The US-based Bitcoin ETFs (exchange-traded funds) have continued to wrestle when it comes to investor participation and curiosity over the previous few weeks. Within the final week of February, the crypto-based monetary merchandise witnessed a record-breaking $1.14 billion single-day withdrawal.

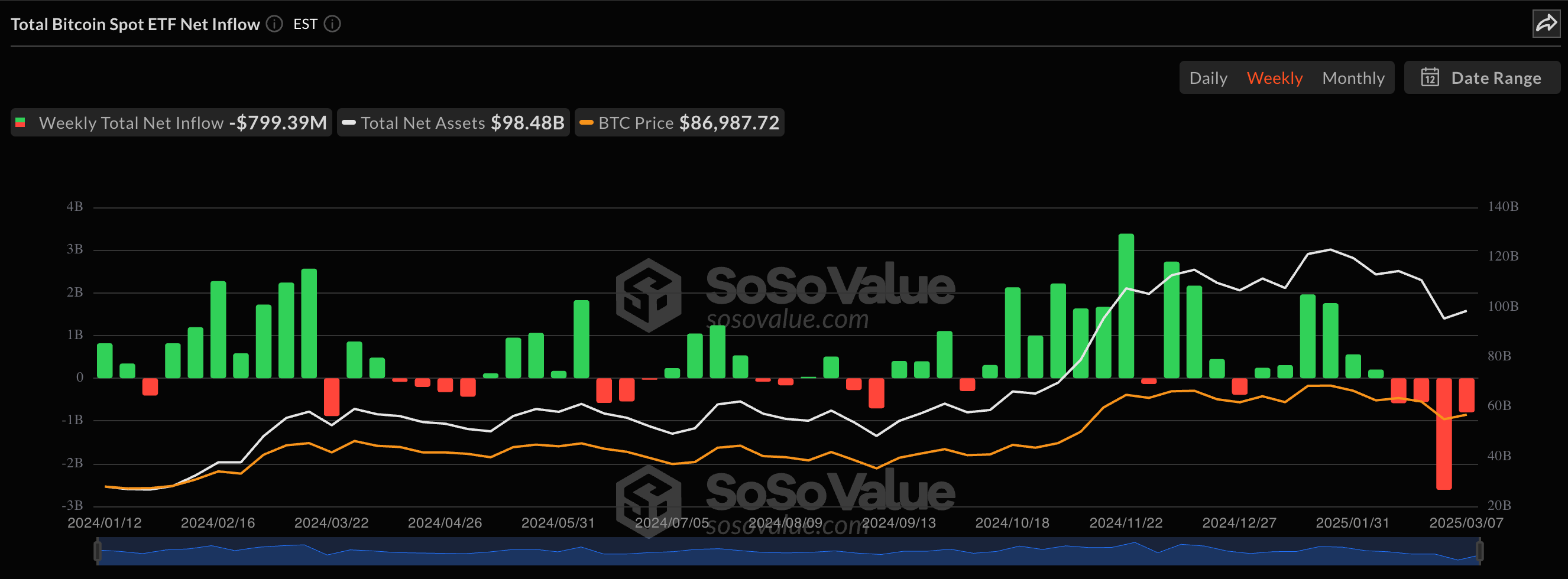

The story wasn’t any a lot totally different for the Bitcoin ETFs to begin the month of March, registering a web outflow of almost $800 million prior to now week. This rising pattern displays the shift within the urge for food and sentiment of institutional traders, particularly in the USA.

Bitcoin ETFs Publish $409 Million Every day Web Outflow

In accordance with the most recent market information, the USA Bitcoin ETF market posted a each day web outflow of roughly $409 million on Friday, March 7. This marked the fifth consecutive day of withdrawals for the Bitcoin exchange-traded funds.

Ark & 21 Shares Bitcoin ETF (with the ticker ARKB) noticed the biggest quantity of withdrawals (over $160 million) on Friday. This was adopted carefully by Constancy Clever Origin Bitcoin Fund (FBTC), which posted web outflows of roughly $155 million to shut the week.

BlackRock’s Bitcoin Belief (IBIT), the biggest Bitcoin exchange-traded fund by web belongings, declined in web worth by $39.85 million on Friday. In the meantime, Grayscale’s Bitcoin Belief (GBTC) and Bitwise’s BTC fund (BITB) adopted with whole outflows of roughly $36.5 million and $18.6 million, respectively, on the day.

Supply: SoSoValue

Curiously, VanEck’s Bitcoin fund (with the ticker HODL) was the one one of many US-based Bitcoin ETFs that recorded a web influx on Friday. The exchange-traded fund added about $617,500 in worth to shut the week.

As already talked about, this single-day efficiency marked the fifth straight day of web outflows for the Bitcoin ETFs. The crypto-based merchandise are but to document an influx day in March, as they final posted a web each day influx on Friday, February 28.

This $409 million single-day withdrawal put the Bitcoin ETFs’ weekly efficiency at a web outflow of $799.9 million prior to now week. Curiously, this represents the fourth consecutive week (and the second-highest ever) of web outflows for the crypto exchange-traded funds.

Bitcoin Worth At A Look

The efficiency of the BTC exchange-traded funds in latest weeks considerably mirrors the sluggish Bitcoin worth motion inside this identical interval. The worth of Bitcoin has been unable to maintain any optimistic momentum from the considerably bettering crypto local weather in the USA.

As of this writing, the premier cryptocurrency is valued at round $86,100, reflecting an over 1% worth decline prior to now 24 hours. On the weekly timeframe, although, the Bitcoin worth is up by greater than 2%, in accordance with information from CoinGecko.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.