- Franklin Templeton has filed for an XRP ETF, aiming to let buyers achieve publicity to XRP with out straight shopping for or storing it.

- 9 main monetary corporations, together with Bitwise, Grayscale, and ProShares, have utilized for XRP ETFs, signaling rising institutional curiosity.

- If permitted, XRP ETFs may make crypto investing extra accessible, bridging the hole between conventional finance and digital property.

Franklin Templeton has taken a significant step towards launching an XRP ETF, submitting a 19b-4 software with the U.S. Securities and Change Fee (SEC). If permitted, this exchange-traded fund would permit buyers to achieve publicity to XRP with out having to purchase or retailer it themselves.

Why an XRP ETF Issues

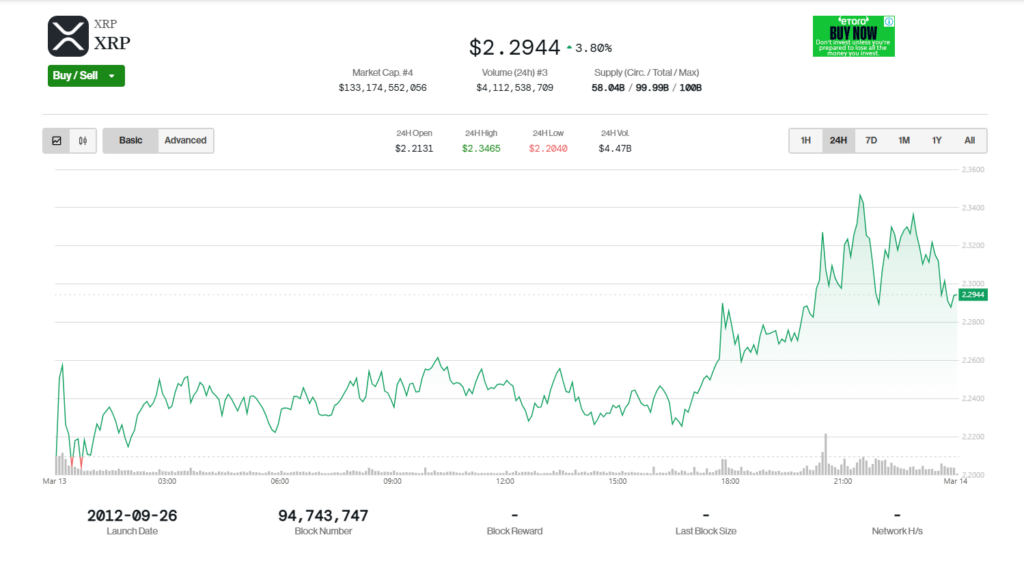

XRP has been a rollercoaster asset, coping with regulatory hurdles and an ongoing authorized battle with the SEC. Regardless of these challenges, institutional demand is rising, and Franklin Templeton’s submitting alerts confidence in XRP’s future as a mainstream funding car.

coindesk.com

For these unfamiliar, an ETF (Change-Traded Fund) lets buyers purchase shares representing an underlying asset, on this case, XRP. As an alternative of navigating crypto exchanges or dealing with non-public keys, buyers may achieve publicity by means of conventional brokerage accounts.

A Surge in XRP ETF Filings

As of March 13, 2025, 9 main monetary corporations have filed for XRP ETFs, marking a major milestone for the crypto trade. Main candidates embody:

What’s Subsequent?

With institutional curiosity heating up and a number of ETF functions pending, XRP’s accessibility to conventional buyers may quickly skyrocket. If the SEC grants approval, it may pave the best way for broader adoption of crypto-based ETFs, bringing digital property into mainstream finance like by no means earlier than.