Toncoin (TON) has rebounded by over 3.5% on the cryptocurrency market within the final 24 hours. Regardless of this restoration, about 96% of TON addresses are working at a loss, a stunning shift from earlier this yr, when it had extra addresses in earnings. IntoTheBlock information reveals that 96% of holders are “out of cash.”

TON’s value motion and investor sentiment

The figures reveal that TON holders recorded $36.77 million in losses from internet outflows throughout the final seven days. A lot of the losses got here from massive holders, who signify 96% of the overall addresses.

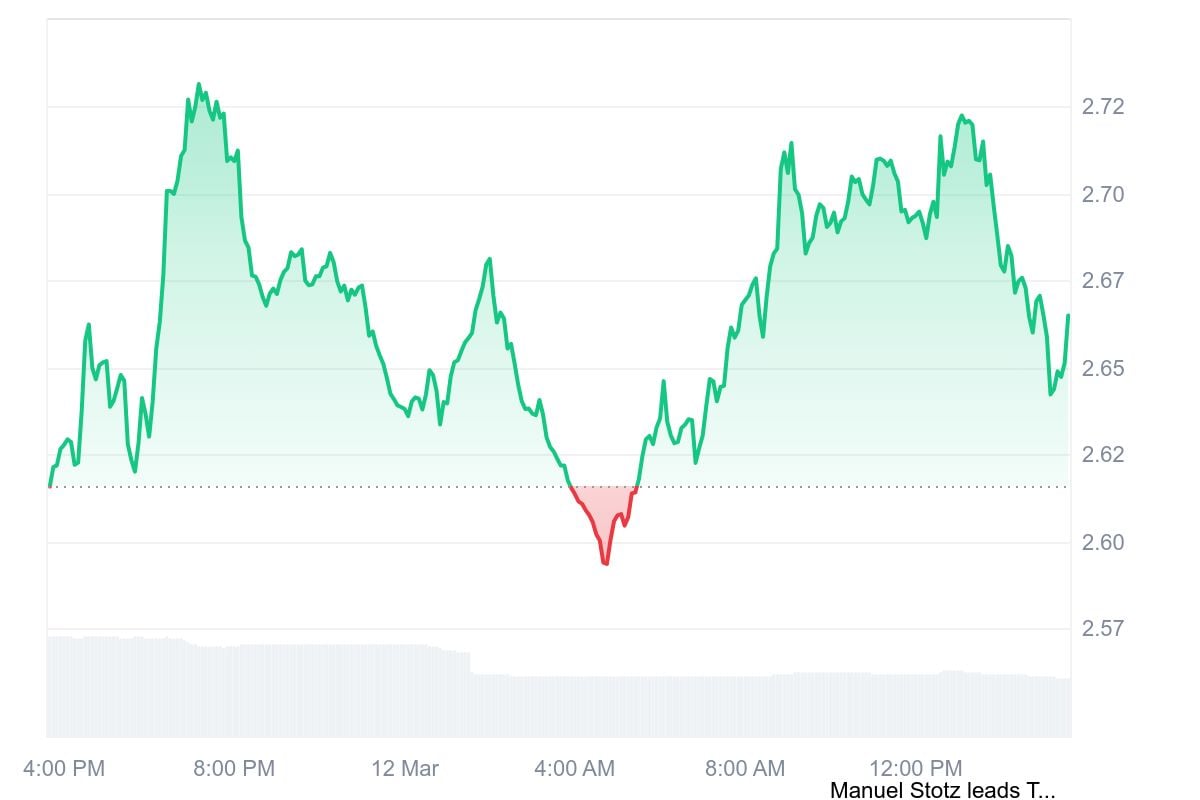

TON has been on a nosedive over the past seven days and briefly breached the $2.40 assist stage to commerce at $2.39.

Nonetheless, it quickly rebounded to its present stage some 48 hours in the past. Regardless of experiencing fluctuations, TON has maintained regular upward motion.

As of this writing, TON value was altering fingers at $2.66, which represents a 4.77% improve within the final 24 hours, in accordance with CoinMarketCap information. Traders are but to totally soar on board to buy the coin as buying and selling quantity is down by 36.78% at $187.17 million.

This growth raises issues amongst group members. Notably, TON has been talked about a lot within the trade as a consequence of its astronomical progress up to now.

What’s subsequent for Toncoin?

Apparently, TON achieved a big milestone in Might 2024 when it climbed into the world’s prime 10 digital belongings record by market capitalization. It hit a market cap of over $20 billion to occupy ninth place, flipping Cardano (ADA).

Analysts attributed its speedy progress to the mass adoption it skilled within the crypto area. Primarily, Toncoin leveraged Telegram’s huge consumer base, which has near a billion energetic customers month-to-month.

Many had anticipated a comeback in mid-January because the asset entered a low-risk part with bullish technical indicators. Nonetheless, TON couldn’t keep its $5.67 value motion nor search increased ranges.

Now, TON is occupying twenty first place within the rankings because the hype seems to have pale amongst customers. Toncoin’s volatility because the starting of 2025 has not helped to rekindle buyers’ curiosity within the asset.

Market watchers are eager to see if the Toncoin ecosystem can halt the losses and provoke a value rediscovery.