Solana (SOL) has confronted intense promoting strain, not too long ago dropping beneath $120 – its lowest degree since February 2024. It has declined greater than 38% over the previous 30 days, reinforcing its bearish momentum.

With sellers firmly in management, SOL now faces a crucial take a look at of help ranges, whereas any potential restoration would want to interrupt by means of key resistance zones to sign a shift in momentum.

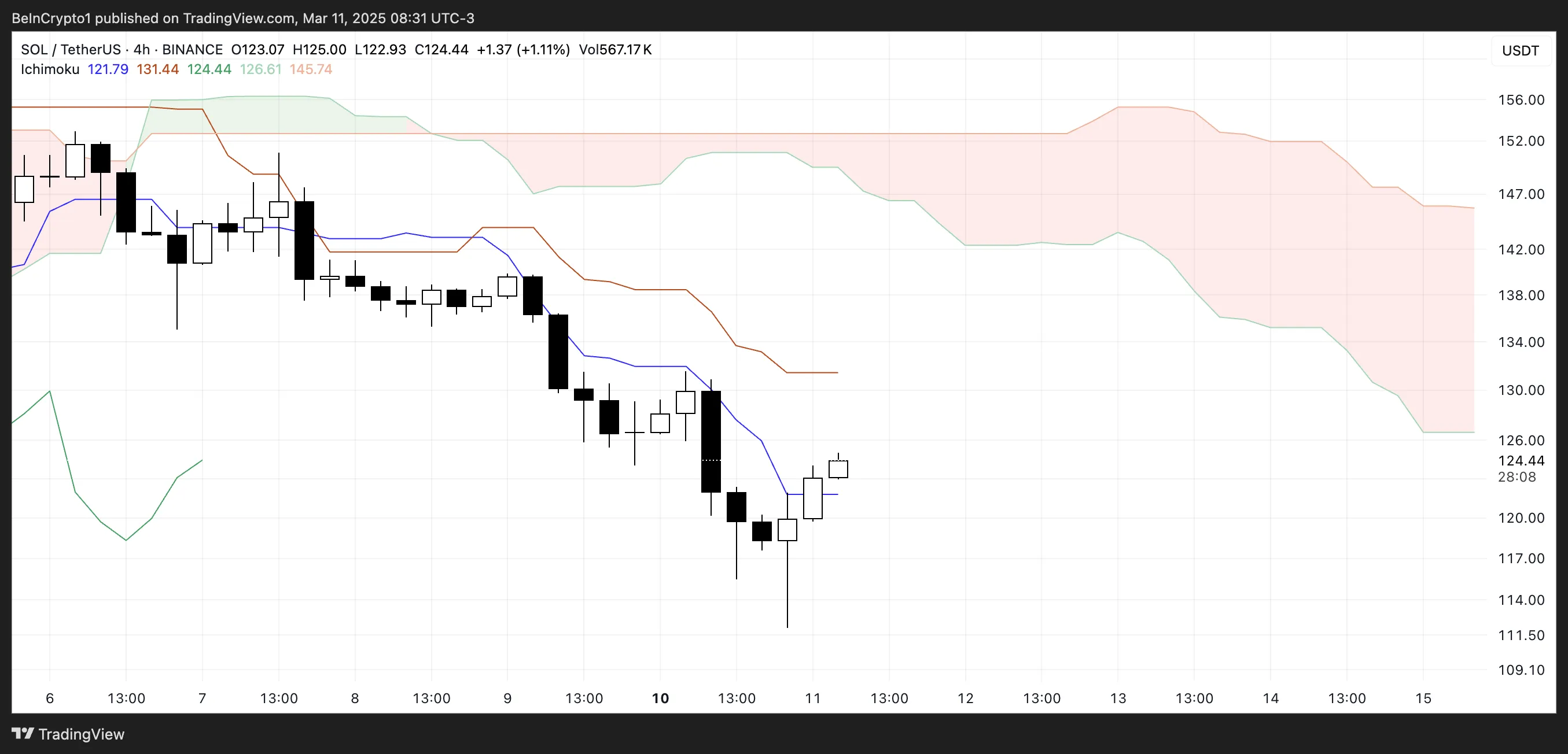

Solana Ichimoku Cloud Exhibits a Sturdy Bearish Setup

Solana Ichimoku Cloud exhibits that the worth is at present buying and selling beneath each the blue Tenkan-sen (conversion line) and the pink Kijun-sen (final analysis), indicating that the short-term pattern stays bearish.

The worth not too long ago bounced from a neighborhood low however has not but reclaimed these key resistance ranges. Moreover, the Ichimoku cloud (Kumo) forward is pink, reflecting bearish sentiment available in the market.

