Knowledge exhibits XRP and Solana have seen their Realized Volatility spike up after the sharp worth motion. Right here’s how Bitcoin and different cash evaluate.

Belongings Throughout Crypto Have Seen An Enhance In 60-Day Realized Volatility

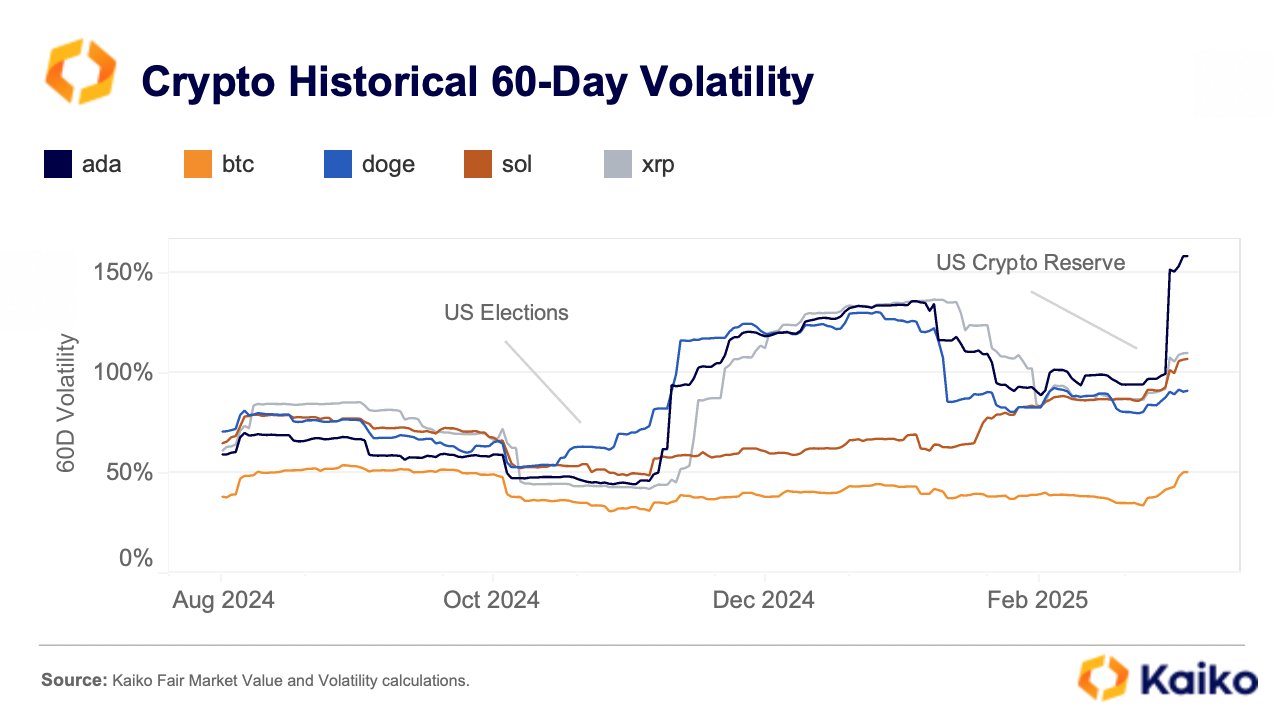

In a brand new publish on X, the analytics agency Kaiko has shared how the 60-day Realized Volatility has modified not too long ago for the assorted high cash within the cryptocurrency sector.

The “Realized Volatility” right here refers to an indicator that mainly tells us about how a lot an asset’s worth has fluctuated throughout a given window of time. Within the context of the present subject, the interval of relevance is the 60-day one.

Right here is the chart shared by the analytics agency, that exhibits the development within the Realized Volatility for 5 high digital property: Bitcoin (BTC), XRP (XRP), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA).

Appears like BTC has been the least risky out of those property throughout this era | Supply: Kaiko on X

As displayed within the above graph, the 60-day Realized Volatility has seen a rise for every of those property not too long ago. That is naturally a results of all of the risky worth motion that the totally different property have gone by means of, particularly for the reason that US Crypto Reserve announcement from President Donald Trump.

XRP and SOL, two of the property initially confirmed for the Reserve, have each seen the metric spike to an identical worth above 100%. The third altcoin from the announcement, ADA, has seen its volatility break free from the remaining, because the indicator has reached a brand new all-time excessive (ATH) of about 150% for it.

The memecoin DOGE has seen the smallest improve out of those property, though its 60-day Realized Volatility continues to be at an considerable degree. The coin that stands out for having a comparatively low worth of the indicator is BTC, the unique cryptocurrency.

Despite the fact that Bitcoin has seen a notable leap within the metric, its worth nonetheless stays at round simply 50%. Thus, it could seem that XRP and others have seen considerably sharper worth motion than BTC within the final 60 days.

In another information, the current market volatility has meant that worry has exploded among the many cryptocurrency merchants, because the analytics agency Santiment has defined in an X publish.

The social media mentions of various Bitcoin worth ranges | Supply: Santiment on X

Within the chart, the info of an indicator known as the Social Quantity is displayed. This metric counts up the variety of posts/threads/messages which can be making distinctive mentions of a given subject or time period.

From the graph, it’s seen that the Social Quantity associated to low Bitcoin worth ranges ($50,000 to $69,000) has spiked not too long ago, that means that the buyers are predicting a bearish end result for the asset.

Traditionally, a excessive quantity of worry surrounding the primary digital asset has truly been a bullish signal for not simply its worth, but in addition the altcoins like XRP and Solana.

At current, the bullish Social Quantity ($100,000 to $119,000) continues to be at a excessive degree, so whereas worry is rising, optimism hasn’t disappeared but. As Santiment notes,

The true capitulation level (and optimum purchase spot) will likely be when low costs ($50K-$69K) are being predicted throughout social media with little or no point out of excessive costs ($100K-$119K).

XRP Value

On the time of writing, XRP is floating round $2.1, down greater than 14% over the past seven days.

The value of the coin has been following a bearish trajectory not too long ago | Supply: XRPUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.