Crypto buying and selling platform Hyperliquid (HYPE) is below scrutiny. A number of high-leverage trades on Bitcoin (BTC) and Ethereum (ETH) have raised suspicions of potential cash laundering actions.

Analysts have famous a sample of unusually massive and frequent leveraged trades executed with near-perfect timing. This led to questions in regards to the funds’ supply and the merchants’ identities.

Spotonchain Flags Excessive-Stakes Trades

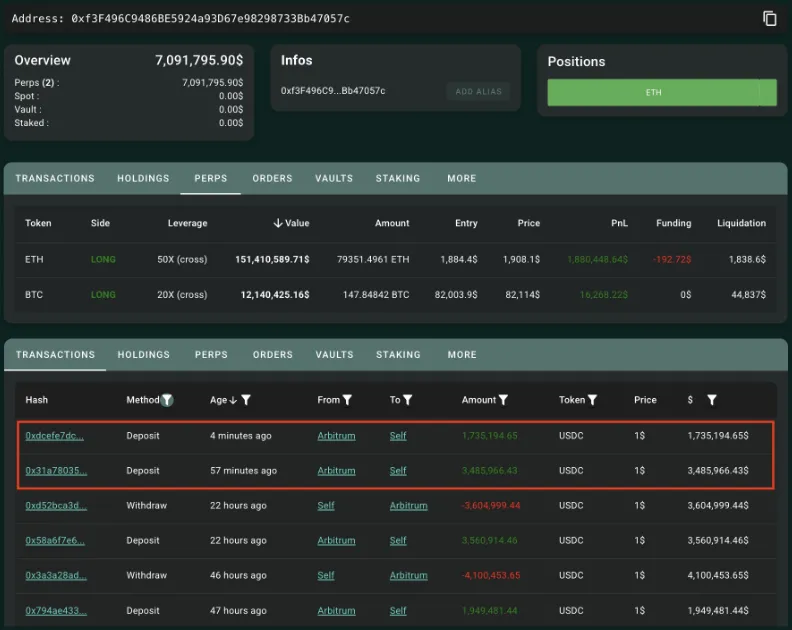

Blockchain analytics platform Spotonchain reported a collection of great leveraged trades executed on the Hyperliquid platform. In keeping with their evaluation, a well-funded dealer deposited $5.22 million onto the platform to open extremely leveraged lengthy positions in BTC and ETH.

The dealer positioned an ETH lengthy place at 50x leverage, with an entry value of $1,884.4 and a liquidation level of $1,838.2. Moreover, they opened a BTC lengthy place at 20x leverage, coming into at $82,003.9 and setting a liquidation value of $61,182.

SpotOnChain additional revealed that this dealer had a historical past of executing short-term leveraged trades with a 100% win price. The dealer netted $2.2 million in revenue in simply two days.

“Notably, previously 2 days, this whale closed two fast ETH lengthy positions with a 100% win price, netting $2.2 million in revenue,” Spotonchain revealed.

The consistency of those trades has led to hypothesis that the exercise isn’t random market hypothesis. As an alternative, it leans towards a complicated laundering operation or insider buying and selling scheme.

AB Kuai Dong, a crypto market analyst, speculated that the funds utilized in these Hyperliquid trades may very well be linked to North Korean hackers. The analyst famous that North Korean cybercriminals have been recognized to check high-frequency buying and selling methods on crypto platforms as a part of cash laundering operations.

The analyst steered they may very well be an try to wash illicit funds obtained by hacking. This assumption relies on the Hyperliquid trades’ anonymity and fast execution.

“I’m very interested by these massive nameless orders of Hyperliquid. Mixed with the earlier information about North Korean hackers testing Hyper buying and selling, is it attainable that these massive and frequent 50-fold openings are all grey market funds laundering cash?” the analyst posed.

One other analyst generally known as Ai on X supported this principle by pointing to earlier analysis on high-leverage income made on Hyperliquid. In early March, Ai reported that three addresses had generated $2.53 million in revenue by GMX high-leverage trades.

Playing or Insider Buying and selling? Consultants Weigh In

These addresses had been linked to playing platforms reminiscent of Roobet and AlphaPo. That they had additionally interacted with ChangeNOW, an alternate favored by hackers. Ai speculated that the merchants won’t be insiders however professional gamblers utilizing probably stolen funds to execute high-risk trades.

“Insider or final gambler? It’s certainly extra just like the latter,” the analyst opined.

Crypto analyst Adolyb, who cited analysis from Coinbase’s Conor Grogan, supplied additional proof of potential illicit exercise.

“Coinbase folks discovered that it’s a phishing tackle with 4 layers of jumps + playing gamers,” Adolyb remarked.

In keeping with Grogan, the crypto pockets accountable for some suspicious hyperliquid trades acquired funds from phishing assaults. He described the account as a “Roobet whale,” suggesting that the dealer steadily engaged in high-stakes playing on platforms traditionally related to illicit fund flows.

Grogan famous that this particular person had beforehand liquidated lengthy positions simply earlier than a big market occasion. In keeping with the analyst, this means that their trades weren’t based mostly on insider information. Relatively, stolen funds are used for playing.

The experiences have reignited considerations about the usage of high-leverage buying and selling platforms for illicit monetary actions. Whereas leverage permits merchants to amplify their positions, it additionally permits criminals to maneuver and disguise massive sums of cash quickly.

The anonymity provided by decentralized and offshore exchanges additional complicates efforts to trace and regulate such transactions. Regulators and blockchain forensic companies will possible improve their scrutiny of comparable actions. That is amidst mounting proof linking Hyperliquid’s high-leverage trades to probably illicit sources.

BeInCrypto knowledge exhibits Hyperliquid’s token’s value is down virtually 8% since Wednesday’s session opened. As of this writing, HYPE was buying and selling for $13.35.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.