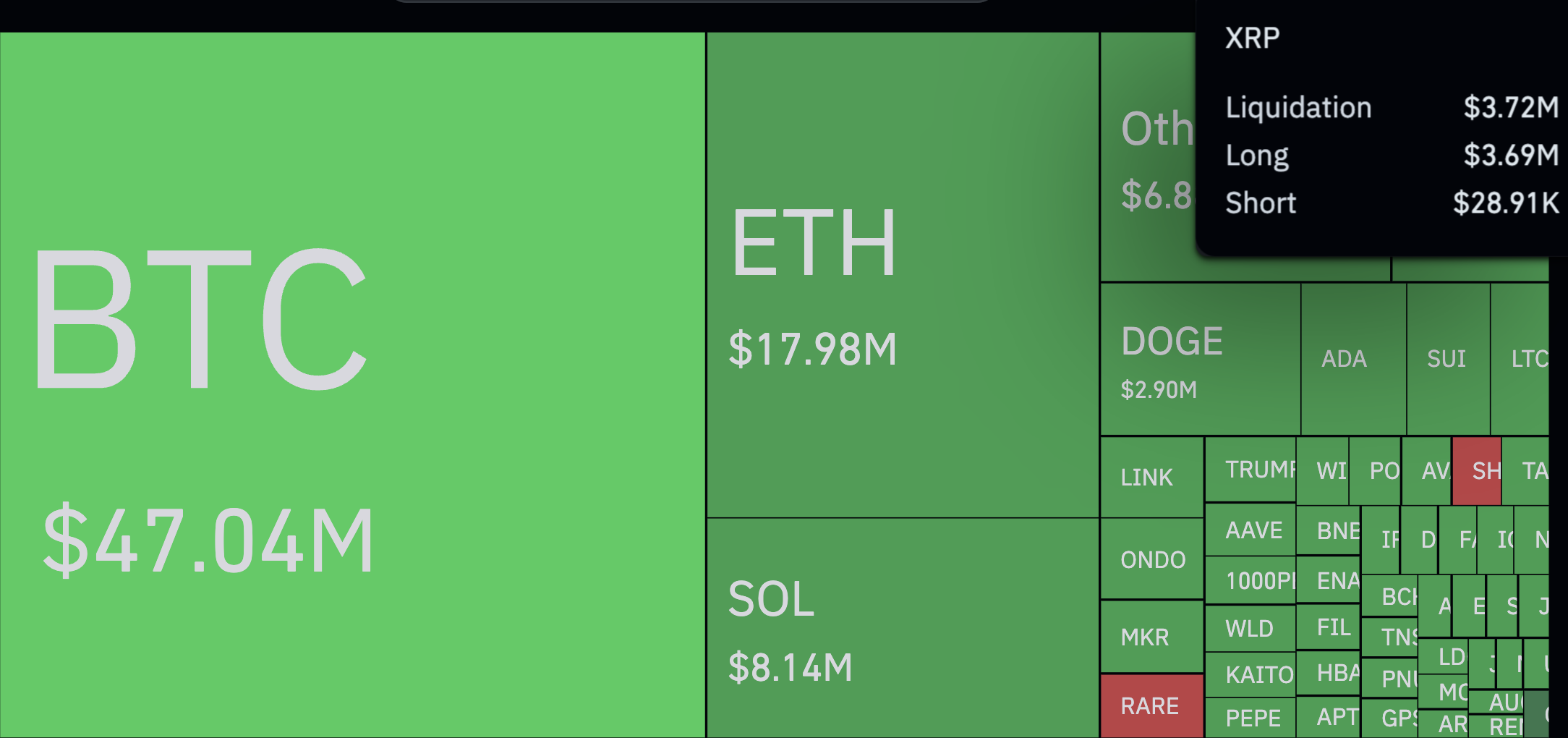

We’re seeing wild numbers, which isn’t unusual in crypto. The final hour noticed liquidations hit practically $109.74 million, in accordance with CoinGlass information. Market swings occur quick, however this one stands out, not due to the quantity however due to the way it performed out.

Lengthy positions took the largest hit – 88.94% of the liquidated quantity got here from merchants betting on value will increase within the derivatives market. Shorts? Simply $12.23 million. The imbalance is very large. However in some circumstances, like XRP, it’s even larger.

Thus, quick liquidations on the third largest cryptocurrency barely registered at $28,910, whereas lengthy liquidations soared to $3.69 million. It’s a distinction of 12,763%. The worth itself is simply down 2.73% in the identical timeframe. It’s a small dip however sufficient to set off a wave of pressured promoting that worn out overly optimistic merchants.

XRP isn’t any stranger to volatility, however at this time it stands out. It’s a clear signal of the bullish sentiment that existed earlier than the crash – a sentiment that, no less than for now, has been dealt a heavy blow.

The timing of all of it was not random. Earlier, Technique, led by Michael Saylor, introduced a $21 billion providing to purchase extra Bitcoin. The market took it effectively at first. Optimism crept in, however then actuality hit. The U.S. inventory market opened, the S&P 500 dropped to its lowest degree since September 2024 and sentiment flipped. Crypto adopted.

Merchants had been caught on the incorrect aspect of the commerce. Once more. The market doesn’t look ahead to second probabilities. If something, at this time’s occasions function a reminder – leverage is a double-edged sword – and in occasions like these, it cuts deeper.