Stablecoins on exchanges are sometimes seen as a key indicator of traders’ buying energy. A better stablecoin stability suggests merchants are prepared to purchase altcoins, setting the stage for a market rebound.

On-chain knowledge reveals that stablecoin reserves on exchanges have reached a three-year excessive. Nonetheless, altcoin market capitalization continues to say no sharply.

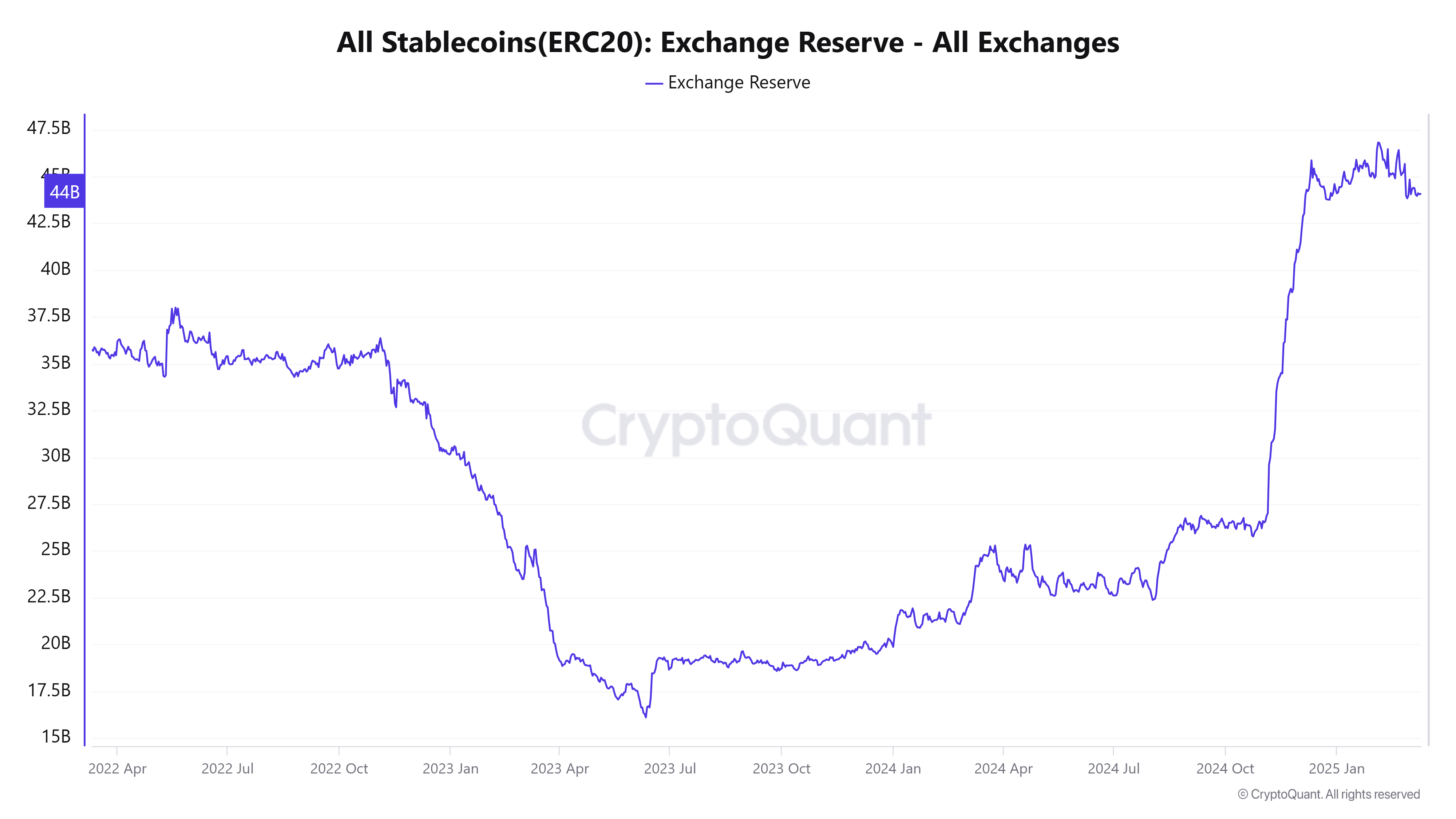

Stablecoin Reserves Surpass $45 Billion in Early 2025

In line with CryptoQuant, the overall worth of ERC-20 stablecoins on exchanges hit $46.5 billion firstly of 2025. As of now, this determine stands at $44 billion. The information has led traders like The DeFi Investor to imagine that the capital is available to gas a market restoration.

