- ETH struggles to keep up stability after latest fluctuations, signaling unsure sentiment.

- Present worth motion hovers round a key assist degree that would decide the subsequent transfer.

- Restoration makes an attempt stay weak, however consumers could step in if a stronger catalyst emerges.

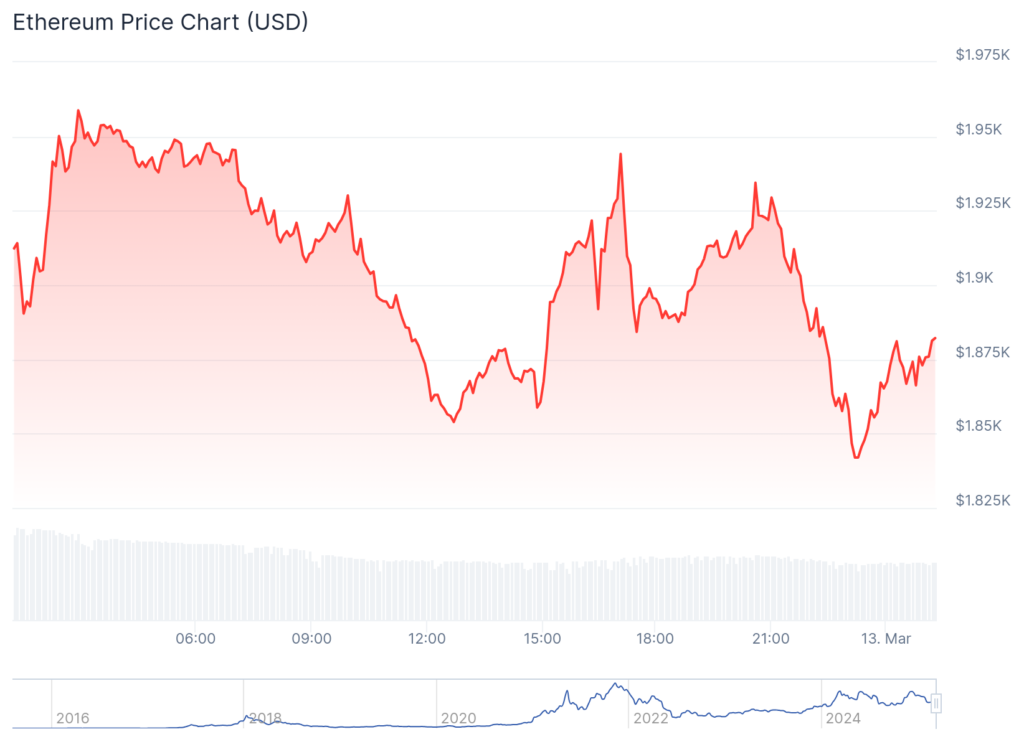

Ethereum’s worth has been on a rollercoaster experience, making merchants uncertain about its subsequent path. The CoinGecko chart displays a sample the place ETH examined resistance, dipped decrease, and is now making an attempt to stabilize. The latest downward motion reveals sellers are nonetheless in management, however it’s not totally doom and gloom but.

Worth actions have been uneven, with fast spikes adopted by fast pullbacks. This type of motion suggests a scarcity of sturdy momentum from both facet, making it troublesome to foretell a transparent breakout. A decisive transfer above the latest highs would point out that consumers are gaining confidence, but when ETH retains struggling at resistance, sellers may take over as soon as once more.

For now, Ethereum is sitting on an essential degree, and the way it reacts right here may decide whether or not it makes a stronger push upward or breaks decrease for a deeper correction. The market stays cautious, ready for a stronger catalyst to shake issues up.

Bouncing Again or Only a Pause?

Probably the most vital areas on the chart is the assist degree ETH is presently hovering round. This zone has traditionally acted as a robust shopping for space, and if merchants defend it once more, we may see a short-term bounce. Nevertheless, the issue is that latest rallies have been weak, missing the momentum wanted for a full-blown restoration.

If ETH begins closing above earlier highs, that may be a very good signal that demand is selecting up. On the flip facet, a clear break under this assist may set off one other wave of promoting, which could push Ethereum towards even decrease ranges.

Patrons have stepped in at this degree earlier than, however this time, they’ll want to indicate extra energy to flip market sentiment. In any other case, Ethereum may stay caught in a downward trajectory, with merchants hesitant to tackle new positions.

Trying on the Larger Image

Zooming out, Ethereum’s total development has been weaker in comparison with its earlier bullish runs. This doesn’t imply a whole breakdown is inevitable, however it does recommend that ETH wants a robust basic driver to shift momentum in its favor.

The broader market sentiment will play an enormous function in what occurs subsequent. If Bitcoin finds stability, it may raise Ethereum alongside it. But when uncertainty stays excessive, Ethereum’s worth may battle to seek out strong footing. Waiting for indicators of renewed shopping for strain or a clear break under key ranges might be important for figuring out Ethereum’s subsequent main transfer.

Ethereum, initially launched in 2015 by Vitalik Buterin, was designed as a decentralized platform for good contracts and decentralized purposes (dApps). Not like Bitcoin, which primarily serves as a retailer of worth, Ethereum’s flexibility in creating and executing good contracts has positioned it as a spine for a lot of blockchain-based initiatives. Its long-term potential stays sturdy, however short-term worth actions might be closely influenced by market traits and investor confidence.