The cloud itself is positioned nicely above the present worth, suggesting that even when SOL experiences a short-term restoration, it’s going to doubtless face robust resistance close to the $130 – $135 area.

The positioning of the Tenkan-sen beneath the Kijun-sen additional helps the bearish outlook, as this crossover usually indicators downward momentum.

For any indicators of a pattern reversal, SOL would want to interrupt above each of those traces and ideally enter the cloud, which might point out a possible transition to a impartial section.

Till then, the bearish cloud forward and the present weak worth construction recommend that any rallies could also be momentary earlier than the broader downtrend resumes.

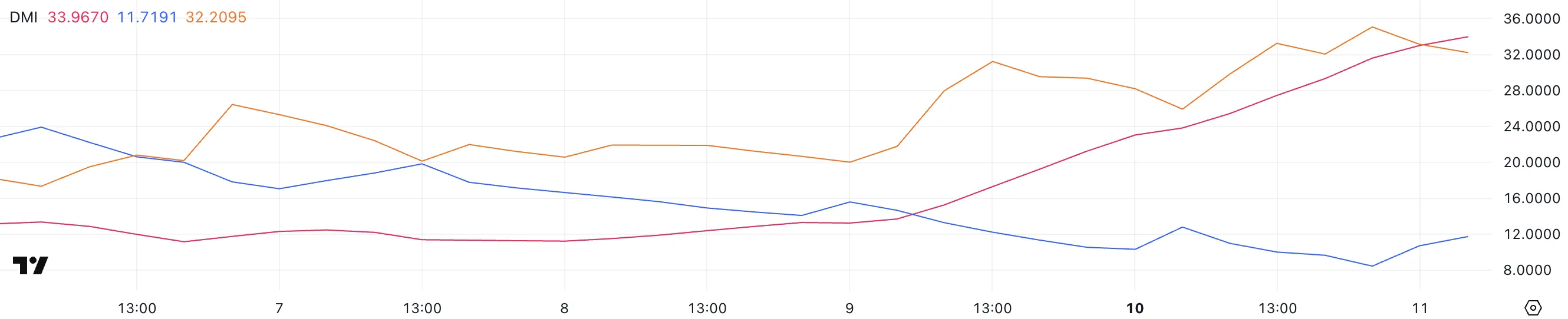

SOL DMI Exhibits Sellers Are Nonetheless In Management

Solana Directional Motion Index (DMI) chart reveals that its Common Directional Index (ADX) is at present at 33.96, a big improve from 13.2 simply two days in the past.

The ADX measures pattern energy, and a studying above 25 usually signifies a powerful pattern, whereas values beneath 20 recommend a weak or non-existent pattern. Given this sharp rise, it confirms that SOL’s ongoing downtrend is gaining energy.

The +DI (constructive directional index) has dropped to 11.71 from 15.5 two days in the past however has barely rebounded from 8.43 yesterday. In distinction, the -DI (detrimental directional index) sits at 32.2, up from 25.9 two days in the past, although barely down from 35 just a few hours in the past.

The relative positioning of the +DI and -DI traces means that sellers are nonetheless in management, because the -DI stays considerably increased than the +DI.

The latest dip in -DI from 35 to 32.2 might point out some short-term aid, however with the ADX climbing shortly, it reinforces that the prevailing downtrend stays intact.

The slight bounce in +DI suggests minor shopping for strain, however it’s not sufficient to shift momentum in favor of bulls. Till +DI rises above -DI or ADX begins declining, SOL’s bearish pattern is more likely to persist, with sellers dominating worth motion within the close to time period.

Will Solana Fall Under $110?

Solana Exponential Transferring Common (EMA) traces proceed to depict a bearish pattern, with the short-term EMAs positioned beneath the long-term EMAs.

This alignment means that downward momentum stays dominant, although the worth is at present making an attempt a restoration. If this rebound positive aspects energy, Solana’s worth might face resistance at $130 and $135, key ranges that should be cleared for any potential pattern reversal.

A profitable break above these resistances might push SOL towards $152.9, a big degree that, if breached with robust shopping for strain, may pave the best way for a rally towards $179.85 – the worth degree final seen on March 2, when SOL was added to the US crypto strategic reserve.

Nonetheless, if the bearish construction stays intact and promoting strain resumes, Solana might retest the $115 and $112 help ranges, each of which have beforehand acted as key worth flooring.

A failure to carry these helps might open the door for a deeper decline, presumably pushing SOL beneath $110 for the primary time since February 2024.

Given the EMAs’ present positioning, the downtrend stays in management except Solana reclaims key resistance ranges and establishes a bullish crossover, signaling a shift in market sentiment.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.