“Stablecoin CEX reserves are at an all-time excessive. There’s a variety of capital ready to be deployed. However we want the macro state of affairs to enhance first,” The DeFi Investor commented.

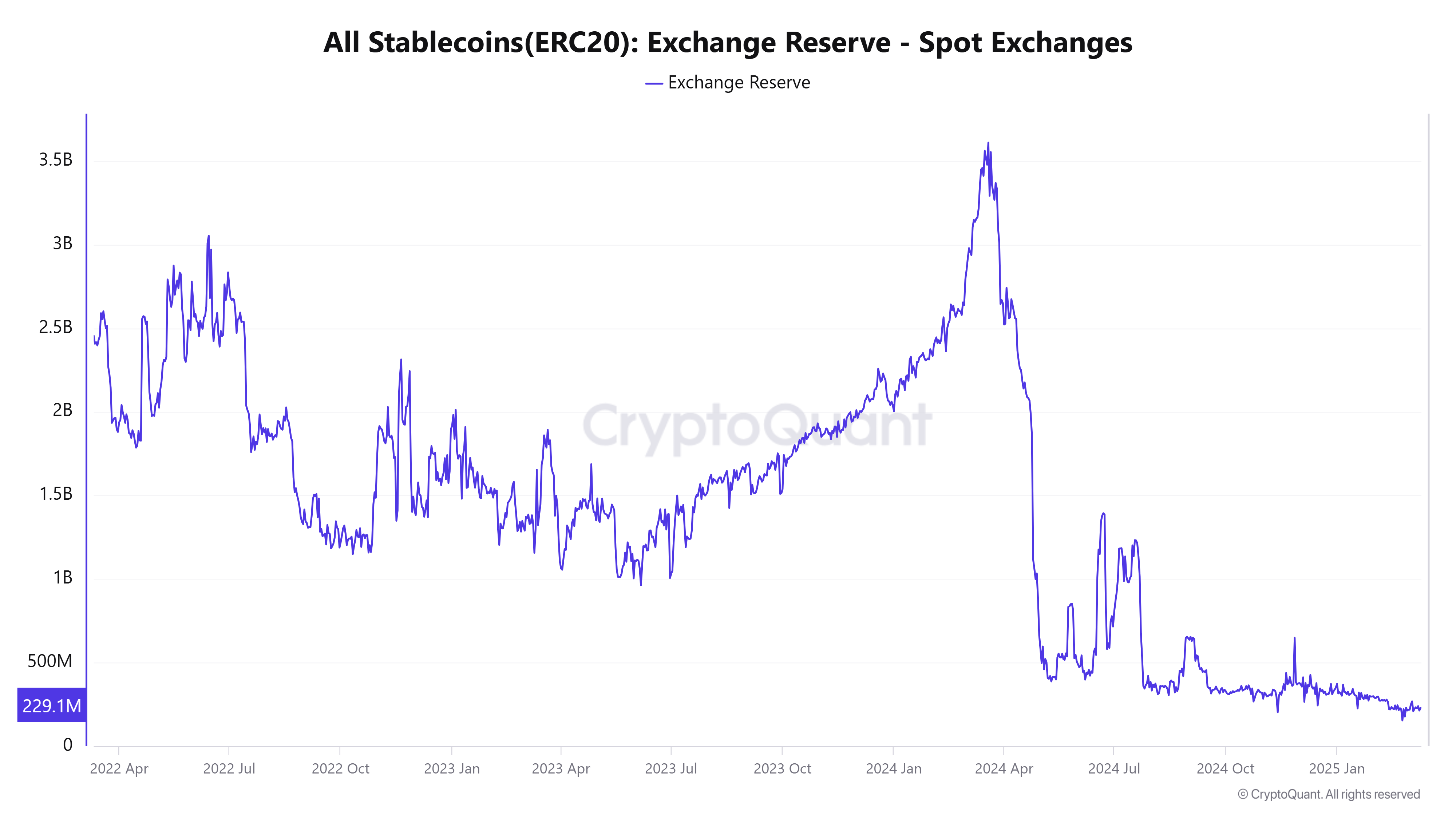

Nonetheless, a more in-depth have a look at spot exchanges tells a unique story. As a substitute of rising, stablecoin reserves on these platforms have really declined considerably.

