Ondo Finance (ONDO) is up practically 7% within the final 24 hours, trying to reclaim a $3 billion market cap after a pointy 38% correction over the previous 30 days. The latest value restoration suggests a possible development shift, however key resistance ranges have to be damaged for affirmation.

Indicators just like the DMI and CMF present that promoting strain is fading whereas shopping for curiosity is rising. If ONDO breaks previous $0.90, it may rally towards $1.08 and even $1.20. Nevertheless, failure to maintain momentum may result in one other drop under $0.70.

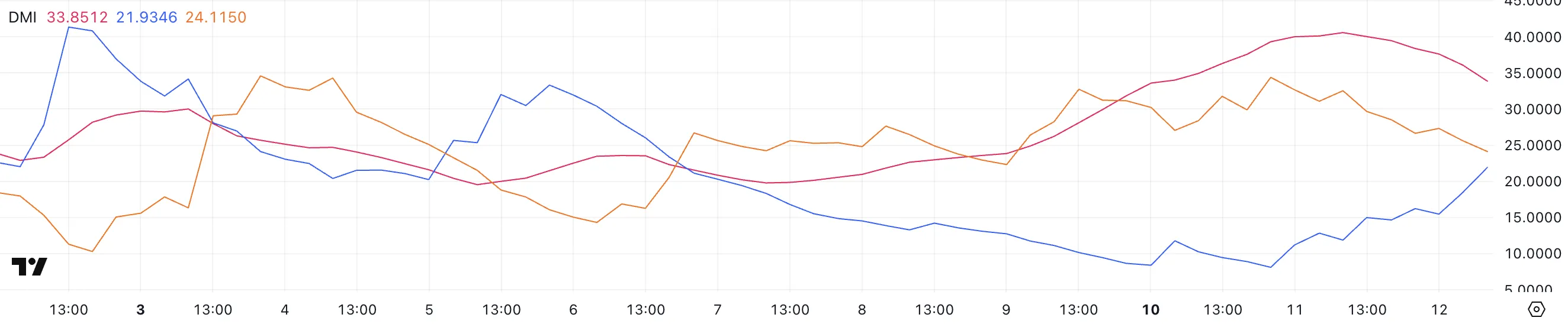

ONDO DMI Exhibits The Downtred May Revert Quickly

ONDO’s ADX is at present at 33.8, down from 40.5 yesterday. This means that whereas the downtrend stays robust, its depth is beginning to weaken.

The ADX (Common Directional Index) measures development power on a scale from 0 to 100, with values above 25 signaling a powerful development and values under 20 suggesting a weak or non-trending market.

Since Ondo Finance ADX continues to be effectively above 25, the bearish development stays dominant, however the decline means that momentum might be slowing.

In the meantime, the +DI has climbed to 21.9 from 11.18, whereas the -DI has dropped from 34.3 to 24.11, exhibiting that promoting strain is fading whereas shopping for strain is rising.

Nevertheless, since -DI stays barely above +DI, the downtrend continues to be in place. If +DI continues rising and crosses above -DI, it may affirm a shift in momentum, doubtlessly signaling a development reversal.

Till then, Ondo Finance stays in a downtrend, however bulls are gaining floor.

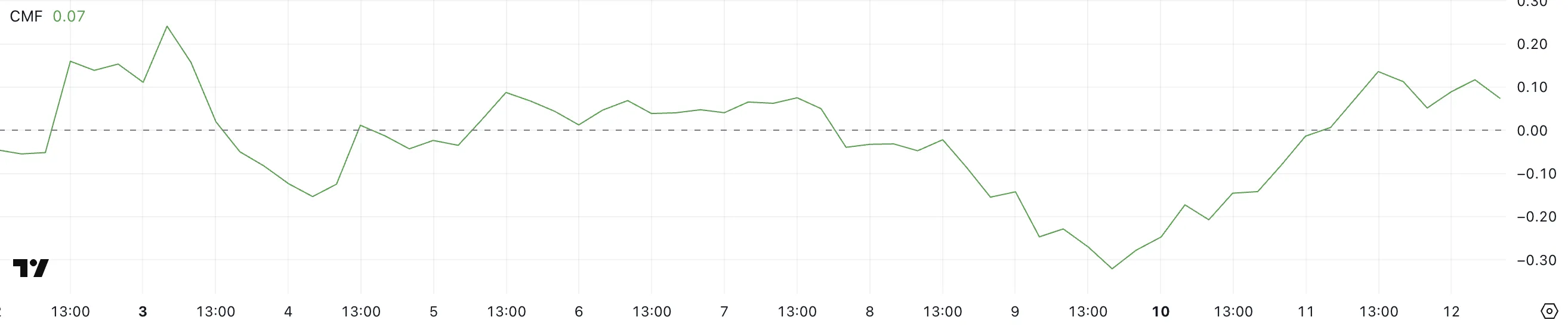

Ondo Finance CMF Surged In The Final Three Days

ONDO’s Chaikin Cash Stream (CMF) is at present at 0.07, recovering from a adverse low of -0.32 simply three days in the past.

The CMF measures shopping for and promoting strain by analyzing each value and quantity, with values above 0 indicating accumulation (shopping for strain) and values under 0 signaling distribution (promoting strain).

A CMF above 0.05 suggests rising bullish momentum, whereas extended adverse readings usually align with downtrends.

Ondo Finance CMF turned optimistic yesterday after spending two consecutive days in adverse territory, signaling that purchasing strain is rising.

With CMF now at 0.07, capital inflows are returning, which may help additional value restoration. Nevertheless, because the worth continues to be comparatively low, sustained shopping for quantity is required to verify a powerful uptrend.

If CMF continues rising, it may point out stronger accumulation, doubtlessly resulting in a breakout, establishing ONDO among the many high Actual-World Belongings cash out there.

Will ONDO Reclaim $1 Quickly?

ONDO is at present recovering after dipping under $0.79 for the primary time in months, following a broader correction throughout main RWA cash within the final 30 days.

The latest bounce suggests patrons are stepping in, however the development stays unsure, with key resistance ranges forward.

If it breaks above $0.90, it may proceed rising towards $0.99, and an extra breakout may ship it to $1.08 and even $1.20.

Nevertheless, if the uptrend fails and promoting strain returns, ONDO value may drop to $0.73, with the danger of falling under $0.70 for the primary time since November 2024.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.