Hedera (HBAR) has dropped almost 20% prior to now seven days, however within the final 24 hours, it has rebounded by virtually 5%, signaling a possible pattern shift. Whereas the broader pattern stays bearish, key indicators counsel that purchasing stress is rising, and a reversal might be forming.

If HBAR breaks resistance at $0.219, it may climb towards $0.258 and even $0.287, however failure to maintain upward momentum may see it retesting $0.179 or decrease.

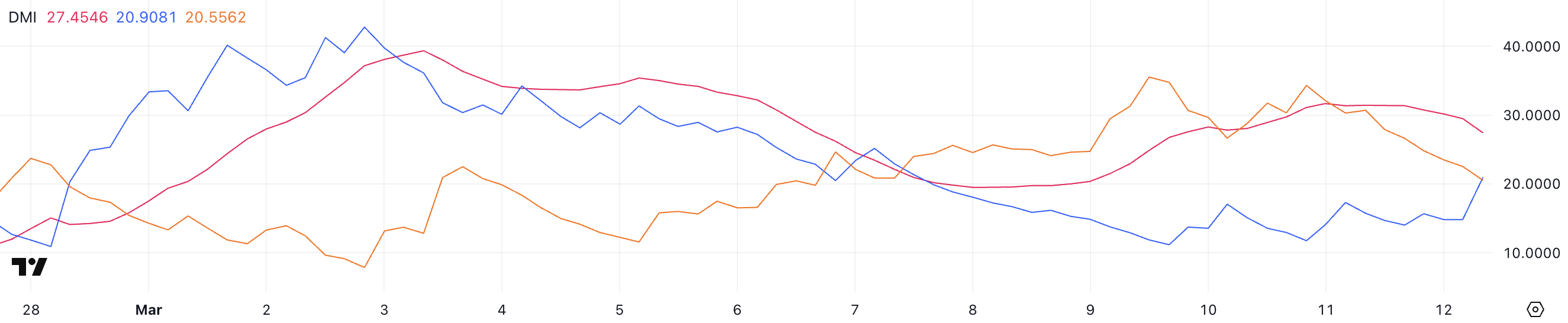

HBAR DMI Reveals Consumers Are Taking Management

The Common Directional Index (ADX) for HBAR is at the moment at 27.4, down from 31.4 yesterday, indicating that the downtrend power is weakening.

ADX measures the power of a pattern on a scale from 0 to 100, with values above 25 sometimes signaling a powerful pattern, whereas something beneath 20 suggests a weak or non-trending market.

Regardless of the decline, ADX stays above the important thing 25 threshold, that means HBAR downtrend continues to be intact however dropping momentum.

In the meantime, the +DI (Directional Indicator) has risen to twenty.9 from 11.7, whereas the -DI has dropped from 30.3 to twenty.5. This shift means that promoting stress is fading whereas shopping for stress is rising.

Nonetheless, with ADX declining and each directional indicators nonetheless shut to one another, Hedera has not confirmed a pattern reversal but.

The value stays in a downtrend, but when +DI continues rising above -DI, it may sign the start of a shift towards bullish momentum.

