On Tuesday, the US Securities and Alternate Fee (SEC) postponed its resolution on a number of altcoin exchange-traded funds (ETFs), together with Solana’s.

This improvement has additional dampened investor sentiment towards SOL, which has continued to witness important spot market outflows.

Solana Traders Exit Amid SEC Delay—$16 Million Pulled Below 24 Hours

In a collection of filings made on March 11, the SEC introduced its plans to postpone its resolution on a number of ETFs tied to main property, one in every of which is SOL. Based on the regulator, it has “designated an extended interval” to assessment the proposed rule modifications that may allow the ETFs to turn out to be operational.

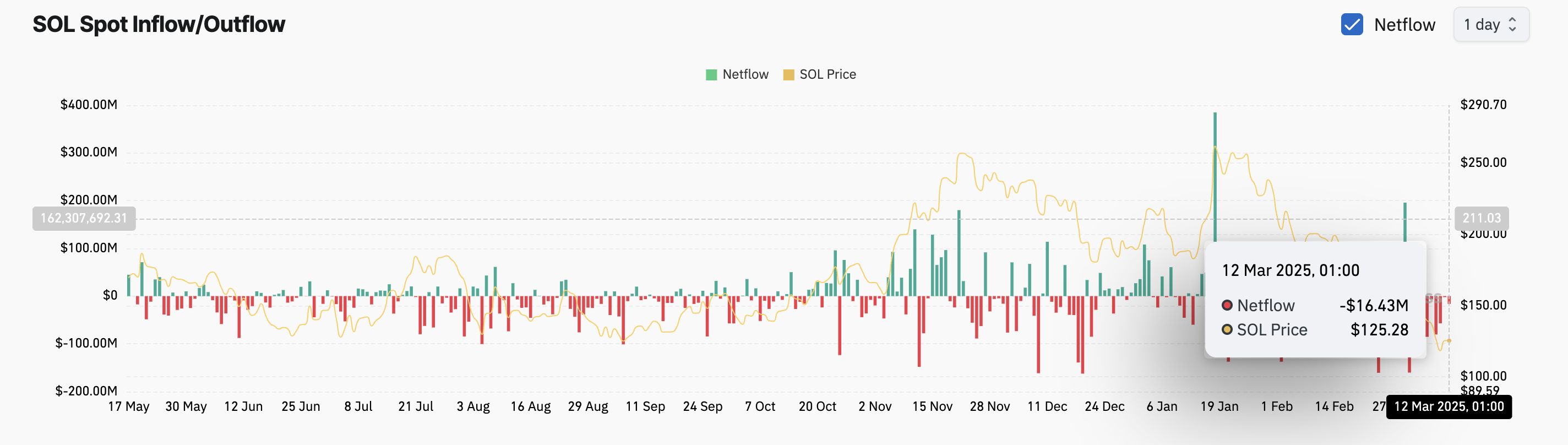

This has exacerbated the bearish sentiment towards SOL, which is mirrored within the capital outflows from its spot markets over the previous 24 hours. As of this writing, $16.43 million has been faraway from the market, marking the seventh day of consecutive outflows, which have now exceeded $250 million.

When an asset experiences spot outflows like this, its buyers are promoting their holdings. This development displays a insecurity in SOL’s short-term worth restoration, with merchants selecting to money of their accrued good points to forestall additional losses on investments.