CryptoQuant knowledge reveals that out of the $44 billion in ERC-20 stablecoins on centralized exchanges (CEXs), a staggering $43.8 billion is held on derivatives exchanges. In the meantime, spot exchanges maintain simply over $220 million in stablecoins.

Historic tendencies point out that from July 2023 to March 2024, a surge in spot alternate stablecoin reserves coincided with the market capitalization rising from $1 trillion to $2.7 trillion. Immediately, spot alternate reserves have dropped to a three-year low.

Most stablecoins on derivatives exchanges don’t contribute to sustainable value will increase. As a substitute, they mirror short-term leveraged buying and selling with excessive threat. BeInCrypto just lately reported that 334,404 merchants had been liquidated up to now 24 hours, totaling $947.7 million. Lengthy positions suffered essentially the most.

Moreover, the altcoin market capitalization (TOTAL2) dropped by 20% in March, falling from $1.2 trillion to beneath $1 trillion.

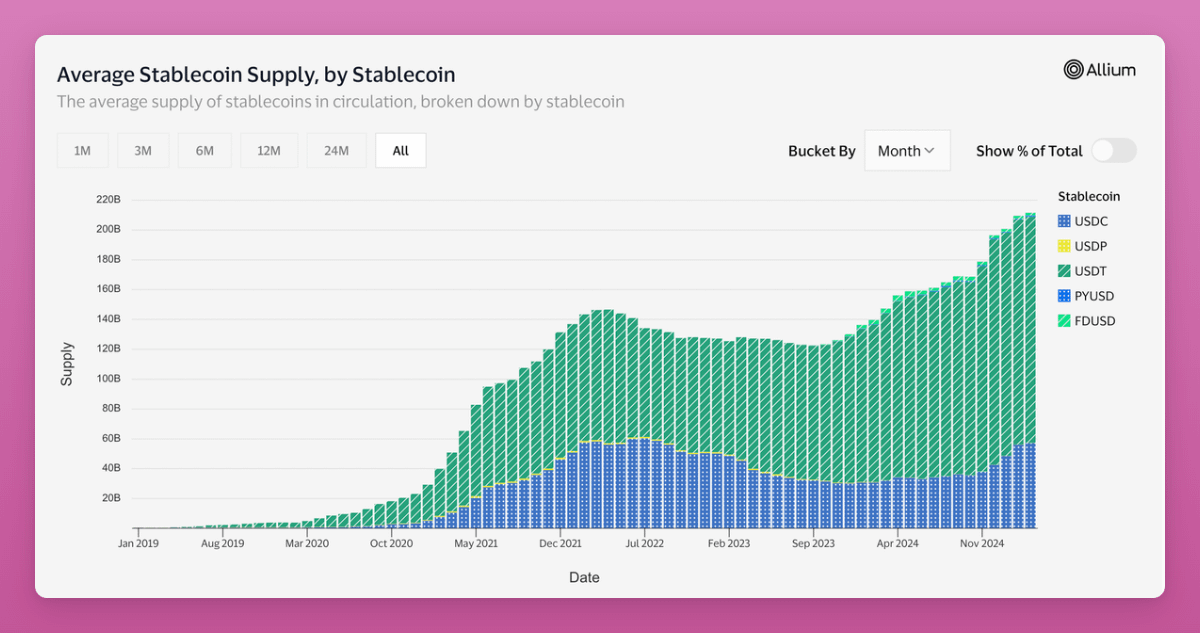

Stablecoin Market Cap Hits New Excessive Amid Rising Adoption

In line with Ignas, co-founder of Pink Brains, stablecoin market capitalization has surged 44% over the previous two years, surpassing $200 billion.

Traditionally, a rising stablecoin provide signaled the beginning of an Altcoin Season. Nonetheless, Ignas believes the narrative in 2025 is completely different.

“Till just lately, a rise in stablecoin provide led to a pump in crypto costs, as stablecoins had been largely used for short-term holding between trades. Now, stablecoins are rising past hypothesis,” he famous.

He pointed to real-world use instances that stretch past crypto buying and selling. For instance, SpaceX processes Starlink gross sales in Argentina and Nigeria utilizing stablecoins. ScaleAI pays abroad staff with stablecoins.

In the meantime, main TradFi establishments are getting ready for stablecoin progress. Financial institution of America is open to launching its personal stablecoin if laws allow. PayPal plans to develop PYUSD in 2025. Stripe just lately acquired Bridge, a stablecoin platform, for $1.1 billion. Revolut is contemplating issuing a stablecoin. Visa is integrating stablecoins into world funds and operations.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.