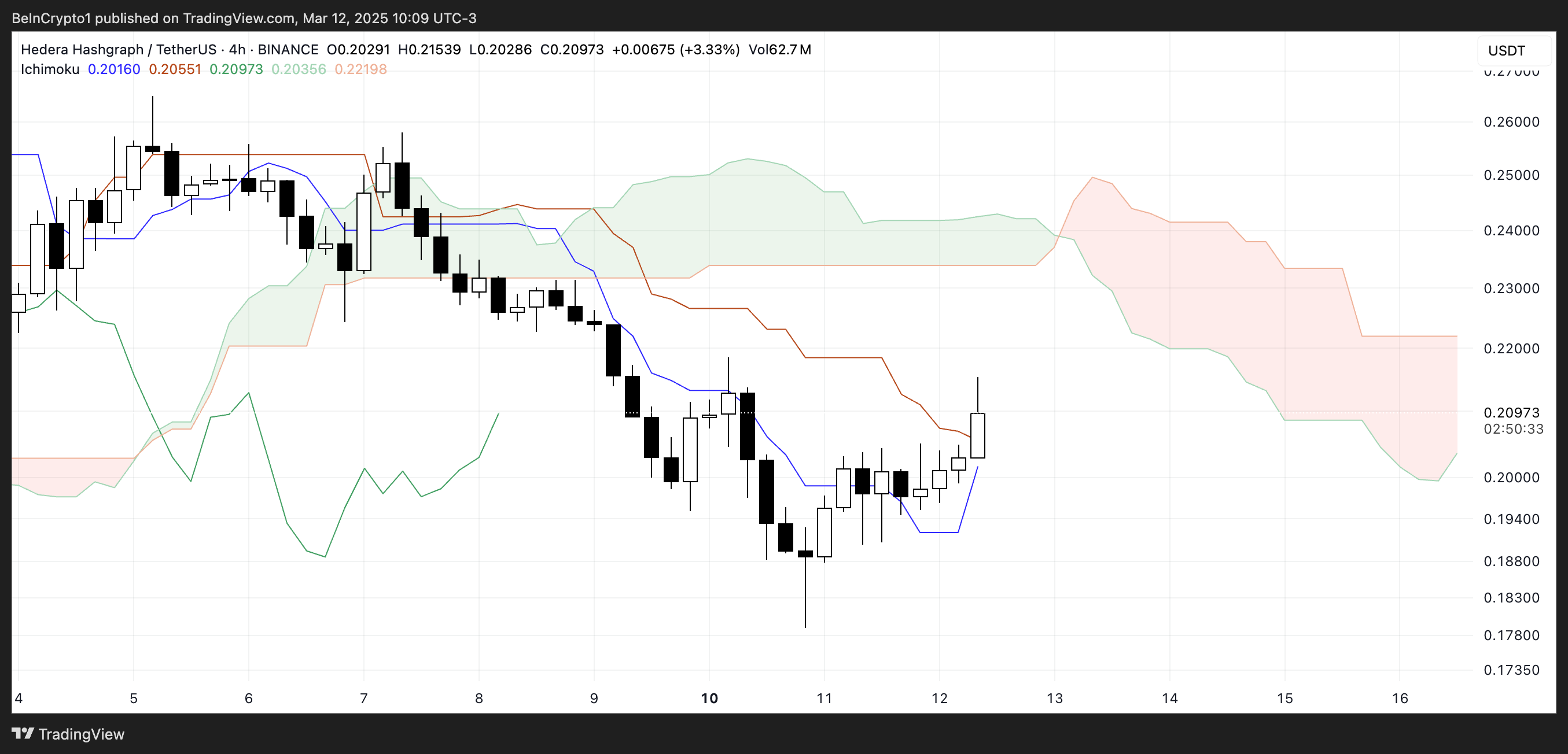

Hedera Ichimoku Cloud Suggests The Pattern Might Shift Quickly

The Ichimoku Cloud chart exhibits that Hedera value has not too long ago moved above the blue Tenkan-Sen (conversion line), a short-term pattern indicator.

This implies that momentum is shifting, however the value stays beneath the Kijun-Sen (baseline) and contained in the cloud’s resistance zone.

The cloud itself is purple forward, signaling that bearish stress nonetheless dominates. Till the worth clears this resistance, the pattern stays unsure.

Whereas the latest value motion signifies a possible short-term reversal, the Kumo (cloud) stays bearish, suggesting that the general pattern continues to be downward.

HBAR would want to interrupt above the cloud to verify a pattern shift extra strongly. If the worth faces rejection right here, it may point out continued weak point, main to a different downward transfer.

The battle between consumers and sellers at this degree will decide whether or not HBAR can maintain this rebound or resume its broader downtrend.

Will Hedera Get Shut To $0.30 Quickly?

Hedera’s EMA traces point out that the pattern continues to be bearish, as short-term EMAs stay beneath long-term ones. Nonetheless, the short-term EMAs are beginning to flip upward, suggesting {that a} pattern reversal might be forming.

If HBAR breaks the important thing resistance at $0.219, it may set off a rally towards $0.258 and even $0.287, representing a possible 40% upside.

On the draw back, if the pattern fails to reverse, HBAR may proceed its decline and check the $0.179 assist degree.

A break beneath that will open the door for a drop beneath $0.17, marking its lowest value since November 2024.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.