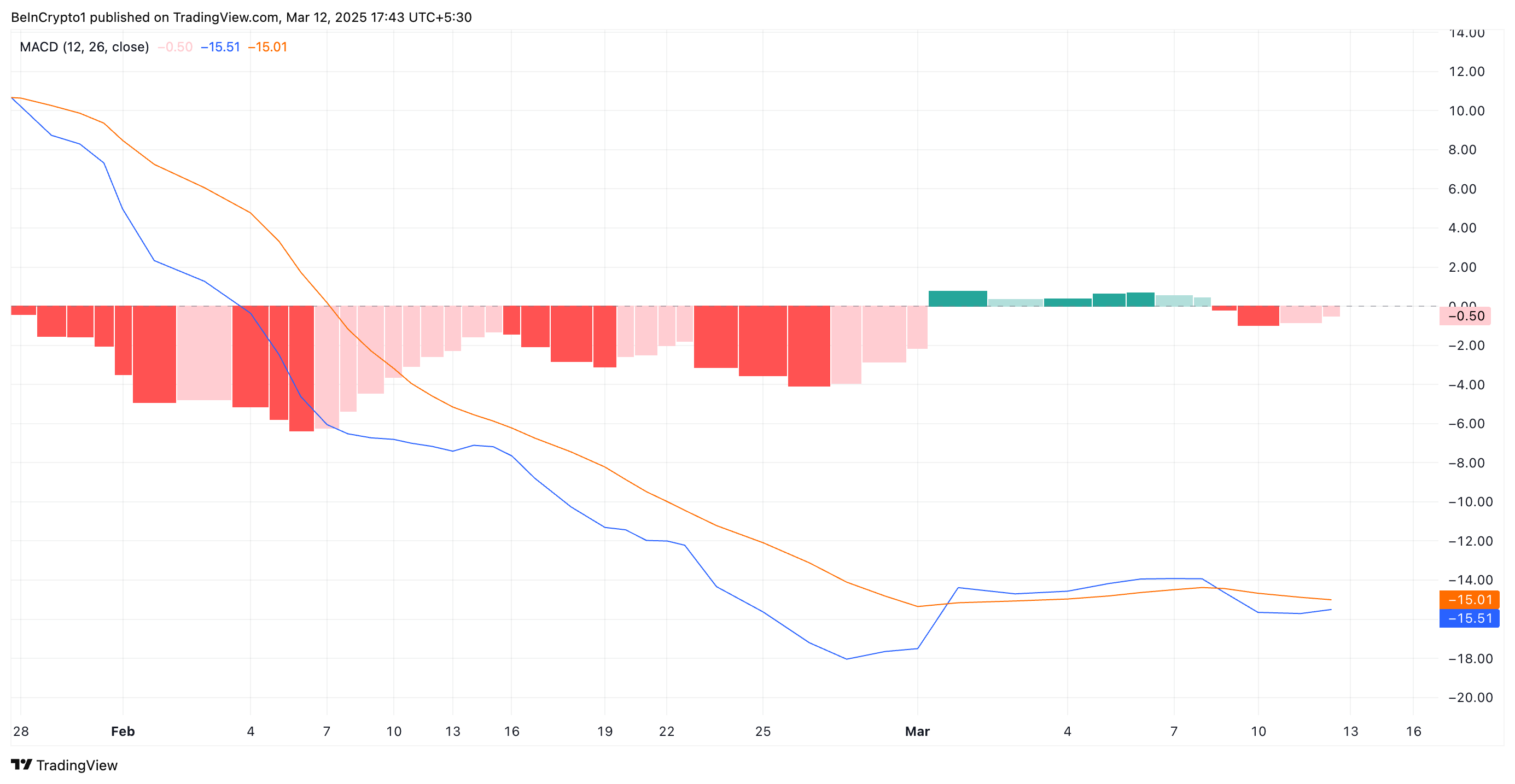

Moreover, SOL’s Shifting Common Convergence Divergence (MACD) indicator, noticed on a every day chart, helps this bearish outlook. As of this writing, the coin’s MACD line (blue) is under its sign line (orange).

An asset’s MACD measures its worth developments and momentum shifts and identifies potential purchase or promote indicators primarily based on the crossing of the MACD line, sign line, and modifications within the histogram.

When the MACD line rests underneath the sign line, the market is in a bearish development. This means that SOL selloffs exceed shopping for exercise amongst market individuals, hinting at an additional worth drop.

Solana at Crossroads: Will SOL Maintain $126 or Fall to $110?

SOL trades at $126.82 at press time. With waning shopping for strain, it dangers falling to $110, a low that it final reached in August 2024.

Nevertheless, a robust resurgence in shopping for exercise would stop this. For this to occur, SOL has to ascertain a robust help circulate at $135.22. If profitable, it might propel its worth to commerce at $138.84 and above.

Disclaimer

In step with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.