CoinShares, a distinguished European digital asset supervisor, earlier as we speak launched its newest report on cryptocurrency funding flows. The findings revealed that digital asset funding merchandise skilled their fourth consecutive week of outflows, totaling $876 million.

Regardless of the slowdown in outflows in comparison with earlier weeks, CoinShares’ Head of Analysis, James Butterfill, famous that investor sentiment continues to lean bearish.

Regional and Asset-Particular Developments

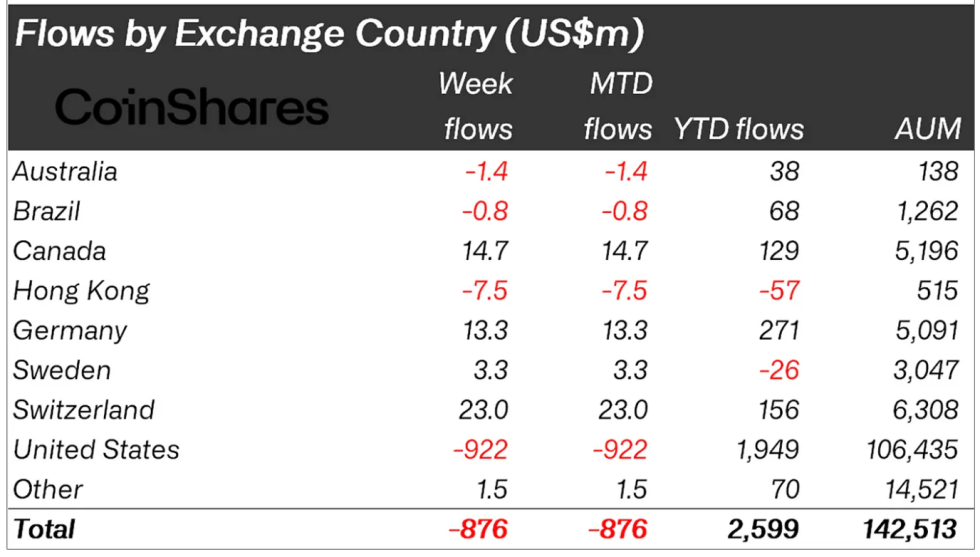

Over the previous four-week, cumulative outflows reached $4.75 billion, in response to CoinShares, lowering the year-to-date inflows to $2.6 billion. In consequence, the corporate’s complete belongings underneath administration (AuM) in digital belongings have declined by $39 billion from their earlier peak, now sitting at $142 billion.

This marks the bottom level for AuM since mid-November 2024, pushed by a mix of destructive worth actions and chronic outflows. The report additional indicated that US traders confirmed the strongest bearish tendencies, pulling out $922 million throughout the week.

In distinction, different areas interpreted the market circumstances as a shopping for alternative. Switzerland led the inflows with $23 million, adopted by Canada and Germany with $14.7 million and $13.3 million respectively.

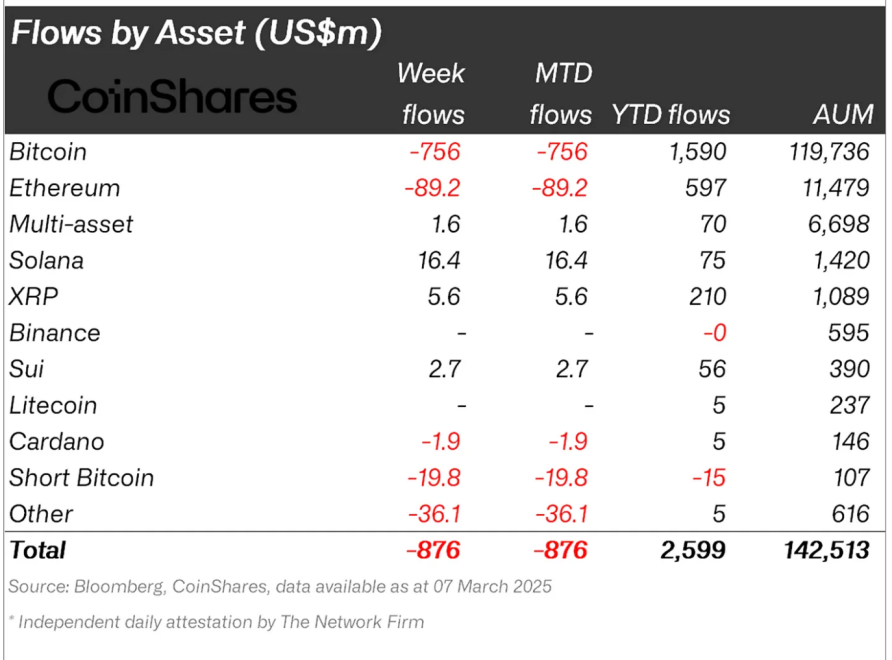

When it comes to asset-specific traits, Bitcoin dominated the outflows, shedding $756 million over the week. Apparently, short-Bitcoin merchandise additionally noticed outflows totaling $19.8 million, the most important since December 2024.

Altcoins weren’t resistant to this destructive sentiment both, as Ethereum skilled $89 million in outflows, whereas Tron and Aave noticed $32 million and $2.4 million exit respectively. Conversely, a couple of altcoins recorded inflows, with Solana attracting $16.4 million, XRP gaining $5.6 million, and Sui receiving $2.7 million.

Crypto Market Efficiency

Amid the destructive fund flows reported by CoinShares, the general crypto market efficiency has proven the same downward development, reflecting a gentle decline in valuation.

Notably, in response to information from CoinGecko, over the previous week, the worldwide cryptocurrency market capitalization has plunged from $3.26 trillion seen final Monday to $2.81 trillion as of as we speak—roughly $450 billion decline.

This drop comes on account of the unstable upward momentum from BTC. This lack of upside momentum has led to BTC seeing extra lower in worth than improve. Up to now 7 days, Bitcoin has seen an 11.3% drop.

Its previous day worth motion has additionally added to this destructive efficiency with BTC at present buying and selling at a worth of $82,370, marking a further 2.3% drop to its worth.

The continous drop from BTC has been pushing the asset additional away from its all-time excessive above $109,000 registered in January. At present market worth, BTC is down practically 25% from this peak.

Different main cryptocurrencies together with Ethereum and Solana have additionally adopted BTC carefully in its bearishness with each belongings down by 11.9% and 22.9% respectively over the previous 7 days.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.