The US CPI (Client Worth Index) information reveals inflation eased to 2.8% in February, a optimistic shock as it’s beneath the anticipated 2.9% Yr over Yr (YoY).

This softer-than-expected inflation print boosted threat urge for food, as merchants now see an elevated likelihood of charge cuts by the Federal Reserve (Fed) later within the 12 months.

US CPI Beneath Expectations at 2.8%

Bitcoin (BTC) responded with a modest upward transfer, leaping to $83,371. The surge comes as decrease inflation reduces the chance of additional tightening and helps risk-on sentiment. Inventory markets additionally reacted positively, with main indices posting features following the discharge.

Whereas inflation cooled in February, the Core CPI got here in at 3.1% YoY, additionally beating estimates of three.2%. Core inflation excludes unstable gadgets like meals and vitality. Notably, this marks the primary decline in headline and Core CPI since July 2024 and suggests inflation is cooling down within the US.

If inflation continues to development decrease, the Fed might shift to a extra dovish stance, doubtlessly opening the door to extra liquidity getting into the markets. In the meantime, the response for conventional property was as anticipated, with the US greenback and Japanese yen dropping.

“Each general and core are down! This clearly raises expectations for an rate of interest lower. Each rates of interest and the greenback/yen trade charge responded with declines. This might be optimistic for inventory costs,” an analyst on X noticed.

Some analysts are taking these inflation numbers with a pinch of salt, as Donald Trump’s commerce tariffs might result in larger shopper costs.

However, many analysts view the newest inflation information as a tailwind for Bitcoin, which has traditionally benefited from simpler financial situations. Now, all eyes are on the Fed’s upcoming coverage steering as merchants search for affirmation that the trail to charge cuts is opening up.

“A excessive print wouldn’t be very welcomed (as standard). Particularly throughout unsure occasions out there like now, this sort of financial information often has an elevated affect. A excessive quantity would doubtless transfer the bond yields again up which is the alternative of what the administration is seemingly making an attempt to realize at the moment. Then there’s additionally FOMC subsequent week and the Fed will certainly be taking a look at this CPI print as properly,” analyst Daan Crypto Trades remarked.

In the meantime, this CPI information comes after JOLTS (Job Openings and Labor Turnover Survey) report on Tuesday, which gave the market a purpose to cease falling. Notably, Fed Chair Jerome Powell said on Friday that the US central financial institution would take a cautious method to financial coverage easing, including that the economic system at the moment “continues to be in place.”

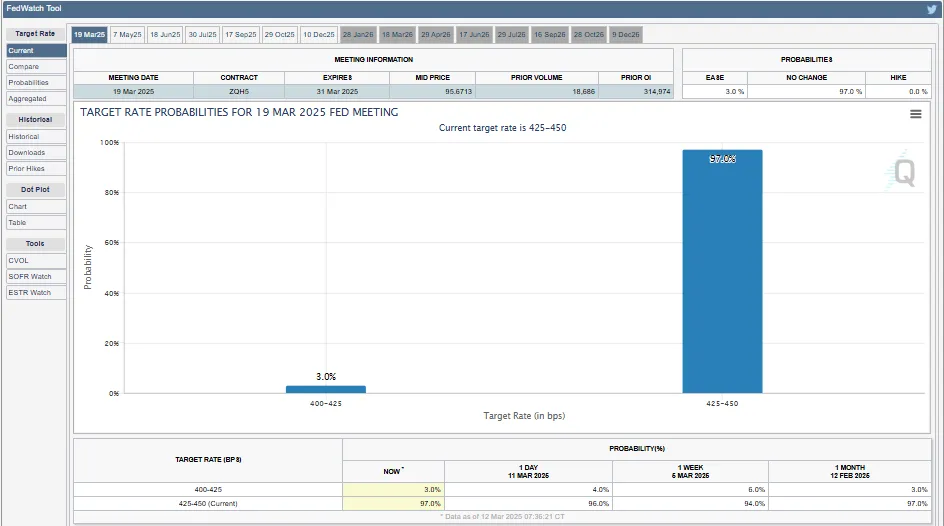

In line with information from the CME Fedwatch software, markets are betting on an rate of interest lower on the Fed’s subsequent assembly.

“Inflation simply got here in at 2.8% which is decrease than expectations. The actual quantity is even decrease. The Fed ought to lower charges instantly,” chimed Anthony Pompliano, the founding father of Skilled Capital Administration.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.