Cardano (ADA) is going through intense promoting stress, dropping practically 10% within the final 24 hours and nearly 29% over the previous week. Since its inclusion within the U.S. strategic crypto reserve, ADA has fallen 39%, struggling to regain bullish momentum.

Indicators like BBTrend and DMI present that bearish sentiment stays sturdy, with sellers nonetheless in management. If the present downtrend continues, ADA may take a look at key help ranges, however a reversal may push it again towards main resistance zones.

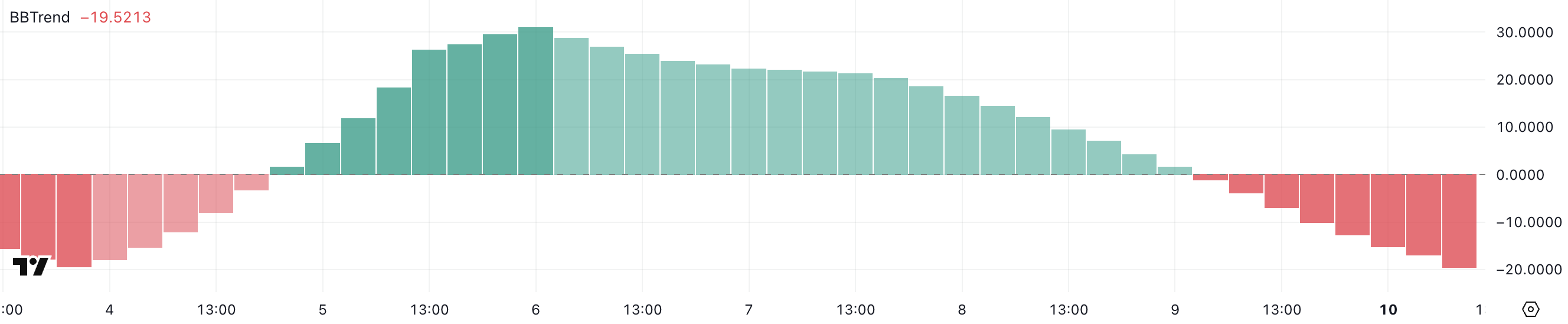

ADA BBTrend Exhibits the Promoting Stress Is Getting Stronger

Cardano BBTrend indicator is at the moment at -19.52, persevering with its decline since yesterday. Earlier this month, from March 5 to March 8, BBTrend remained optimistic, reaching a peak of 31 on March 6.

This shift from optimistic to destructive territory suggests a weakening bullish development, with rising draw back stress on ADA value. Merchants at the moment are watching whether or not this decline continues or if ADA can regain momentum.

BBTrend, or Bollinger Band Pattern, is an indicator that measures value tendencies primarily based on Bollinger Bands. It exhibits whether or not an asset is in a robust, bullish, or bearish section. When BBTrend is optimistic, it suggests sturdy upward momentum, whereas destructive values point out rising promoting stress.

With ADA’s BBTrend now at -19.52, it alerts rising bearish sentiment, suggesting the value may proceed declining except patrons step in. If the downtrend persists, ADA might take a look at key help ranges within the coming days.

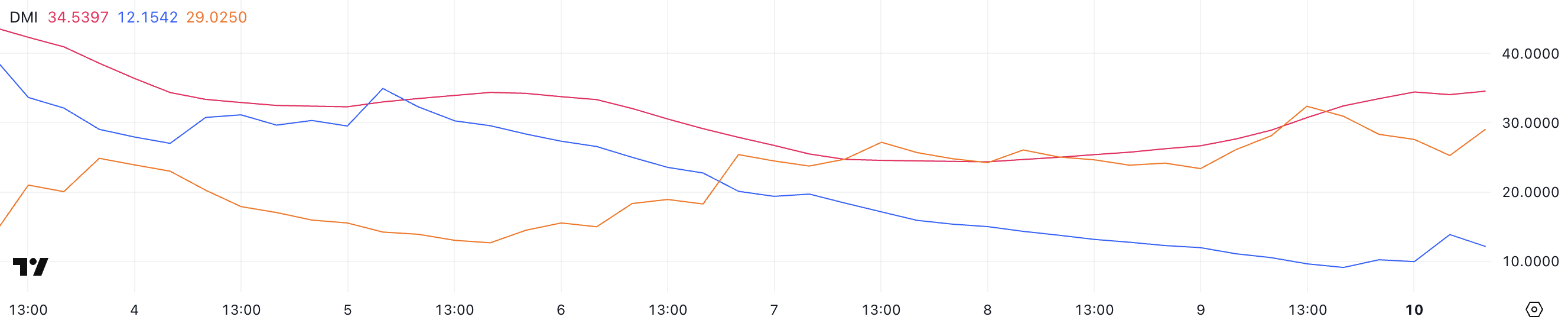

Cardano DMI Exhibits Sellers Are Nonetheless In Management

Cardano Directional Motion Index (DMI) chart exhibits that its Common Directional Index (ADX) has risen to 34.5, up from 26.6 yesterday. This enhance means that ADA’s present development – whether or not bullish or bearish – is gaining power.

On condition that ADA is in a downtrend, the rising ADX signifies that promoting stress is intensifying, making it tougher for the value to reverse within the quick time period.

ADX measures the power of a development on a scale from 0 to 100, with values above 25 indicating a robust development and above 50 suggesting an especially sturdy development.

In the meantime, ADA’s +DI (optimistic directional index) has climbed to 12 from 9.6 yesterday however is barely down from 13.8 a number of hours in the past, indicating weak bullish makes an attempt.

On the similar time, -DI (destructive directional index) is at 29, decrease than yesterday’s 32.3 however rising from 25.2 a number of hours in the past.

This implies that whereas sellers nonetheless management the development, some short-term pullbacks are occurring. If -DI stays dominant and ADX continues rising, ADA’s downtrend may prolong additional.

Will Cardano Fall Beneath $0.60?

Cardano EMA traces point out {that a} potential demise cross may type quickly, signaling a bearish momentum.

A demise cross happens when a short-term EMA crosses beneath a longer-term EMA, typically resulting in elevated promoting stress.

If this bearish crossover occurs, ADA value may decline additional, with the $0.58 help stage turning into a key space to look at. A breakdown beneath this stage may set off even deeper losses.

Nevertheless, if patrons regain management and ADA can reverse its development, the value might rise towards the $0.818 resistance stage. A breakout above that would open the door for additional beneficial properties towards $1.02 and even $1.17 if momentum strengthens.

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.