The crypto market has kicked off the week with a pointy downturn, as a wave of liquidations worn out $620.5 million prior to now 24 hours.

The sell-off was fueled by a steep decline in Bitcoin’s (BTC) value, which plunged to as little as $80,000 over the weekend. The sudden drop triggered widespread margin calls, forcing merchants out of leveraged positions and amplifying volatility throughout the market.

Crypto Market Hit by $620 Million Liquidation Wave

In keeping with knowledge from Coinglass, the previous 24 hours noticed a large shakeout within the crypto market, with 225,381 merchants liquidated.

Lengthy positions took the toughest hit, accounting for $529.4 million in losses. In the meantime, brief positions noticed $91.1 million in liquidations.

Bitcoin led the liquidation spree, with $239.5 million in positions worn out. $205.6 million got here from lengthy merchants caught off guard by the market downturn, triggering compelled sell-offs. The most important single liquidation order occurred on Binance, the place a BTC/USDT place value $32.0 million was worn out.

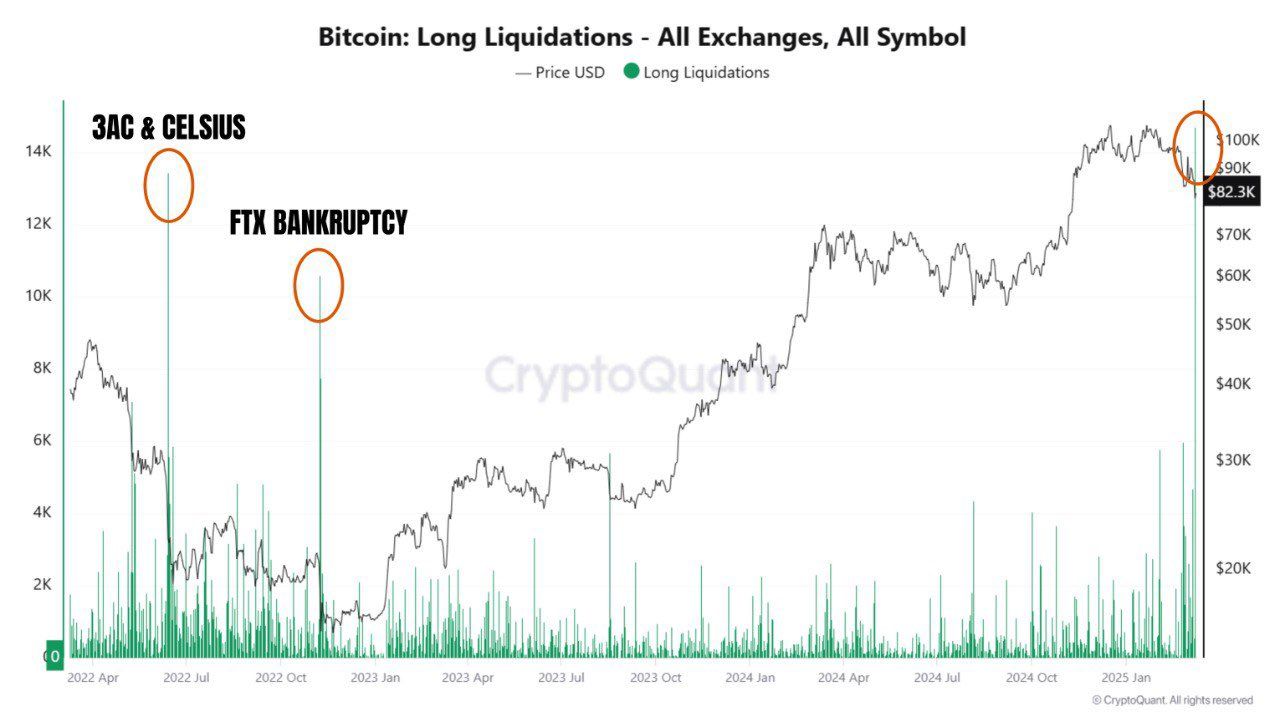

Analyst Ash Crypto highlighted the severity of the latest market turmoil within the newest X (previously Twitter) publish.

“Bitcoin lengthy liquidations in all exchanges exceeds 3AC, Celsius and FTX collapse,” the publish learn.

Knowledge from CryptoQuant exhibits that Bitcoin’s lengthy liquidations surged to 14,714 yesterday. For comparability, 13,453 BTC had been liquidated in the course of the Celsius crash, 1,807 BTC in the course of the FTX collapse, and 1,311 BTC within the Three Arrows Capital (3AC) meltdown.

The wave of liquidations comes as Bitcoin struggles out there, going through renewed downward strain. Opposite to expectations, President Donald Trump’s Strategic Bitcoin Reserve government order triggered a pointy decline in Bitcoin’s worth.

Moreover, the downturn intensified as recession fears escalated, including additional uncertainty to the market.

“An unsightly begin to the week. Appears like BTC will retest $78,000,” Arthur Hayes, former BitMEX CEO wrote.

He predicted that if $78,000 fails to carry, $75,000 would be the subsequent crucial help stage. Hayes additionally identified a considerable amount of open curiosity (OI) in Bitcoin choices between $70,000 and $75,000. Thus, if BTC enters that vary, it may result in heightened volatility.

For now, BTC continues to carry above $80,000. On the time of writing, it was buying and selling at $82,629, down 3.9% prior to now 24 hours.

Market Plunge Forces Crypto Whales Into Liquidation Chaos

The broad impression of Bitcoin’s value drop was felt throughout the sector. The whole crypto market cap suffered a $148 billion drop. Ethereum (ETH) was the second most affected asset, with $108.5 million in liquidations. As per BeInCrypto knowledge, ETH was down 5.3% over the previous day, buying and selling at $2,062 at press time.

The downturn has positioned whales beneath growing strain, with some now going through the chance of large liquidations. In keeping with Lookonchain knowledge, a whale holding 65,675 ETH (value $135.8 million) on Maker is on the verge of liquidation.

The whale’s well being fee has dropped to 1.05, with a liquidation value set at $1,931, elevating considerations about potential compelled sell-offs if ETH continues to say no.

Moreover, an on-chain analyst revealed that World Liberty Monetary’s (WLFI) funding portfolio has suffered heavy losses. The agency had initially invested $336 million throughout 9 tokens. But, the portfolio’s worth has plunged to $226 million, marking a $110 million loss.

Ethereum makes up 65% of your entire portfolio, making it essentially the most affected asset. The common buy value of ETH was $3,240, however with ETH now buying and selling round $2,000, the DeFi venture has suffered a 37% loss, amounting to $80.8 million.

Regardless of the turmoil, OnchainLens reported {that a} whale has elevated lengthy positions throughout a number of belongings, together with Solana (SOL), Ethereum, dogwifhat (WIF), and Bitcoin.

The positions have turned in opposition to the dealer, who’s now sitting on an unrealized lack of $14.3 million. The whale nonetheless has an open order value $8.4 million for these tokens, additional growing threat publicity. Furthermore, the whale equipped 19,413 ETH to fund these trades and borrowed $16.2 million USDC to go lengthy on HyperLiquid.

Nonetheless, not all whales are dropping cash on this market shakeout. Knowledge from Lookonchain highlighted that one other whale has efficiently shorted BTC a number of instances throughout latest value drops. The dealer has collected an unrealized revenue of over $7.5 million.

“He has now set extra brief positions at $92,449 – $92,636 and positioned restrict orders to take revenue between $70,475 – $74,192,” the publish additional added.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.