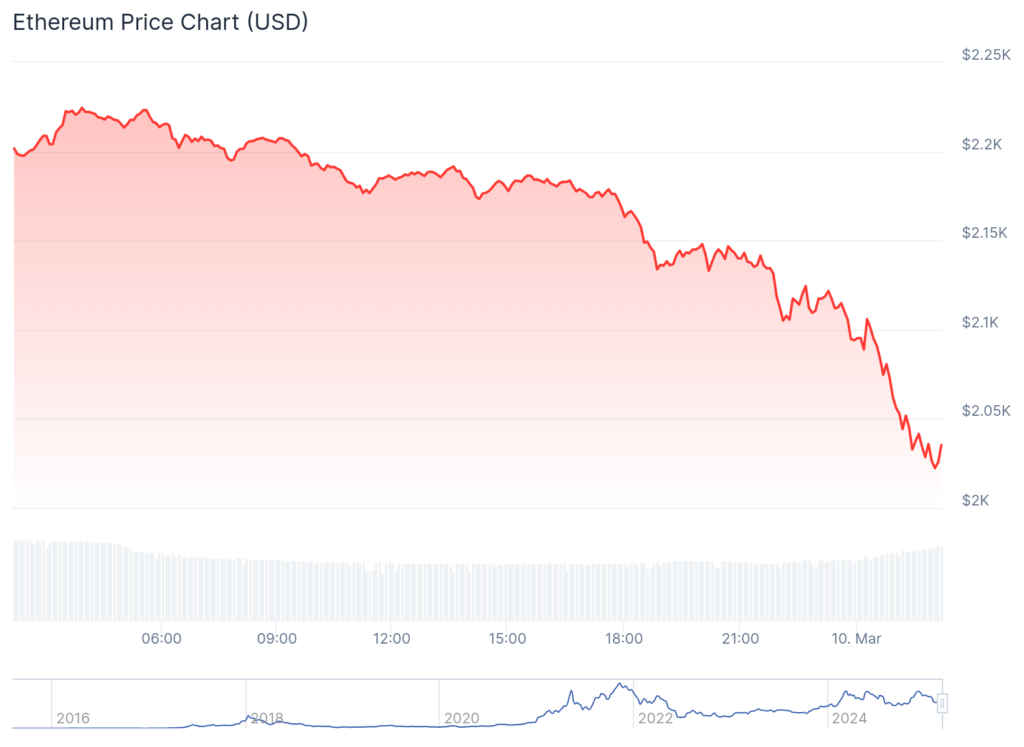

Ethereum’s worth has been on a gradual decline, with sellers pushing it nearer to the essential $2,000 degree. After briefly buying and selling above $2,200, ETH has been dropping floor, exhibiting indicators of exhaustion in bullish momentum. The current drop as seen within the CoinGecko chart aligns with the broader market correction, as many altcoins observe Bitcoin’s lead in a pullback part.

Whereas some merchants anticipated a bounce round $2,100, that degree failed to carry as help, permitting additional draw back motion. Now, ETH is testing a zone that has traditionally been an space of excessive curiosity. If patrons step in at $2,000, a short-term reversal may play out, but when this degree breaks, it may set off a sharper decline towards $1,900 or decrease.

Ethereum Struggles to Preserve Momentum

Inspecting Ethereum’s current pullback by way of Fibonacci retracement, the worth has now dipped right into a area the place a possible bounce may happen. The 61.8% retracement degree sits proper close to the $2,000 mark, which regularly acts as a key turning level in worth motion. If Ethereum holds above this vary, merchants might even see a rebound towards $2,100 and even $2,150.

On the flip facet, dropping this degree can be a significant warning signal. If ETH falls under the Fibonacci golden pocket, it may result in additional liquidation, probably testing deeper helps close to $1,850. Market contributors ought to watch how worth reacts at these key ranges within the coming periods.

CoinGecko

Bollinger Bands Recommend Elevated Volatility

Ethereum’s Bollinger Bands have began widening, a basic signal of accelerating market volatility. The value has been driving the decrease band, which means that ETH is at the moment oversold. This might result in a reduction rally if patrons regain management. Nevertheless, with out sturdy demand, any rebound might be short-lived.

If Ethereum manages to reclaim the mid-band, which aligns with the $2,100 resistance zone, it may point out the start of a restoration. But when the worth stays caught under, it could sign that additional draw back continues to be on the desk. Merchants ought to keep cautious and search for affirmation earlier than making any main strikes.

Ethereum was created in 2015 by Vitalik Buterin and a workforce of builders with the imaginative and prescient of constructing a decentralized platform for sensible contracts and functions. In contrast to Bitcoin, which primarily serves as digital gold, Ethereum powers a whole ecosystem of decentralized finance (DeFi), NFTs, and blockchain-based improvements.

As ETH hovers round $2,000, merchants are on edge. If this degree holds, Ethereum may see a restoration, but when it breaks, a deeper correction may unfold. All eyes are actually on whether or not patrons can defend this key help zone.